Worried about a market pullback?

Let’s discuss seven sturdy dividends with yields up to 8%. These are “low beta” stocks which means they stand tall when the market sinks. Low beta stocks may still go down, but they tend to regress less than average.

And generally speaking, the lower the beta, the more cushion to the downside. The lower a stock’s beta, the less volatile (the less it moves) compared to a benchmark (like the S&P 500). It’s really easy:

Beta more than 1 = more volatile than the market.

Beta less than 1 = less volatile than the market.

Then we want to pair low beta with high dividend yields. Not only is that dividend income an additional source of return, but it also attracts buyers during market scares, which in turn can buoy our shares.

Let’s look at several examples, which yield at least 5% and all the way up to 8%.

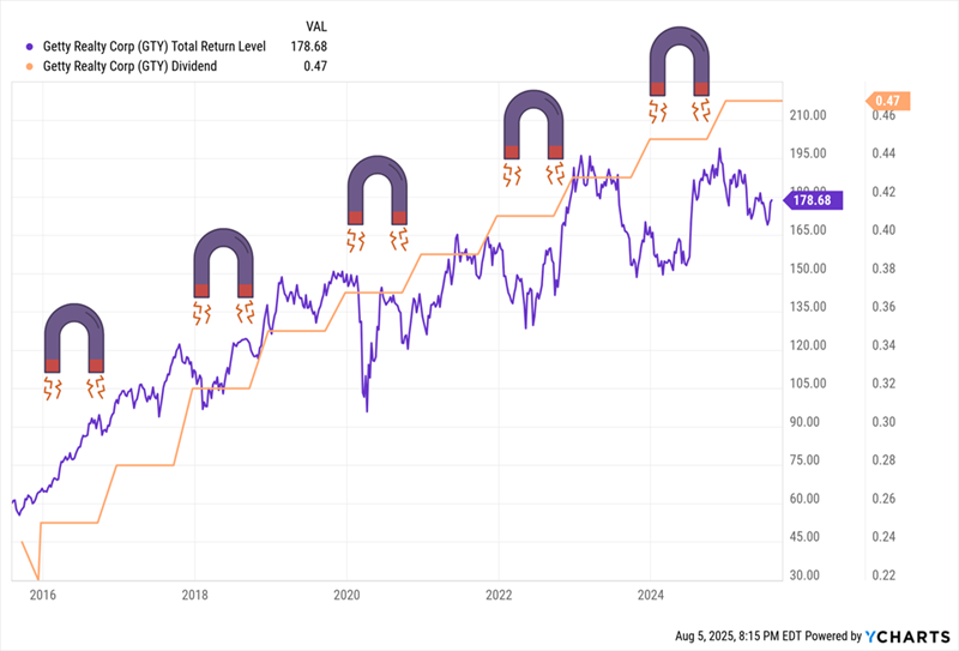

Low-Beta Dividends: Getty Realty

I’ll start with Getty Realty (GTY, 6.6% yield), an owner of more than 1,130 freestanding (read: single-tenant) retail properties across 44 states and the District of Columbia.

Getty offers both the high yield we expect out of real estate investment trusts (REITs) and a lot less wiggle. Getty sports a 5-year beta of 0.86 (modestly less volatile than the broader market), and a 1-year beta of 0.12 that’s downright sleepy no matter what we compare it to.

A 10% decline in the S&P 500 would theoretically only “spill over” to Getty to the tune of 1.2%.

The reason for this stability? An always-cash-flowing brick-and-mortar tenant base. Nearly two-thirds of Getty’s base rent comes from convenience stores, another 20% comes from express tunnel car washes, and the rest is spread across auto service centers, drive-through quick-service restaurants, auto parts, gas stations and repair shops. That has been a long-term recipe for both outperformance against the sector, and solid dividend growth.

However, it also reflects what has been a weak 2025 (shares are down a couple percent year-to-date) for a company that has significantly outperformed the real estate sector over the long haul.

GTY hasn’t delivered any particularly bad news. The stock merely tanked with the rest of the market in April and, between two middling earnings reports—including a miss on adjusted funds from operations, or AFFO, reported a couple of weeks ago—hasn’t yet given Wall Street much to be excited about.

Low-Beta Dividends: AES Corp.

Any list of low-beta stocks is bound to include a utility company like Virginia-based AES Corp. (AES, 5.5% yield), which distributes power to some 2.7 million customers through its regulated utility businesses.

A few months ago, I noted that AES trades more in line with cyclical plays. And at a 1-year beta of 0.88 and a 5-year beta of 0.96, the stock is more volatile than the utility sector. So why does it make the cut?

Because a.) it’s still less volatile than the market, and b.) AES Corp. isn’t an average utility company. It also sells renewable energy to corporate customers and data centers: an operation that spans 11 states coast to coast, as well as South America, Europe, Asia, and the Middle East. That gives it a lot more growth potential. On top of that, AES’s 5%-plus dividend is well ahead of the typically generous utility sector. It’s cheap, at just six times earnings estimates.

Another point of interest that has nothing to do with stability? AES could be buyout bait. Bloomberg, citing anonymous sources with knowledge of the matter, reported in July that the company was considering a potential sale, and that Brookfield Asset Management (BAM) and BlackRock’s (BLK) Global Infrastructure Partners had been studying the company.

Low-Beta Dividends: Northwest Bancshares

The financial sector has its fair share of decent dividends, but few as lofty as what Northwest Bancshares (NWBI, 6.8% yield) offers at current prices. NWBI is the holding company behind Northwest Bank, a regional financial firm that operates more than 150 full-service locations in Ohio, Pennsylvania, New York and Indiana. That includes a couple dozen Pennsylvania locations that were added in late July, courtesy of a completed merger with Penn Woods Bancorp.

NWBI has long been a high-quality bank with a concrete balance sheet and a penchant for lower-risk loans, reflected in a typically stable stock. The financial sector is generally as volatile as the market, and NWBI is less so, boasting a 5-year beta of 0.69 and a 1-year beta of 0.80.

But it has struggled to find consistent growth despite specialized lending programs such as sponsored finance and equipment finance. The Penn Woods acquisition won’t necessarily be transformational, but it adds scale and could provide a small lift to the bottom line—something Northwest Bancshares needs to get its dividend back into gear.

Low-Beta Dividends: General Mills & Kraft Heinz

Earlier this year, I suggested that readers dump a number of stocks to start Trump 2.0, including a pair of low-beta stocks:

- General Mills (GIS, 5.0% yield)

- Kraft Heinz (KHC, 5.9% yield)

How’s that going so far?

We know what we’re getting into with staples stocks: In hectic markets, outperformance. In up markets, underperformance—but not the faceplant that KHC and GIS investors have endured in this latest rip.

Interestingly, the low nearer-term betas in Kraft Heinz (0.16) and General Mills (virtually zero) show us how low betas can sometimes be deceiving. The market is up 20% over the past year, so we’d almost expect a low-vol stock to be up, just less so—and that’s definitely one way a stock can show little volatility. But in the case of KHC and GIS, their low volatility readings are more the product of counter-market movement for much of the past year.

Going forward? Both stocks are cheaper than they were to start the year, both nominally and on a forward P/E basis, but neither have become a screaming value. Their dividends are bigger, too, but again, that has more to do with shrinking prices than anything else—KHC’s distribution hasn’t budged since the company cut it in 2019, and GIS’s payout growth has slowed to a penny per share in each of the past two years.

Low-Beta Dividends: Conagra Brands

Conagra Brands (CAG, 7.4% yield) is another flailing staples stock, but with a yield approaching the 8% benchmark I prefer for retirement holdings, it deserves a closer look.

Conagra is similar to KHC and GIS in that it houses a variety of popular food brands, including Birds Eye frozen vegetables, Marie Callendar’s and Healthy Choice frozen meals, Duncan Hines baking mixes, Slim Jim meat sticks, Reddi-wip whipped cream and Angie’s Boomchickapop popcorn, among others. But it also has a foodservice business that provides a bit more diversification than most grocery-anchored staples names.

Unfortunately, it’s also similar to KHC and GIS in that its razor-thin betas (1-year: -0.05, 5-year: 0.08) are more the result of occasional periods where CAG zigs as the market zags.

We can’t walk 10 feet without bumping into something holding Conagra back. Supply chain issues. Food inflation. Migration to private-label brands. Tariffs. CAG’s fiscal year 2025, which ended May 31, saw profits drop by 14%; analysts see a bigger plunge of 24% for FY 2026. The dividend has been stuck at 35 cents quarterly for more than two years, and if 2026 estimates are on target, Conagra’s payout ratio will spike to 80%.

If that sounds like a wasteland, it is.

And yet, it’s worth keeping an eye on Conagra because it could go from “cheap” to “value” if a few initiatives bear fruit. The company is investing to drive growth in its frozen and snacks businesses, as well as improve supply chain issues within its frozen chicken business. It’s using funds from divestitures of businesses such as Chef Boyardee and Van de Kamp’s to pay down debt and reduce leverage. It’s nothing that will trigger a run on CAG shares anytime soon, but it could be the start of a healthier foundation—and with a 7%-plus yield, investors are at least being paid decently to stick around and see.

What if we want a consumer staples stock that isn’t already busted to pieces?

Low-Beta Dividends: Cal-Maine Foods

Cal-Maine Foods (CALM, 8.0% yield), the country’s largest producer and distributor of fresh shell eggs in the U.S., is up 60% year-to-date and has tripled over the past five years (that’s 2x the S&P 500). And it has done so in a pretty orderly fashion, boasting 1- and 5-year betas of 0.67 and 0.19, respectively.

That doesn’t mean Cal-Maine is an, ahem, calm business.

CALM’s fortunes have been lifted by a longer-term upcycle in egg prices that has been accentuated by a couple of wild spikes.

Recently reported full-year results, for the fiscal year ended May 31, included an 83% YOY surge in revenues and profits that more than quadrupled. Swings like that (in both directions) are common enough, because of the business’s reliance on egg prices, that management doesn’t even bother to provide earnings guidance.

But more importantly for income investors: CALM’s extremely variable income means management has to rely on an extremely variable dividend.

And while the stock might have a history of relative stability, there’s still a significant risk of a pullback if analysts—who are looking for cumulative drops of 26% on the top line and 70% on the bottom line across the next two fiscal years—are reading the tea leaves correctly.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: How to Live off Huge Monthly Dividends (up to 8.7%) — Practically Forever.

Disclosure: none