The financial plumbing powering our daily transactions is being rebuilt, and the infrastructure companies operating behind the scenes are reaping the benefits.

When Sarah Chen tapped her Coinbase card to buy coffee in downtown San Francisco, the barista barely looked up as the payment cleared in seconds. Coinbase instantly converted her crypto to dollars and authorized the charge. The payment glided across Visa’s network, processed through Stripe, and landed in the merchant’s account. She walked away, unaware she had just taken part in a $400 billion gold rush. Fortunes here are made not in mines, but in the invisible highways of financial infrastructure.

With crypto established as a legitimate asset class, held by ETFs and on the verge of inclusion in 401(k)s and retirement plans, the next leap is inevitable: spending it as effortlessly as cash. That shift isn’t just a convenience upgrade; it’s a multi-hundred-billion-dollar race to build the payment rails that let crypto flow through the same networks as fiat money.

That gold rush isn’t about flashy apps or the next hot token. It is about the payment backbone, the underlying systems powering a financial transformation most people never see but everyone increasingly depends on.

The Last Mile Problem

Sarah’s seamless experience masks a deeper reality: for all its progress, crypto’s core challenge remains unresolved. You might hold thousands in Bitcoin, but try buying groceries and you’ll hit a wall of friction that makes spending feel like solving a Rubik’s Cube in the checkout line with a timer ticking down.

The solution isn’t flashy; it’s infrastructural. While consumer apps grab headlines and venture capital, the heavy lifting happens in the underlying systems: payment processors, compliance engines, and settlement networks that make crypto cards work at any merchant accepting traditional payment methods such as Visa, Mastercard, AmEx, Apple Pay, Google Pay, or PayPal.

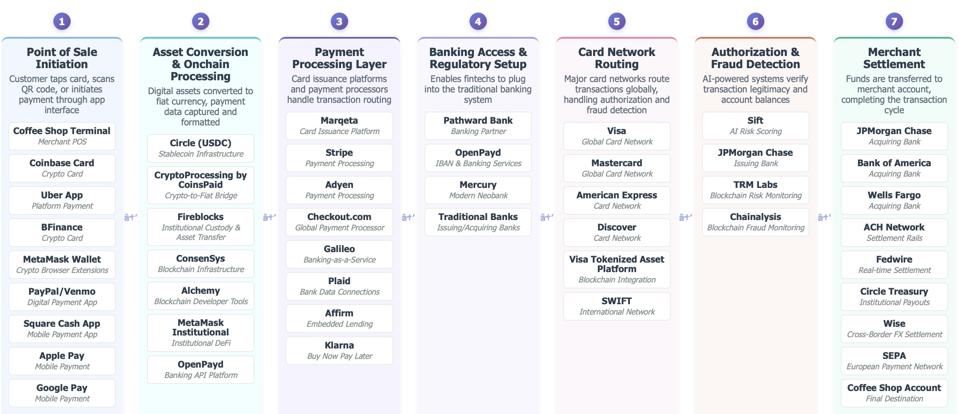

Think about the hidden complexity behind Sarah’s coffee purchase. Marqeta issued her Coinbase card. When she tapped to pay, Coinbase instantly converted her crypto to dollars and authorized the transaction. Visa’s network carried the payment to Stripe, which processed it for the coffee shop. Seconds later, the merchant was paid. This entire chain handled conversion rates, compliance checks, and regulatory requirements automatically, making the complexity invisible and the experience effortless.

The economics are compelling. Card processing fees typically range from 1.5% to 3.5% of the purchase price. On Sarah’s coffee ($5), that’s roughly $0.07–$0.17 split among the players, small numbers at the transaction level, but massive at scale. Multiply by millions of daily transactions, and the incentives for controlling these rails become obvious.

From Tap to Settlement: The Invisible Ballet Behind Every Crypto Payment

McKinsey projects global fintech revenues will surge past $400 billion by 2028, growing 15% annually versus just 6% for traditional banking. The fastest-growing slice is the infrastructure layer: payment rails, custody platforms, and compliance systems. $150 billion to $205 billion in banking revenue has already shifted to these infrastructure providers.

It’s a land grab for digital finance’s foundations. Infrastructure players are locking down the pipes that move the money, competing to control the world’s payment flows while the market is still taking shape.

Three Forces Driving The Infrastructure Gold Rush

Embedded Finance: Money Is Vanishing Into The Platforms

Loans from Shopify, insurance from Tesla, and payments through Uber. Financial services are no longer destinations; they’re features hidden inside the apps and platforms we use every day.

The scale is staggering. Embedded finance is projected to handle $7.2 trillion in transaction volumes by 2030, larger than most national economies, and increasingly dependent on payment systems that can handle both fiat and crypto with equal ease. Amazon isn’t just a retailer; it’s a bank, lender, and insurer. Uber makes as much from payments as it does from rides. Shopify realized the real profit wasn’t building websites, but processing the billions flowing through them.

All of this drives demand for financial infrastructure. Every app offering “buy now, pay later” or instant payouts needs card issuers like Marqeta, data connectors like Plaid, and processors like Adyen. These firms quietly capture a slice of every transaction, and the consumer never sees them.

Blockchain Becoming Pervasive

What began as a niche experiment is now mainstream money. With 659 million holders worldwide and 28% of U.S. adults owning digital assets, crypto has shifted from speculative bet to spendable wealth. That scale is fueling demand for infrastructure that can convert digital assets into everyday purchases seamlessly.

This shift is mirrored in traditional finance, where blockchain has leapt from crypto forums to bank boardrooms: JPMorgan processes over $2 billion a day through blockchain settlement, UBS runs “Digital Cash” for instant cross-border payments, and Visa’s Tokenized Asset Platform with Mastercard’s Multi-Token Network signals that blockchain-based payment rails are here to stay. Fireblocks secures over $10 trillion in digital asset transactions for major banks, ConsenSys powers 100 million wallets, and Alchemy became the “AWS of blockchain” for enterprise. Infrastructure providers are becoming indispensable.

AI Guards Every Transaction

AI eliminates decades of financial inefficiency. Every crypto payment triggers algorithms verifying wallet history, assessing risk, and optimizing conversion rates in under 200 milliseconds. AI can flag suspicious wallets mid-transaction or approve high-value payments instantly.

Juniper Research projects AI fraud detection spending will exceed $10 billion by 2027. But AI’s impact extends beyond fraud: instant underwriting, real-time risk assessment and compliance automation. For infrastructure companies, AI creates competitive moats. Those with superior algorithms for crypto conversion and compliance automation will dominate as transaction volumes explode.

The Race For The Financial Stack

Visa, Mastercard, and Stripe already own the broad traditional finance highways, but crypto-specific middleware is what allows those highways to be used: the translation layer that connects wallets to card networks, merchant processors, and banking compliance systems. The real competition plays out in this split-second choreography: converting crypto into the language of traditional finance, moving it through currency conversion, risk checks, and regulatory reporting in milliseconds. Companies that master this choreography can capture outsized revenue at the exact moment old rails meet new money.

The prize isn’t replacing banks or infrastructure; it’s connecting seamlessly to it. Every crypto transaction needs traditional bridges, every wallet needs compliance, and every fintech needs banking partners. These connection builders position themselves as essential plumbing for finance’s evolution.

Players Racing To Own The Rails

That translation layer isn’t theoretical—it’s already a battleground. From consumer-facing crypto cards to enterprise-grade banking APIs, companies are racing to own the critical points where digital assets meet traditional finance. Some are building mass-market ecosystems, others are focusing on specialized infrastructure, but all are competing for the same prize: becoming indispensable at the moment crypto hits the legacy rails.

Consumer Payments Layer

Major players like Crypto.com and Coinbase have built large crypto card ecosystems with tiered benefits, staking incentives, and broad merchant acceptance. While these giants focused on feature-rich platforms, BFinance bet on simplicity instead: what if spending crypto could be as easy as texting a friend? Each month, it processes $20 million through virtual Visa and Mastercard cards compatible with Apple Pay, Google Pay, and Samsung Pay. Fees are simple: $10 to issue, 2 percent on top-ups, and $0.50 per transaction. Users can load major tokens and access eSIMs, crypto transfers, and bill payments, all inside Telegram.

Enterprise Infrastructure Tier

Firms like Fireblocks and Anchorage secure billions in digital assets for global banks, exchanges, and asset managers. Taking a different approach, OpenPayd bridge crypto and fiat with a single API offering IBANs, FX, SEPA, and Open Banking services across the UK and Europe. They provide regulatory-compliant rails without the licensing burden. Recent deals with Circle and Ripple enable real-time stablecoin ramps, FX conversion, and cross-border payments—unlocking trusted, bank-grade access to digital dollars and global liquidity.

Merchant Acceptance Layer

Established processors like BitPay and CoinPayments handle millions in monthly crypto transactions with multi-currency support and merchant integrations. By contrast, leaner platforms are winning adoption by streamlining features and simplifying merchant onboarding. CryptoProcessing by CoinsPaid, for example, powers hundreds of merchants globally and handles tens of millions in monthly volume. The platform supports 20+ cryptocurrencies, real-time fiat settlement, sub‑1.5 percent fees, automatic volatility protection, and no chargebacks. With a single API, fast onboarding, and built-in compliance, it removes friction for merchants integrating crypto-to-fiat payments.

Jason Gardner, founder of Marqeta, explains the infrastructure advantage: “I don’t want to go compete with a Stripe or an Adyen… There are 3,000 competitors in that [acquiring] space, versus 200 to 300 in issuing and processing. The odds are in our favor.”

Ultimately, they all rely on the same traditional card networks: Visa and Mastercard. The pattern is unmistakable: the companies controlling how digital value moves at the protocol layer, in the middleware, and at the edge of commerce are the ones shaping the financial stack of the future.

Regulations Create Winners And Losers

Compliance costs are soaring, with top-tier anti-money laundering systems running up to $50 million annually, effectively locking out smaller competitors and creating regulatory moats for established players.

MiCA implementation began on December 30, 2024, requiring full banking licenses for stablecoin issuers by July 2026. In the U.S., the GENIUS Act established a federal stablecoin framework, while Circle became America’s first publicly traded stablecoin issuer with a $6.9 billion valuation.

Companies like Coinbase and Circle aren’t just surviving new rules; they’re helping write them, embedding themselves into the financial architecture. For leaders like Marqeta, Coinbase, and Circle, regulatory navigation isn’t about avoiding risk; it’s about shaping standards that could secure dominance for years. That’s why well-capitalized incumbents with compliance teams and political influence are better positioned to turn regulation into a competitive edge.

What This Means For The Future

This infrastructure gold rush will reshape how money moves globally. Within five years, the distinction between crypto and traditional payments will blur completely. The companies building these rails today are positioning themselves to collect fees on trillions in future transaction volume.

For investors, the lesson is clear: while crypto prices grab headlines, the real value lies in the infrastructure enabling its use. For businesses, early adoption of these payment rails could provide competitive advantages. For consumers, this means financial services will become faster, more convenient, and more seamlessly integrated into daily life. Most importantly, they’ll finally be able to spend their crypto holdings as easily as swiping a debit card.

In fintech’s gold rush, the prize isn’t the next winning coin; it’s controlling the milliseconds between tap and settlement. In finance’s new operating system, the infrastructure isn’t just king, it’s the kingdom. The biggest fortunes will go to those quietly building the invisible highways the rest of us use without ever seeing.