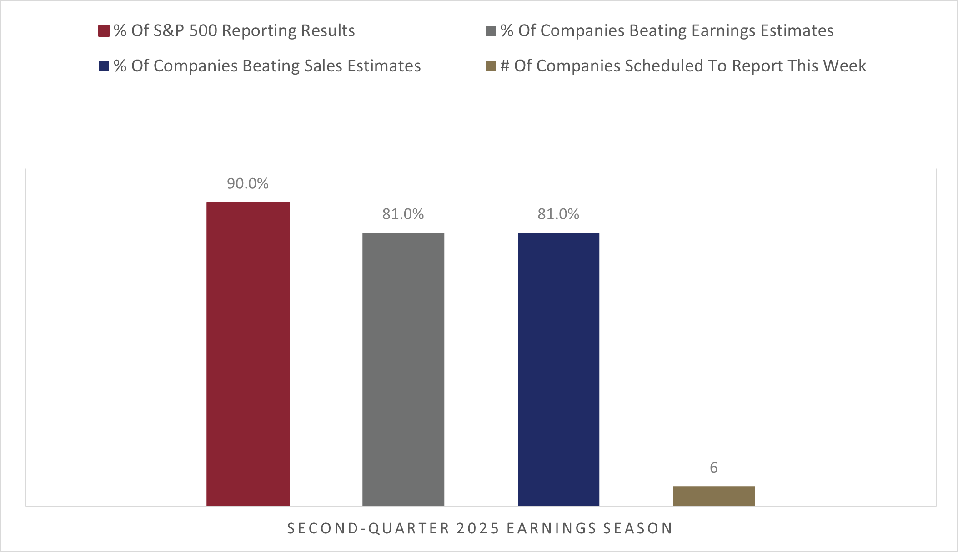

Following the second busiest week, the second-quarter earnings season begins to slow down this week, with just 6 S&P 500 companies scheduled to report. Notable companies scheduled to release earnings include: Deere (DE) and Applied Materials (AMAT).

Earnings Season At A Glance

According to FactSet, 81% of S&P 500 companies have reported earnings above consensus estimates, with 90% of companies having already reported results.

Earnings Estimates Summary

Companies reporting and combining actual results with consensus estimates for companies yet to report, the S&P 500’s blended earnings growth rate for the quarter is at 11.8% year-over-year, well above the 4.9% expectations at the end of the quarter. Notably, the expected earnings growth rate for calendar year 2025 is 10.3%, and for 2026, the expectation is 13.3%.

Market Performance

Following the better earnings results, the S&P 500 came within a hair of an all-time high last week, while the Magnificent 7 reached a new peak. The Magnificent 7, comprising Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA), outperformed primarily due to Apple and Tesla.

Magnificent 7

Because these companies are critical drivers of earnings growth and a significant percentage of the S&P 500’s market capitalization, the Magnificent 7 were the group to watch this earnings season, and they did not disappoint aside from Tesla (TSLA). Furthermore, the artificial intelligence (AI) related companies reinforced the positive narrative surrounding the technology.

With earnings season nearing completion, all eyes now shift to NVIDIA (NVDA), which is scheduled to report on August 27.

Earnings Insights By Sector

Positive earnings surprises from the healthcare and communication services sectors were the most significant contributors to the improved earnings picture last week. Better-than-expected earnings from Pfizer (PFE), Eli Lilly (LLY), Amgen (AMGN), and Warner Bros. Discovery (WBD) were the most essential contributors, according to FactSet.

Revenue Results By Sector

Following better-than-expected data last week, sales growth of 6.3% is ahead of the 4.2% year-over-year expectation at the end of the quarter.

Better sales results in the financials and healthcare sectors were the most significant drivers of the improvement in expected revenue growth last week, according to FactSet.

What To Watch Next Week

Earnings season slows to a crawl beginning this week. While the individual reports are crucial for that stock, none are going to change the overall color of the season at this point.

Friday’s retail sales numbers will be an essential check on the US consumer. The soft monthly jobs report with massive downward revisions to start the month was worrisome for the health of the economy. Since the consumer drives the US economy, retail sales will be closely watched to see if the labor market is spilling over to spending.

Consumer inflation (CPI) on Tuesday will be notable as the odds of a September short-term interest rate cut from the Federal Reserve (Fed) have risen to 90% following the weaker-than-expected jobs report. Year-over-year CPI is expected to increase to 2.8% from 2.7%, but the data will be watched for signs that the Fed needs to delay any cuts to fight inflation. There is still one more monthly jobs report before the Fed’s September meeting, and barring an abnormally large inflation surge, the labor market will be the primary driver behind any rate cuts or lack thereof. In addition, markets have now fully priced in at least two rate cuts of 25 basis points (0.25%) in 2025.

Newsflow about the administration’s trade negotiations and new tariff announcements will remain a market mover.

Berkshire Hathaway (BRK/A, BRK/B) releases its 13F filing after the close on Thursday. Warren Buffett continues to be a net seller of stocks, but this report provides the details. An analysis of Berkshire’s quarterly earnings is here.

The increase in worries about the economy in the wake of a shockingly poor jobs report eased this week, with the betting odds of recession falling to the lows of the year. The falling odds of recession and another week of better-than-expected earnings sent stocks to near record highs.