Markets were running hot until Friday’s Nonfarm Payroll Report (NFP). The revisions to May and June have put a question mark on the reliability of the monthly NFP job numbers on which the markets and businesses rely. The huge revisions to the May and June numbers (discussed below) caused President Trump to terminate the commissioner of the Bureau of Labor Statistics (BLS).1 On Friday, alone, markets dropped precipitously with Nasdaq falling by -2.24% and the S&P 500 by -1.60%.2 The table shows that the four major indexes were down in the -2% to -4% range for the week ended August 1st, and that for the year as a whole, the tech-heavy Nasdaq and S&P 500 are now only up in the 6%-7% range, the old-line industrials (DJIA) at 2.5% while small-caps (Russell 2000) are down nearly -3% year to date.3

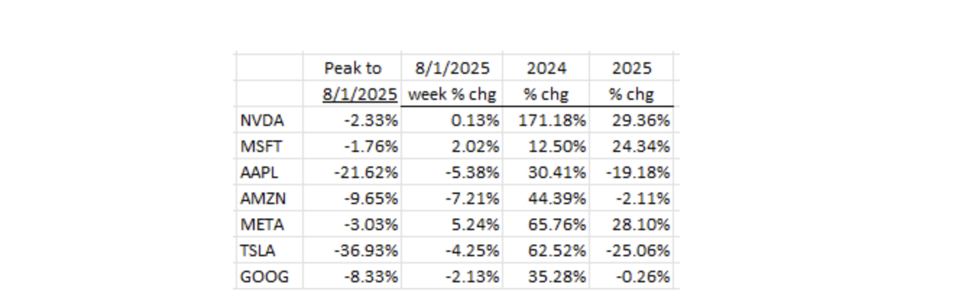

For the Magnificent 7, Meta led the charge this week, up over +5% with Microsoft rising 2%. But that’s where the good news ended. Nvidia ended the week near even while Apple, Amazon, Tesla, and Google closed lower. For 2025 as a whole, Tesla and Apple have been the big losers (-25% and -19% respectively), while Nvidia, Microsoft, and Meta have been the winners (+29%, +24%, +28% respectively).4

The Fed

The Fed has a dual mandate: an inflation mandate and a labor market mandate, i.e., inflation low and employment high. For most of the last few years, the emphasis has been on the inflation mandate, as the employment markets appeared to be strong (“solid” as expressed several times by Fed Chair Powell), with a U3 Unemployment Rate in the low 4% range.5

The Fed’s Federal Open Market Committee (FOMC), the rate-setting committee, met on Wednesday, July 30th. At that meeting, the FOMC held the Federal Funds Rate steady at the 4.25%-4.50% level, with Fed Chair Powell still worrying about the potential inflationary impact of Trump’s tariffs, also noting that the jobs market continued to be on “solid” ground.6 The vote was 9-2 (Fed governor Kugler was absent).7 Noteworthy is the fact that the last time there were two dissenting votes on the FOMC was more than 30 years ago (1993).8 So, some sentiment for lowering rates does exist on the FOMC.

On Friday, the view that the economy is on “solid” ground changed with the NFP report. Even on the surface, the +73K for July payrolls from the Establishment Survey disappointed the consensus estimate of +104K.9 The U3 Unemployment Rate rose, as expected, from 4.1% to 4.2% (and the U6 rate from 7.7% to 7.9%) as jobs appear to be less plentiful and much harder to get.10 On the surface, the NFP report was not far off from market estimates. But it was the revisions to the May and June NFP numbers that proved to be the market-moving event. The May jobs number, originally posted at +144K, was revised down by a huge -125K to a measly +19K. And for June, the +147K reported last month was reduced by -133K to just +14K. On net, the May+June reductions amounted to -258K.11 Thus, with just one report, the job market doesn’t appear to be so “solid” after all. Even July’s +73K number appears suspect given the automatic (uncounted) add of +82K from the Birth/Death model of small businesses. Without the Birth/Death add-on, July’s net NFP number would have been -9K instead of +73K.12 The sister survey, the Household Survey, which has been signaling weakness for the past few months, did so again, indicating a net job loss of -260K for July (this on top of the -696K for the June period).13 On net, the employment report was a disaster and calls into question the health of the labor market and the economy. In our view, if the FOMC could have a “do-over,” they would vote to move rates lower now. The next Fed meeting is mid-September. The market odds of a rate decrease at that meeting have risen from the mid-30% range to nearly 90% as of this writing (Friday, August 1st).14 And, while highly unlikely, there is always the possibility of an intermeeting move via a polling of the FOMC members. That would likely take some additional disastrous economic data.

[A side note: Fed Governor Kugler wasn’t present at the July meeting and has announced her resignation. This will give President Trump the opening he needs to appoint her replacement with someone he will nominate to be Chairman when Powell’s term as Chair ends next May. We suspect this will happen in the near future.15

ADP Data

Prior to Friday’s NFP Report, ADP’s Employment Report for July estimated new jobs at +104K (the consensus estimate was +76K).16 ADP breaks out its jobs data by business size. The fact that small businesses, said to be the barometer of the economy because they respond much more quickly to economic conditions than medium and large-sized businesses, could only register +12K jobs after declines in both prior two months, says something about the strength, or lack thereof, of the jobs market.17 The fact that, year to date, through June, small businesses have only created +50K new jobs puts a “?” around the view that the labor market is, in the words of Fed Chair Powell, “solid.”18 Furthermore, a day prior to the ADP report, the JOLTS (Job Openings and Labor Turnover Survey) showed up with the weakest hiring data in more than four years, i.e., the weakest since March ’21.19 Note in the chart the decline in both job openings and in the hiring rate.

Economic Growth

Despite the controversy over interest rates, the economy continued to grow in Q2, albeit with a large contribution from the trade deficit. Q2 GDP rose +3.0%, beating the consensus estimate of +2.6% and the Atlanta Fed’s +2.9% GDP Now forecast.20 However, much of the rise stemmed from the foreign trade sector. When the U.S. runs a trade deficit, that deficit reduces GDP, and in Q1, many importers were front-running the President’s tariffs. All of the pre-tariff stockpiling pushed the trade deficit higher and Q1’s GDP came in at -0.5%.21 Q2 was the opposite story. The trade deficit shrank (as the pre-tariff buying subsided) making Q2’s GDP number look strong. The average of Q1 and Q2 is 1.25.22 For Q2, “Final Sales to Domestic Purchasers,” i.e., a measure of Consumption, was 1.1% at an annual rate. That number excludes exports, imports, and inventory changes and is a good proxy for the overall growth rate of the economy. By the way, that +1.1% number is the second slowest pace since the Pandemic.23

Final Thoughts

While the equity markets rose in July, the jobs numbers spooked the markets on Friday (August 1st), especially the huge downward revisions to the May and June NFP numbers, indicating that both months showed up with flat employment data.24 As a result, the equity markets ended the week with losses in the -2% to -3% range, with small-caps down more than -4%.25 With five months left in the year, ex-tech (small caps and the old industrials), stock prices have significantly flattened.

The Fed met last week (July 29-30) and decided to hold the Federal Funds Rate at its current relatively high 4.25%-4.50% level. This despite other major central banks lowering.26 We suspect that, after the jobs data, if they could have a “do over,” they would lower rates. Of note is the resignation of Fed Governor Adrianna Kugler.27 President Trump now has the opening to appoint someone for that vacancy, a certainty to be nominated for the Chair position when Powell’s term as Chair expires next May.

Q2’s GDP growth came in at an apparently healthy +3.0% in the first pass at the number. Much of that was due to a significantly lower trade deficit. (The trade deficit subtracts from GDP.) Businesses were front-running the proposed Trump tariffs in Q1 which pushed up the trade deficit and made Q1’s GDP look quite weak (-0.5%).28 We think that a better picture of the economy’s health is the mean of the two quarters, i.e. +1.25% growth.29 That number indicates a slowing economy (which we see in the housing arena and in slowing consumption). We suspect that Q3’s GDP growth will come in on the weak side.

Robert Barone, Ph.D.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Robert Barone, Joshua Barone and Eugene Hoover are investment adviser representatives with Savvy Advisors, Inc. (“Savvy Advisors”). Savvy Advisors is an SEC registered investment advisor. Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy.

Ancora West Advisors, LLC dba Universal Value Advisors (“UVA”) is an investment advisor firm registered with the Securities and Exchange Commission. Savvy Advisors, Inc. (“Savvy Advisors”) is also an investment advisor firm registered with the SEC. UVA and Savvy are not affiliated or related.

References

1: Yahoo Finance, “Data credibility fears fueled after Trump orders firing of labor official,” August 1, 2025.

2: Investing.com, “S&P 500 Hits 9.1% Return Mark—Time to Brace for Seasonal Volatility,” August 1, 2025.

3: Investing.com, “S&P 500 Hits 9.1% Return Mark—Time to Brace for Seasonal Volatility,” August 1, 2025.

4: Data sourced from market performance reports, specific figures aggregated from Yahoo Finance and Bloomberg market summaries, August 1, 2025.

5: U.S. Bureau of Labor Statistics, “Employment Situation Summary – 2025 M07 Results,” August 1, 2025.

6: FXStreet, “Nonfarm Payrolls rise by 73,000 in July vs. 110,000 forecast,” August 1, 2025.

7: FXStreet, “Nonfarm Payrolls rise by 73,000 in July vs. 110,000 forecast,” August 1, 2025.

8: Historical FOMC voting records, Federal Reserve archives, 1993.

9: U.S. Bureau of Labor Statistics, “Employment Situation Summary – 2025 M07 Results,” August 1, 2025.

10: U.S. Bureau of Labor Statistics, “Employment Situation Summary – 2025 M07 Results,” August 1, 2025.

11: U.S. Bureau of Labor Statistics, “Employment Situation Summary – 2025 M07 Results,” August 1, 2025.

12: U.S. Bureau of Labor Statistics, “Employment Situation Summary – 2025 M07 Results,” August 1, 2025, and BLS Birth/Death model methodology.

13: U.S. Bureau of Labor Statistics, “Employment Situation Summary – 2025 M07 Results,” August 1, 2025.

14: CME Group FedWatch Tool, market odds data, August 1, 2025.

15: Yahoo Finance, “Data credibility fears fueled after Trump orders firing of labor official,” August 1, 2025.

16: ADP Employment Report, July 2025.

17: ADP Employment Report, July 2025.

18: ADP Employment Report, July 2025.

19: U.S. Bureau of Labor Statistics, “Job Openings and Labor Turnover Summary, May 2025,” July 1, 2025.

20: FXStreet, “Nonfarm Payrolls rise by 73,000 in July vs. 110,000 forecast,” August 1, 2025.

21: FXStreet, “Nonfarm Payrolls rise by 73,000 in July vs. 110,000 forecast,” August 1, 2025.

22: Calculated from Q1 and Q2 GDP data, U.S. Bureau of Economic Analysis, July 2025.

23: U.S. Bureau of Economic Analysis, “Final Sales to Domestic Purchasers, Q2 2025,” July 2025.

24: U.S. Bureau of Labor Statistics, “Employment Situation Summary – 2025 M07 Results,” August 1, 2025.

25: Investing.com, “S&P 500 Hits 9.1% Return Mark—Time to Brace for Seasonal Volatility,” August 1, 2025.

26: FXStreet, “Nonfarm Payrolls rise by 73,000 in July vs. 110,000 forecast,” August 1, 2025.

27: Yahoo Finance, “Data credibility fears fueled after Trump orders firing of labor official,” August 1, 2025.

28: FXStreet, “Nonfarm Payrolls rise by 73,000 in July vs. 110,000 forecast,” August 1, 2025.

29: Calculated from Q1 and Q2 GDP data, U.S. Bureau of Economic Analysis, July 2025.