Written by Brooke Scaccia and Sam Pryor

The worst-case scenario for any soon- to-be retiree is not having enough money to support yourself and others dependent upon you.

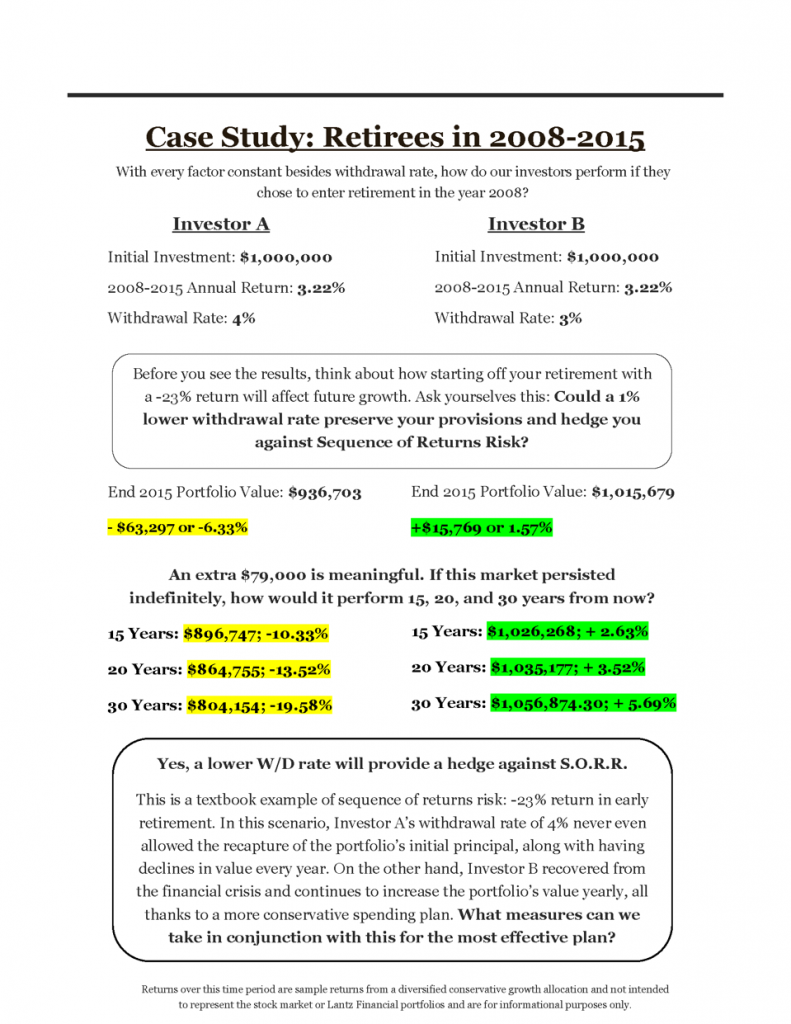

Below we will examine how you can best position yourself to mitigate as much sequence of return risk as possible.

Defining Sequence of Returns Risk

A sequence of returns is simply the order in which you receive your profit or loss. The risk associated with this sequence is stacking heavy portfolio withdrawals on top of poor market performance, especially early in retirement before your money can grow sufficient enough to sustain you for 30+ years. Just as we will enjoy periods of market growth, we will also face recessions and market-destabilizing events. With this in mind, how can you get as close as possible to assurance that the future is secure regardless of market circumstances?1

How to Mitigate Sequence of Returns Risk

We cannot control market returns, so we need to focus on what we can control; the pinnacle of which is the withdrawal rate. Playing the long game is moderating withdrawal rate. Of course, there are many other proactive measures we can implement to avoid risk, and we will discuss them, but pulling out less money is the simplest and most effective. It is understandable to believe an extra percentage point or two of annual withdrawals is insignificant, but, in the long run, every detail matters. The case study below examines this principle in action.

Additional Methods

Bucket Method

The bucket strategy presents to us an ideal guideline about how we should be planning an investment allocation. If done effectively, adopting the bucket strategy will expose you to the least amount of sequence of returns risk as possible. It entails dividing your portfolio into multiple “buckets” for specific purposes and time usages. The closer the ‘bucket’ is to actual use, the less risky it should be, to ensure coverage of all near-term expenses. Firstly, your short-term bucket will cover immediate expenses within the first 1-3 years, holding liquid assets like money market funds and cash. Next, you should have a medium-term bucket meant to provide income and stability for years 3-7 through relatively safe fixed investments like high quality bonds. Finally, you will have a long-term bucket that focuses on long-term funding and growth, usually stock investments. The structure of this strategy ensures that most near-term expenses are accounted for making it less likely that you will be exposed to sequence of return risk since sales of positions down in value should be unnecessary. This gives growth assets time to recover through full market cycles.2

Fixed Income

Fixed income securities, such as Treasury Bonds, Corporate Bonds, or Certificates of Deposit, are investment vehicles that allow you to buy an amount of debt from the US government, Quality Companies, or a bank and agree to have them return your initial investment back at a future date with interest. Even though returns on these vehicles are modest, fixed income assets are far less volatile than the stock market. Take a strategy like bond ladders, for example, where you purchase bonds across various maturity dates so that those different bonds mature each year to cover withdrawals. Fixed income allows you the flexibility to continue the plan for your retirement without endangering your financial future by overdrawing from other growth- oriented accounts.3

Annuities

In the same way that Treasury Bonds generate fixed income, so, too, do Annuity Contracts. Annuities are customizable contracts issued by insurance companies that convert an investor’s premium into a fixed income stream over their lifetime. They are designed to provide a steady income and offer more consistency in the distribution phase. Annuities offer retirees the opportunity to transfer the risk of their portfolio to an insurance company and receive a predictable rate, rather than depending on a volatile market for their returns. A few ways annuities help reduce sequence of returns risk is by providing guaranteed income regardless of market conditions which means one can cover expenses without having to sell investments when the market is down. In turn, this helps to delay or reduce withdrawals from a portfolio and gives one’s investments time to recover from a down market. They can also act as a buffer by helping one ride out downturns in the market without panic selling because they are unaffected by market performance. While annuities can be an effective asset for a retirement plan, it is also important to acknowledge the disadvantages as well. These disadvantages include the potential for higher annual fees than non-insurance related investment products, limited liquidity including surrender charges if the contract is terminated too early and/or withdrawals exceed allowed limits under the contract, and the possibility of lower investment returns on the invested portion due to limited investment options or contract provisions that reduce potential returns. Lastly, one always needs to understand that any insurance contract is dependent upon the sustainability and financial strength of the insurance company backing the investment product.4

Cash Reserve

Finally, one of the most effective ways to reduce the sequence of return risk is by holding a cash reserve at the beginning of your retirement in a money market account. By keeping about one to two years’ worth of living expenses available to you immediately, it prevents excessive withdrawals from your investment accounts in times of market downturns and volatility. This gives your portfolio time to recover without forcing you to sell assets and face economic losses which could in turn potentially diminish your retirement savings.5

1 Sequence of Returns Risk – What It Is & How to Prepare for It – Adams Brown

2 a) Three Ways to Reduce Sequence of Returns Risk – Forbes b) Sequence of Returns: What It Means and How to Deal – Morningstar

3 Certificate of Deposit (CD) | Meaning, Types, & How They Work – Finance Strategists

4 a) Mitigating Risk with Annuities – Annuity.com b) Pros And Cons of Annuities – Forbes Advisor

5 How to Avoid Sequence of Returns Risk – Financial Advisors | U.S. New

Investment advisory services provided by Lantz Financial, LLC, an SEC registered investment adviser.

All content in this article is for informational purposes only and should not be considered investment advice; you should consider your individual investment objectives and risk tolerances before making investment decisions. Not all strategies discussed may be suitable for all investors.

Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. Neither Lantz Financial, LLC nor its representatives provide tax or legal advice, and nothing herein should be construed as such. Always consult with your tax advisor or attorney regarding your specific circumstances.