Incentives play a critical role in shaping behavior. When a company ties executive compensation to revenue growth or flawed metrics like adjusted EBITDA, it’s only natural that executives will prioritize those targets.

However, growing revenue or adjusted EBITDA without regard for real profits undermines the company’s long-term financial health. It also destroys shareholder value.

I think that the board of directors for more publicly-traded companies should tie executive compensation to metrics that drive shareholder value creation. There is no better metric for this purpose than return on invested capital (ROIC). Linking executive compensation to ROIC aligns the interests of the executives with those of the shareholders.

The Exec Comp Aligned with ROIC Model Portfolio includes only those stocks that (1) receive an Attractive-or-better rating and (2) directly link executive compensation to ROIC. I believe this combination signals disciplined capital allocation and strong upside potential.

I am proud to offer the Exec Comp Aligned with ROIC Model Portfolio, and I am excited to give you a stock pick from this Model Portfolio.

The goal behind sharing these stock picks with you is to deliver insight into the uniquely high value-add of my research.

Stock Pick for July: John B. Sanfilippo & Son, Inc.

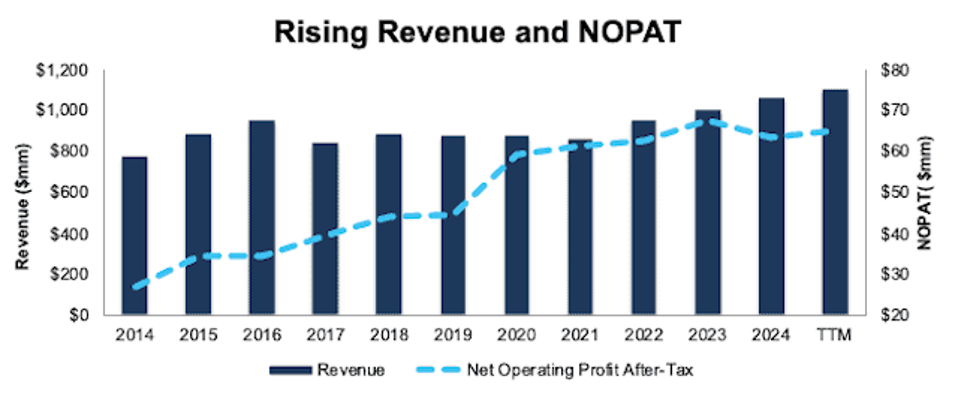

John B. Sanfilippo has grown revenue and net operating profit after tax (NOPAT) by 3% and 9% compounded annually since fiscal 2014, respectively. The company’s NOPAT margin improved from 3% in fiscal 2014 to 6% in the TTM and invested capital turns increased from 2.4 to 2.5 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 8% in fiscal 2014 to 14% in the TTM.

Figure 1: John B. Sanfilippo’s Revenue & NOPAT: Fiscal 2014 – TTM

Executive Compensation Properly Aligns Incentives

John B. Sanfilippo’s executive compensation plan aligns the interests of executives and shareholders by tying its annual bonus awards to a “Return on Capital/economic value added” model which, according to the company’s proxy statement, the company calls the Sanfilippo-Value Added plan. Under the plan, executives are rewarded for year-over-year improvement in economic profit.

The company’s inclusion of economic profit targets, which are similar to my economic earnings, has helped create shareholder value by driving higher ROIC and economic earnings. When I calculate ROIC using my firm’s superior fundamental data, I find that John B. Sanfilippo’s ROIC has increased from 8% in fiscal 2014 to 14% in the TTM.

Economic earnings rose from $15 million to $37 million over the same time. See Figure 2.

Figure 2: John B. Sanfilippo’s Economic Earnings: Fiscal 2014 – TTM

JBSS Has Further Upside

At its current price of $64/share, JBSS has a price-to-economic book value (PEBV) ratio of 0.8. This ratio means the market expects John B. Sanfilippo’s NOPAT to permanently fall 20% from current levels. This expectation seems overly pessimistic for a company that has grown NOPAT 7% and 9% compounded annually over the last five and ten years, respectively.

Even if John B. Sanfilippo’s:

- NOPAT margin falls to 5% (below five-year average of 7% and TTM NOPAT margin of 6%) through 2034, and

- revenue grows just 4% (equal to CAGR over the last five years) compounded annually through 2034 then,

the stock would be worth $87/share today – a 36% upside. In this scenario, John B. Sanfilippo’s NOPAT would grow just 2% compounded annually from 2025 through 2034.

Should the company grow NOPAT more in line with historical growth rates, the stock has even more upside.

Critical Details Found in Financial Filings by My Firm’s Robo-Analyst Technology

Below are specifics on the adjustments I made based on Robo-Analyst findings in John B. Sanfilippo’s 10-K and 10-Qs:

Income Statement: I made under $15 million in adjustments with a net effect of removing under $5 million in non-operating expense.

Balance Sheet: I made under $100 million in adjustments to calculate invested capital with a net decrease of under $10 million. One of the most notable adjustments was for asset write downs.

Valuation: I made over $150 million in adjustments, all of which decreased shareholder value. The most notable adjustment to shareholder value was total debt.