Key News

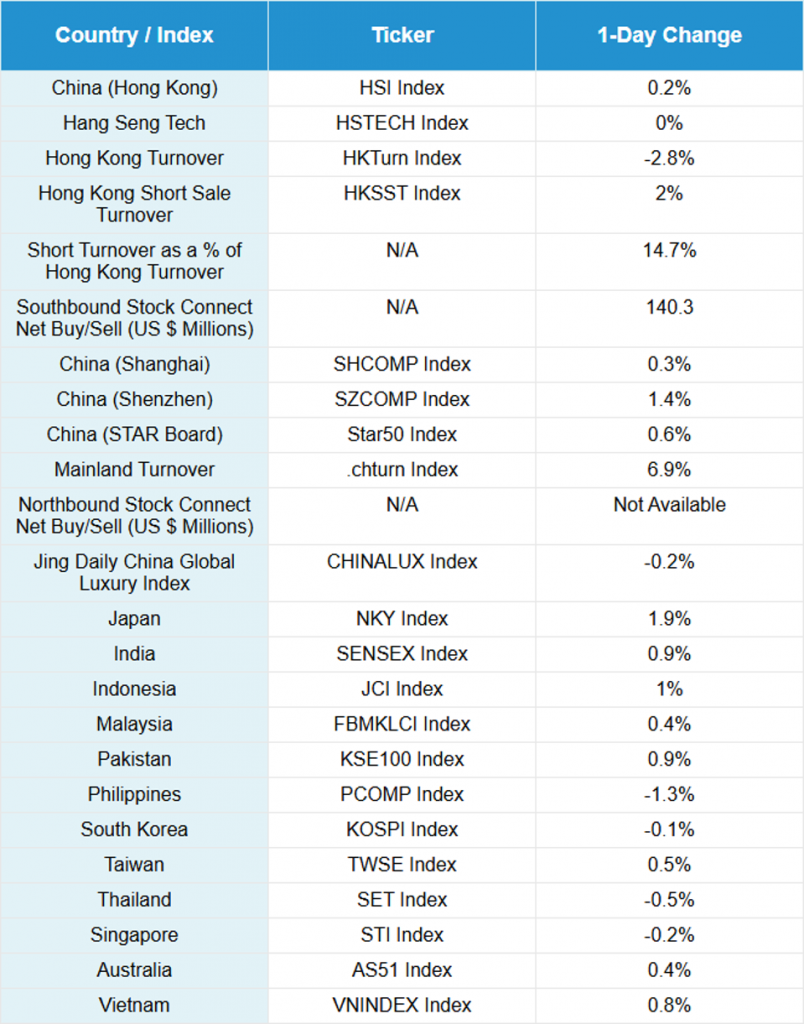

Asian equities were mostly higher overnight, as Japan and Mainland China outperformed, while the Philippines and Thailand underperformed.

Both Hong Kong and Mainland markets were higher overnight, though the Mainland outperformed, as investors remained optimistic about the longevity of the US-China trade truce, especially with the news that Nvidia and Intel will be able to sell AI chips in China, albeit the less-advanced ones, while paying the US government 15% of their China revenues. This shows the importance of China revenue to these companies. Charging companies to export and extracting “golden shares” from US Steel, as a condition of approving Nippon Steel’s takeover, are making the US look more like a state-capitalist model, like China. There was an interesting op-ed in the Wall Street Journal on this very topic. Anyway, there are green shoots for the US-China relationship.

Tencent was flat despite expectations of slowing profit growth for the second quarter. The company has seen gaming revenue increase substantially on an increase in the frequency and volume of game approvals by China’s regulators. AI spending is named as the culprit for the slowing profit growth, though the company needs to continue to stay relevant in the AI space.

CATL will be closing a key lithium mine in China. This is part of the government’s anti-involution campaign against oversupply, especially in the electric vehicle space. The news sent lithium prices higher and is likely to slow the new supply of vehicles to the domestic and international markets. We have discussed previously that China’s electric vehicle manufacturers and solar panel makers are going to start acting like an OPEC, discussing and deciding when to cut or increase production. This vision became real overnight with the announcement of the mine’s closure. The slowing of production and the material step will be useful in trade negotiations, especially with the EU.

Value slightly outperformed growth in both Mainland China and Hong Kong. Internet stocks were mixed as Alibaba gained, Tencent was flat, and Meituan was lower.

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

CNY per USD 7.19 versus 7.18 yesterday

CNY per EUR 8.34 versus 8.37 yesterday

Yield on 10-Year Government Bond 1.72% versus 1.69% yesterday

Yield on 10-Year China Development Bank Bond 1.81% versus 1.78% yesterday

Copper Price 0.06%

Steel Price -0.03%