Plug Power (NASDAQ: PLUG), a company specializing in hydrogen fuel cells, is anticipated to announce its earnings on Monday, August 11, 2025. Historical trends suggest that the stock is more likely to experience a negative one-day reaction. In the past five years, PLUG has recorded a one-day decrease following earnings in 61% of the cases, showing a median loss of -5.9% and a maximum one-day decline of -40.5%. This underscores the stock’s considerable volatility around earnings announcements.

For traders who react to events, recognizing these historical trends can offer an advantage, though the actual outcomes compared to consensus forecasts will be the main factor influencing actions. Here are two potential strategies to explore:

- Pre-Earnings Positioning: Assess the historical odds and establish a position ahead of the public earnings report.

- Post-Earnings Positioning: Investigate the relationship between immediate and medium-term returns following the announcement to inform your choices.

Consensus projections indicate a significant improvement in the company’s performance for this quarter. Analysts anticipate revenue of $158 million and an adjusted loss of $0.16 per share, a positive comparison to the same quarter last year, during which revenue stood at $143 million and the adjusted loss was $0.34 per share.

From a fundamentals standpoint, the company currently holds a market capitalization of $1.4 billion. In the past twelve months, Plug Power has generated $642 million in revenue but recorded operational losses, with operating losses of -$988 million and a net loss of -$2.0 billion.

However, for those seeking potential gains with less volatility compared to individual stocks, the Trefis High Quality portfolio offers an alternative — it has outperformed the S&P 500 and achieved returns exceeding 91% since its launch. In addition, check out – What’s Happening With JOBY Stock?

View earnings reaction history of all stocks

Historical Probability of Positive Post-Earnings Returns for Plug Power

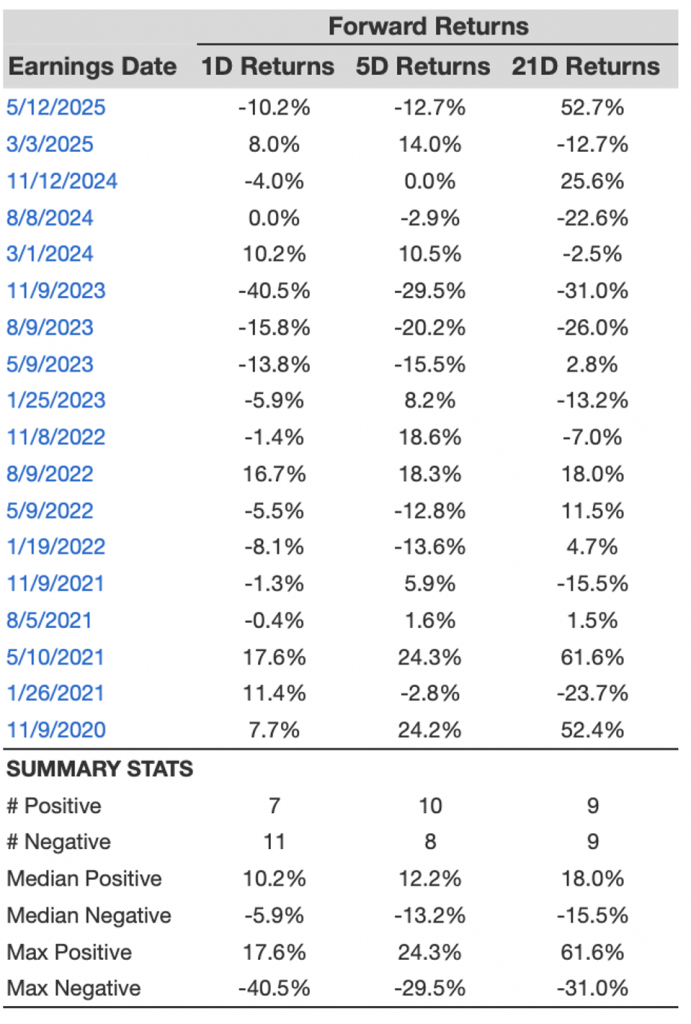

Here are some insights into one-day (1D) post-earnings returns:

- There are 18 earnings data points documented over the last five years, with 7 positive and 11 negative one-day (1D) returns observed. In summary, positive 1D returns occurred approximately 39% of the time.

- Nonetheless, this figure drops to 36% if we consider the data for the last 3 years instead of 5.

- The median of the 7 positive returns is 10%, while the median of the 11 negative returns is -5.9%.

Additional information regarding observed 5-Day (5D) and 21-Day (21D) returns after earnings is summarized along with the statistics in the table below. Related – Plug Power’s Hydrogen Hopes Dashed?

Correlation Between 1D, 5D, and 21D Historical Returns

A relatively less risky strategy (though of limited utility if the correlation is weak) involves understanding the correlation between short-term and medium-term returns post-earnings, identifying a pair that exhibits the highest correlation, and implementing the proper trade. For instance, if 1D and 5D demonstrate the strongest correlation, a trader could opt for a “long” position for the next 5 days if the 1D post-earnings return is positive. Below is some correlation data based on both a 5-year and a 3-year (more recent) timeline. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and the following 5D returns. Additionally, see – Buy or Sell PLUG Stock?

Is There Any Correlation With the Earnings of Peers?

At times, the performance of peers can impact the stock reaction following earnings. In fact, the pricing might begin before the earnings announcements are made. Below is some historical data on the post-earnings performance of Plug Power stock in comparison to the stock performance of peers that released their earnings just prior to Plug Power. For a fair comparison, peer stock returns also reflect post-earnings one-day (1D) returns.

Discover more about the Trefis RV strategy that has outperformed its all-cap stocks benchmark (a combination of all three, the S&P 500, S&P mid-cap, and Russell 2000), delivering strong returns for investors. Separately, if you seek upside with a smoother experience compared to an individual stock like Plug Power, consider the High Quality portfolio, which has outperformed the S&P and recorded >91% returns since its inception.