Cisco Systems Inc. is scheduled to report earnings after Wednesday’s close. The stock hit a record high of $82/share in March 2000 and is currently trading near $70/share. The stock is prone to big moves after reporting earnings and can easily gap up if the numbers are strong. Conversely, if the numbers disappoint, the stock can easily gap down. Investors will want to know if AI can help the company grow. To help you prepare, here is what the Street is expecting:

Earnings Preview

The company is expected to report a gain of $0.98/share on $14.61 billion in revenue. Meanwhile, the so-called Whisper number is a gain of $1.01/share. The Whisper number is the Street’s unofficial view on earnings.

A Closer Look At The Fundamentals

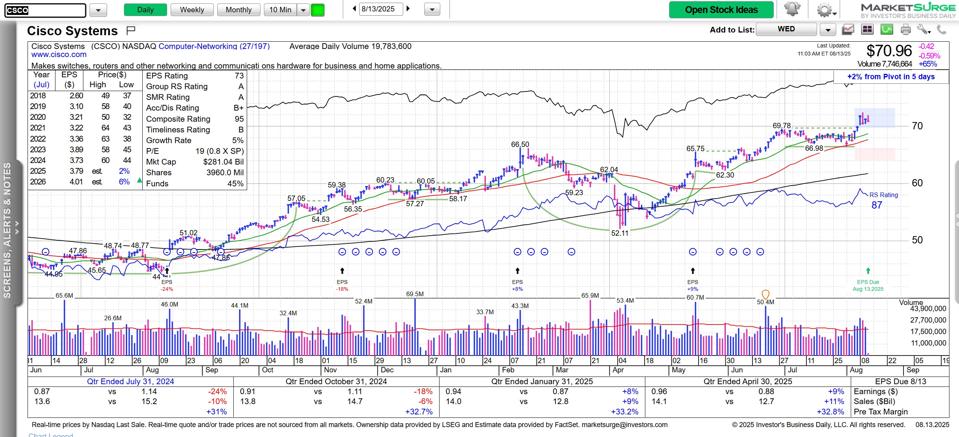

The company has posted steady earnings over the last few years. In 2020, the company earned $3.21. In 2021, earnings came in at $3.22. In 2022, earnings grew to $3.36. In 2023, earnings grew again to $3.89. In 2024, earnings slid to $3.73. Looking forward, earnings are expected to come in at $3.79 in 2025 and grow to $4.01 in 2026. Meanwhile, the stock sports a price to earnings ratio of 19 which is 0.8x the S&P 500.

A Closer Look At The Technicals

Technically, the stock is acting great and just hit a multi-decade high. The stock is trading above its 21, 50, and 200 day moving average lines which are the next levels of support to watch. After earnings, the bulls want to see the stock gap up and rally and the bears want to see it gap down and fall.

Company Background

Cisco Systems, Inc. stands as a global powerhouse in digital networking and communications technology. Founded in 1984 by Stanford University computer scientists Leonard Bosack and Sandy Lerner, Cisco broke new ground by making it possible for computers to connect across networks using multiprotocol routers. The company rapidly evolved from its Silicon Valley roots to become a public company in 1990 and has since grown into a leader in network infrastructure, security, and software services. Cisco’s headquarters remain in San Jose, California, and it maintains a commanding presence in the Americas, Europe, Middle East, Africa, and Asia-Pacific regions.

Company Profile

Cisco develops, manufactures, and sells a diverse range of information technology products and services that serve as the backbone of the modern Internet. The company’s innovations span networking hardware, software-defined networking, wireless technologies, security solutions, collaboration platforms such as Webex, cloud management, and observability suites. These offerings empower businesses and institutions to create secure, robust networks and adapt to the evolving demands of digital transformation.

Cisco provides solutions that address connectivity needs for enterprises, governments, service providers, and public institutions. Its portfolio includes campus and data center switches, enterprise routers for public and private network integration, robust wireless coverage systems, and advanced network security products for threat detection and access management. The company’s collaboration suite integrates cloud, hybrid, and on-premise communications, helping organizations facilitate seamless voice, video, and data interactions.

In addition to hardware, Cisco offers software and technical services such as monitoring, analytics, network assurance, and advisory support. Its direct and channel sales models—utilizing systems integrators, service providers, distributors, and resellers—ensure wide market reach. Over decades, Cisco has built strategic alliances, diversified its portfolio, and supported major digital initiatives across industries from healthcare to energy, media, transportation, and retail.

With its long history of innovation, expansive product suite, and global operations, Cisco remains a central figure in driving connectivity, security, and collaboration for organizations worldwide.

Pay Attention To How The Stock Reacts To The News

From where I sit, the most important trait I look for during earnings season is how the market and a specific company reacts to the news. Remember, always keep your losses small and never argue with the tape.

Disclosure: The stock has been previously featured on stock market membership site: FindLeadingStocks.com