Total US gold demand more than doubled on an annual basis during the three months to June, according to the World Gold Council (WGC).

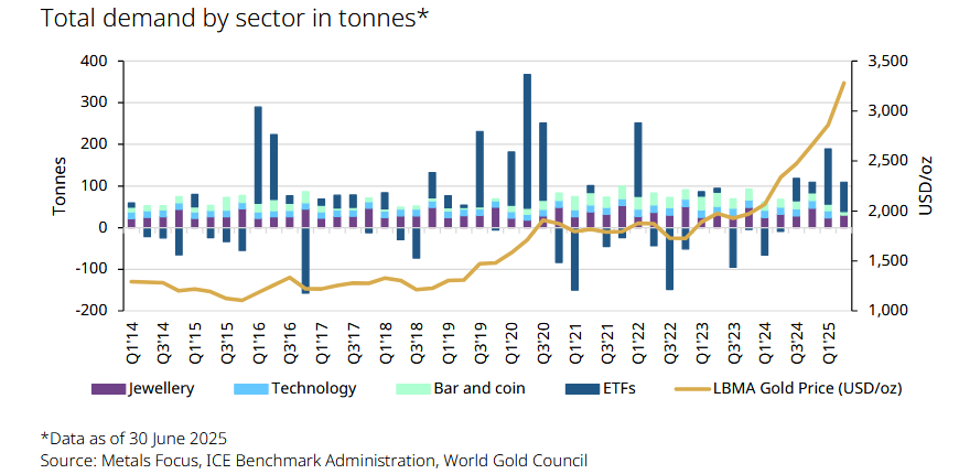

Thanks to robust flows into gold-backed exchange-traded funds (ETFs), overall demand leapt 110% to 124 tonnes during quarter two, the organization said.

However, demand was down 34% quarter-on-quarter, driven by weak sales of physical metal.

The WGC said that “while higher gold prices continued to weigh on US consumer demand, this was partially offset by strong demand into gold-backed ETFs.”

Earlier Council data showed bullion values reach a new quarterly record of $3,280.35 per ounce in quarter two. This was up 40% year on year, and 15% from the first quarter.

The safe-haven metal printed record peaks a shade above $3,500 per ounce in late April.

ETF Demand Booms

WGC data showed US-based ETFs add 70 tonnes of the yellow metal in Q2, taking total additions across the first half to 203 tonnes.

Overall holdings rose to 1,785 tonnes as of the end of June. Assets under management (AUMs) came out at $189 billion.

The organization said that ETF offtake accounted for 70% of total gold investment demand in Q1, and 56% of demand in the previous quarter.

That amounted to 133 tonnes and 70 tonnes respectively, figures which sailed above the 10-year average of 19 tonnes.

The body said that “cumulative net flows for North American gold-backed ETFs have reached $22 billion in inflows through July… 99% of which came from US based funds.”

It added that inflows into North American funds “are on pace for their second-strongest

annual performance on record.”

Global gold ETF investment rose by 170 tonnes in Q2, previous WGC data showed.

… But Consumption Drops Elsewhere

However, gold bar and coin demand retraced to just nine tonnes in quarter two. This was down 53% year on year, and the lowest figure since the final quarter of 2019.

Gold jewellery demand, meanwhile, dropped 7% year on year to 30 tonnes, which the Council said “continued its three-year downward trend.”

The WGC noted that, as a result, total consumer demand (jewellery plus bar and coins) combined dropped 24% year on year, to 39 tonnes.

On a value basis, gold jewellery leapt 30% year on year and 49% quarter on quarter, to $3 billion.

Elsewhere, the WGC said that “demand linked to [artificial intelligence, or AI] applications provided some support” for technology demand during Q2. Still, gold demand from the US tech sector fell 10% on an annual basis, to 15 tonnes.

Japanese technology demand also dropped in the last quarter to 19 tonnes, though this was down a milder 1% year on year. South Korean and Chinese demand both increased 2%, to seven tonnes and 20 tonnes respectively.

Exports Surge

On the trade side, the WGC said the US had exported 268 tonnes of the precious metal in Q2 and chalked up imports of 169 tonnes.

It commented that “this is notable because the US has already exported about 60% of the total volume traded last year (451 tonnes).”

The Council added that “if the pace continues, export volumes could reach levels not seen since 2013 (740 tonnes) and 2022 (701 tonnes).”