When it comes to the economic impact of tariffs on the economy, businesses, and the public, you can see many people figuratively wiping flop sweat from their brows.

Treasury Secretary Scott Bessent talked about the “fantastic” Consumer Price Index inflation numbers on Fox Business last week. As part of the Trump administration, he’s pushing for the Fed to cut interest rates by 0.5 percentage points by saying in part that the expected tariff-driven inflation isn’t happening. He said the increase in July inflation owed to “very odd” services price growth. However, food was up 2.9% year-over-year; electricity increased 5.5%.; housing grew 3.7% more expensive; and medical care expenses had grown 4.3%.

Neither odd nor inconsequential.

Tariffs Lower Than Expected

A Wall Street Journal article last week explained a new theory that is “gaining traction.” Economists at Barclays analyzed tariffs actually paid, not estimated, in May. They found that the weighted-average tariff rate — the average of paid tariffs adjusted for import volume from each country — was about 9%. The estimation based on White House announcements was 12%. Others guessed much higher.

There were multiple reasons why tariffs were so much lower. The Barclays analysis noted that more than half of the imports were duty-free and brought in more from countries that had lower tariffs rather than from sources like China.

Similarly, JPMorgan economists said that June weighted-average tariff rates were lower than the supposed headline averages because importers switched to either domestic producers or other international sources of goods.

Other Reasons Tariffs Could Be Lower

There are other reasons tariffs could have appeared lower. One is the amount of goods imported by companies before the new tariff levels were slated to start. Annualized real economic growth, or GDP, during the first quarter of 2025 was -0.3% because imports are deducted, indicating the volume of foreign goods brought in, so less was needed during the second quarter from April through June.

Another is called transshipping. Products shipped from one location are sent to an intermediate location to either change shipping methods or optimize logistics.

Unscrupulous exporters or importers can also use transshipping for an illegal practice called origin washing. The shipped products get new packaging and labeling along with altered paperwork to act as though they came from the intermediate country. The administration had promised a 40% additional penalty for origin washing. But the government needs to prove origin washing happened to apply the penalty. The volume of goods entering the U.S. is enormous with tangled logistics, making identification challenging.

[Update, 8/19/2025, 7:30 p.m. Eastern] A thank you to colleague researcher, analyst, and accounting expert Olga Usvyatsky who reminded me of yet another approach: cutting margins. The importer and/or exporter can make less and absorb some or all of the tariff cost so it doesn’t pass onto their customers. However, this is either a temporary remedy or one that will cut corporate profits, which might not be sustainable.

Producer Prices Take A Huge Jump

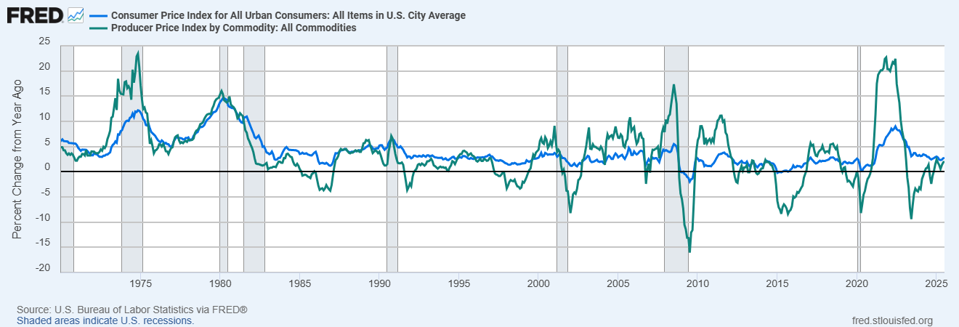

Another data source, the Producer Price Index, which is a business inflation measure, suggests that tariff effects are finally being felt. The median estimate from a Dow Jones poll of economists for July was 0.2%. The actual number was 0.9%, the fastest increase since the pandemic jumps caused by broken supply chains and the resulting high costs of goods and materials. The year-over-year increase was 3.3% rather than the expected 2.3%.

That is only one month and PPI can be volatile. But it’s interest to note in the graph below, taken from the Federal Reserve Bank of St. Louis, how year-to-year percentage increases of the PPI and Consumer Price Index, a measure of consumer inflation, stay in sync, even with greater ups and downs by PPI.

Where this will end is impossible to know, other than to recognize that no one else knows the answer for certain.