AIG (NYSE:AIG) is scheduled to release its earnings on Wednesday, August 6, 2025. The earnings are anticipated to be around $1.60 per share, according to consensus estimates, while revenues are expected to increase by approximately 4.5% to $6.85 billion. AIG has been putting more emphasis on property and casualty insurance following the spinoff of its life insurance and retirement segment. Although the first quarter was challenging due to catastrophic losses from the Los Angeles wildfires, the second quarter is likely to show some recovery in underwriting results. Furthermore, AIG’s expansion in commercial lines and international markets, along with strategic initiatives aimed at enhancing operational efficiency, could contribute positively to its performance.

The company boasts a current market capitalization of $46 billion. Over the past twelve months, revenue was $27 billion, with net losses amounting to $-1.9 billion. Much will depend on how these results compare with consensus and expectations; thus, understanding historical trends could work to your advantage if you are a trader focused on events.

There are two approaches to achieve this: either understand the historical probabilities and position yourself before the earnings announcement or analyze the correlation between immediate and medium-term returns after earnings and position yourself accordingly after they are reported. If you’re interested in higher returns with lower volatility than single stocks, the Trefis High Quality portfolio offers an alternative – having outperformed the S&P 500 and produced returns exceeding 91% since its inception.

See earnings reaction history of all stocks

American International’s Historical Odds Of Positive Post-Earnings Return

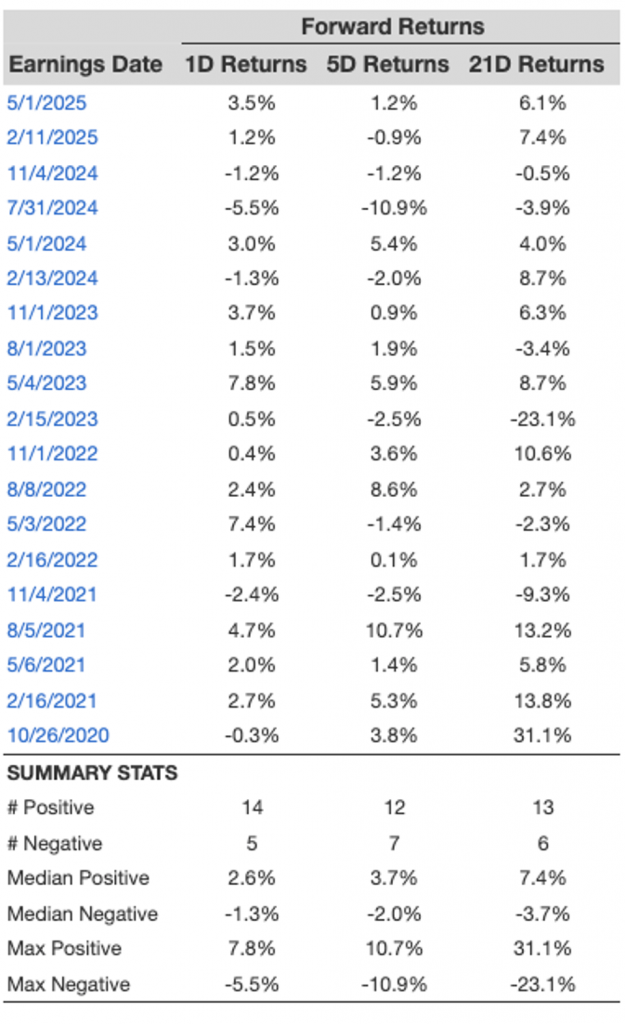

Here are some observations regarding one-day (1D) post-earnings returns:

- There have been 19 earnings data points documented over the last five years, with 14 positive and 5 negative one-day (1D) returns recorded. In summary, positive 1D returns have occurred about 74% of the time.

- This percentage notably rises to 75% when we examine data from the last 3 years instead of 5.

- The median of the 14 positive returns = 2.6%, and the median of the 5 negative returns = -1.3%

Additional data for observed 5-Day (5D) and 21-Day (21D) returns following earnings are summarized with statistics in the table below.

Correlation Between 1D, 5D and 21D Historical Returns

A relatively less risky strategy (though ineffective if the correlation is low) is to analyze the correlation between short-term and medium-term returns after earnings, identify a pair with the highest correlation, and execute the appropriate trade. For instance, if 1D and 5D display the strongest correlation, a trader can position themselves “long” for the subsequent 5 days if the 1D post-earnings return is positive. Below is some correlation data based on a 5-year and a more recent 3-year history. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and subsequent 5D returns.

Is There Any Correlation With Peer Earnings?

On occasion, the performance of peers can affect the stock’s reaction after earnings. In fact, the market pricing may start before the earnings announcements. Here is some historical data comparing the post-earnings performance of American International stock with that of peers that reported earnings shortly before American International. For a fair comparison, peer stock returns also represent post-earnings one-day (1D) returns.

Learn more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000) to deliver strong returns for investors. Additionally, if you are looking for potential gains with a steadier approach than a stock like American International, consider the High Quality portfolio, which has surpassed the S&P and achieved >91% returns since its inception.