Earnings season is in full swing. The second quarter earnings of Trade Desk delivered what should have been a good quarter: revenue rose 19 percent year‑over‑year to $694 million, nudging past estimates, and adjusted EPS landed at $0.41, on target, maybe even slightly ahead, but rather than celebrating, investors punished the stock. It crashed, dropping 39 percent, depending on whether you’re watching after-hours or the full trading session.

It’s become a familiar pattern. Across sectors, companies meet or beat the numbers and still get sold. The market isn’t in love with the details of the quarter anymore. It wants clarity on what comes next, growth runway, real guidance, and leadership that inspires confidence before you can earn it.

If you’re still trading earnings like the playoff buzzer matters most, you’re late to the game. At The Edge, we don’t just model the quarter. We model how the market is going to price leadership, strategy integrity, and believable forward narrative ahead of the P&L. Because in today’s market, that’s where the real moves begin.

The Market’s Old Playbook Is Broken

From 2010 to 2019, earnings season followed a familiar script. A company beat expectations, and the stock typically moved higher, often within minutes. Algorithms and quant funds amplified the pattern, scooping up shares on surprise beats and reinforcing the idea that the quarter’s numbers were the main driver of short-term price action.

Even the COVID shock didn’t fully dismantle the playbook. The pandemic introduced volatility, and post-COVID markets were noisy, but if a company could clear the consensus bar, there was usually a short-term reward.

That dynamic is breaking down. In 2025, FactSet data shows that companies delivering positive earnings surprises averaged just a +0.4 percent price move in the days around the announcement, less than half the five-year average. Even those that beat both revenue and EPS barely outperformed the S&P 500 by 0.5 percent, compared with a historical average of 1.5 percent.

The reasons are structural:

- Narrative dissonance—The numbers hit, but guidance fails to inspire.

- Credibility gap—leadership no longer gets the benefit of the doubt.

- Structural mistrust—regulatory overhang, questionable buyback logic, or opaque reporting.

Earnings season hasn’t lost its relevance, but the reaction function has changed. It’s no longer about who beat the quarter; it’s about who the market believes can deliver beyond it.

What’s Actually Moving Stocks

What is moving stocks in 2025 is no longer the quarterly scorecard; it is the market’s view of credibility, transparency, and the road ahead. Earnings season still delivers news, but it is filtered through a different lens.

1. Strategic Credibility

The first question a money manager asks now is whether leadership has a strategy worth believing in. A clean beat is meaningless if the market doubts the team can deliver on what comes next. Boeing is still working through leadership changes that have dented investor faith. Intel has become as much a political story as a corporate one, with Washington pressure complicating execution. UnitedHealth faces regulatory heat that challenges its integrated model. In each case, the market reaction has less to do with the last quarter’s numbers and more with whether management can credibly guide the next year.

2. Trust and Transparency

Investors are punishing companies whose reporting leaves too many questions unanswered. Complex segment structures, opaque metrics, and “adjusted” results packed with exclusions create mistrust. A tech company can clear EPS expectations and still lose ground if the fine print shows slowing customer growth or a shrinking order book. The market has grown quicker to discount anything that feels massaged or withheld.

3. Forward-Looking Catalysts

In today’s market, the next event often matters more than the last one. M&A potential, activist involvement, strategic reviews, product launches, and corporate breakups are the levers that can reprice an equity faster than an earnings beat. A company can post a flat quarter and still rally 15 percent on news of a spinoff. The driver isn’t just what happened; it’s what could happen next and how quickly it can alter the setup. That’s where the real money moves.

In this new environment, the companies that outperform in earnings season are not those that simply beat the numbers, but those that align credibility, transparency, and catalysts in a way the market believes will deliver.

Why This Matters For Professional Investors

Many professional investors still run processes built for an older market. Quarterly results remain overweight in decision-making, with too much emphasis placed on beating consensus and too little on the structural factors that now dictate price action. This creates a blind spot that can be costly.

Risk comes before P&L. You can be right on earnings, model every line perfectly, and still lose money if the market decides to reprice trust, downgrade leadership credibility, or question the company’s strategic path. The inverse is also true. You can position early on a structural catalyst and profit well before the quarter validates it. Activist involvement, a credible CEO appointment, or a strategic asset sale can create value that shows up in the share price long before it shows up in the income statement.

Clinging to the old model is like playing after the whistle. By the time the numbers are released, the real move has often already happened. In this environment, risk isn’t missing a one- or two-cent EPS beat. It’s missing the moment when the market changes its mind about a company’s trajectory. For professional investors, adapting to this shift isn’t optional; it’s the only way to stay ahead of where the capital is flowing.

Navigating This Shift

At The Edge, our framework is built for a market where the biggest moves often happen before the quarterly numbers hit the tape. It is designed to find opportunities where traditional earnings-season analysis falls short. We focus on three core pillars.

1. Structure Before Numbers

We begin by assessing the situation, ownership changes, insider activity, and corporate actions before even looking at the quarter. Market structure often drives price action more than short-term results. In a spinoff, for example, forced selling by index funds or mandates can create a temporary supply imbalance, pushing the stock well below intrinsic value regardless of EPS. Understanding that structure means you can buy into weakness while others are focused on the income statement.

2. Leadership & Incentives

We dig into management track records, incentive plans, and capital allocation discipline. If leadership is misaligned with shareholders, no beat will save the stock. Poor governance, misguided acquisitions, or self-serving buybacks are structural drags. Conversely, a well-aligned team with a clear strategy can drive a sustained re-rating even through a few soft quarters. We want to know not just what management is saying, but what they are paid to do.

3. Catalyst Mapping

We chart the next 6–12 months for events that can reprice the equity, activist campaigns, strategic reviews, asset sales, buyback changes, or CEO appointments. These are the moments when the market reassesses a company’s trajectory. Our catalyst maps are not just about predicting events; they are about understanding how the market will react to them and positioning in advance. We focus on market psychology alongside financial modeling to anticipate those inflection points.

This approach has consistently put our clients ahead of the Street. The GE breakup, PayPal’s value unlock post-eBay, and more recent under-the-radar names all moved significantly before P&L improvement appeared. In each case, the market’s re-pricing began on structure, leadership, or catalysts, not the quarter’s results. That is where we operate, and why we have outperformed in a market where earnings alone is no longer enough.

A Current Play Thats Not Earnings

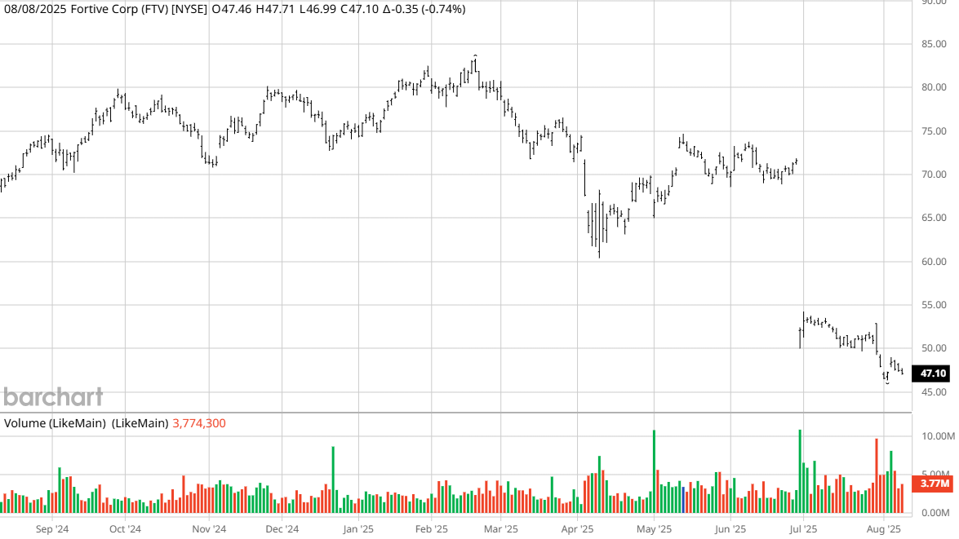

Fortive’s Ralliant spinoff was a perfect case of structure overshadowing earnings. The parent reported a clean EPS beat. Under the old playbook, that was enough to buy. Not this time. But the market wasn’t sold. The Precision Technologies unit that became Ralliant loaded the company with lower-margin, cyclical risk, and trading pressure was already baked in from index rebalancing logic.

We passed on chasing the quarter. That paid off. Fortive dropped nearly 5% on spin-off day, a reflection of uncertainty, not fundamentals. No knee-jerk reaction, no fading discipline.

We waited. We looked for when technical overhangs cleared, and Fortive’s new, asset-light structure began to trade on its merits: recurring revenue, free cash flow, and better capital returns. That’s the moment we believe will set the stage for a durable move higher once visibility improves on execution and macro headwinds ease.

Our discipline protected us from short-term noise and set us up for upside when the market refocuses on the new Fortive. In today’s landscape, patience through structural inflection, not reflexive buying on earnings, is where money gets made.

The New Mandate For Money Managers

Earning season has become a lagging indicator. The real drivers of stock moves in 2025 are trust in leadership, transparency in reporting, and forward-looking catalysts that can alter a company’s trajectory. For professional investors, the advantage lies in anticipating structural re-ratings before they are reflected in the numbers.

That requires a shift from reacting to P&L headlines to proactively assessing the setup market structure, management alignment, and the events that can change sentiment. It means understanding where the risk sits and how it will be priced before the Street gets there.

At The Edge, we’ve built our process for this environment. We identify and size the real risks before they hit the tape, map the catalysts that matter, and get positioned before the market reprices them. This approach not only protects capital, it captures the opportunities others see too late.

If your process starts with earnings season, you’re already too late. The real edge is knowing what the market will care about next and getting there first.