Markets are finally wavering thanks to the implementation of global tariffs and concerns about jobs and interest rates. To help you navigate the volatility, a trio of MoneyShow experts break down what’s happening…and what’s NEXT (Plus one name worth targeting as a yield play here!)

No, I’m not seeing anyone run for the hills. But I am seeing signs of concern CREEP in.

That’s how I’d sum up today’s markets. And by “markets,” I don’t mean just stocks. I’m also talking about currencies, volatility, and high-yield bonds.

Take a look at the MoneyShow Chart of the Day. It shows the Invesco DB US Dollar Index Bullish Fund (UUP), the SPDR S&P 500 ETF (SPY), the CBOE Volatility Index (VIX), and the US High Yield CCC or Below Option Adjusted Spread. They show how the greenback and stocks are trading – as well as how much concern, uncertainty, and/or fear is being priced into equity and bond markets.

Where the Dollar, Stocks, Volatility, and High-Yield Spreads Stand

No, we’re not seeing panic like we did in April. But the dollar is turning higher. Volatility is perking up a bit. And the yield premium that investors are demanding to buy the highest-risk bonds relative to underlying US Treasuries is climbing modestly.

So, yes, concern IS creeping in.

Frankly, it’s understandable given how far the averages have come. We’ve also seen many of the riskiest stocks in the market soar, as Gav Blaxberg of Wolf Financial and Tom Bruni at Stocktwits noted in this week’s MoneyShow MoneyMasters Podcast.

The Federal Reserve just refused to cut rates again, too. Plus, most countries on Planet Earth are soon going to be paying tariffs between 15% and 50%.

So, yes, I think you might want to play your cards closer to the vest. Or in other words, if you’re a trader, lighten up.

Lance Roberts Bull Bear Report

The bullish tone of the market has continued relentlessly over the last couple of months, while volatility has become increasingly compressed. But the probability of some corrective action is increasing. The key is participation with discipline, observes Lance Roberts.

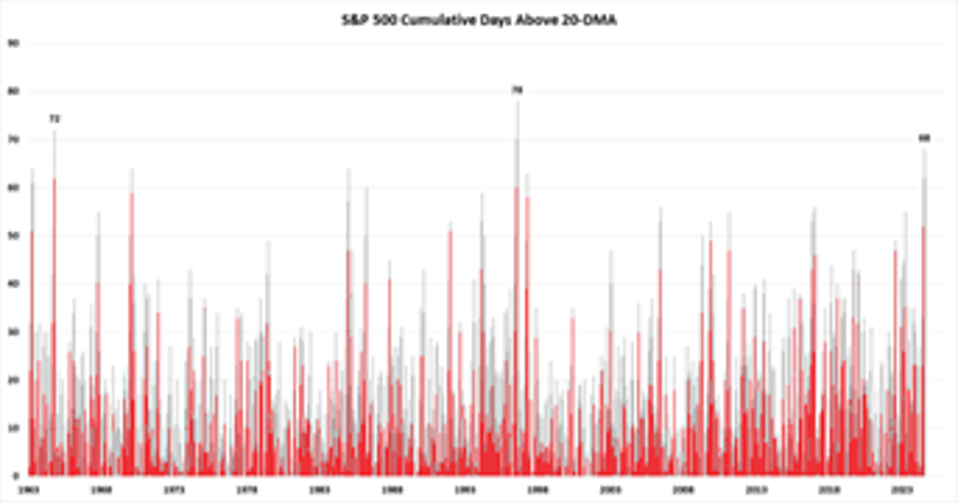

Historically speaking, the market has traded above the 20-DMA for a long stretch. This does not mean the market will crash, but a correction below the 20-DMA is becoming more likely.

Another reason we expect volatility to increase is that we are entering a seasonally weak period in the market, which corresponds with periods of increased volatility. This also explains why August and September are two of the weakest months of the year.

While all of this is historical data, none of it guarantees that the market will correct over the next two months. It only suggests that. As such, we recommend that risk management become increasingly important, a point we made in this past weekend’s update:

“The return of meme-stock euphoria is a stark reminder that complacency is again gripping markets. Whether it’s zero-day options, surging penny stocks, or speculative AI plays with no earnings, the current environment mirrors the excessive risk-taking seen in early 2021. Retail investors are chasing high-beta trades, while volatility remains suppressed and equity indices hover near all-time highs. This combination creates a seductive but dangerous backdrop for capital deployment.”

Elliott Gue Energy and Income Advisor

This month, we’re taking a higher-yielding bet on an oil and gas price recovery, buying royalty producer Dorchester Minerals LP (DMLP). It’s ideal for risk-tolerant investors who want rising commodity prices to flow directly into higher quarterly dividends, notes Elliott Gue.

We’re making this move now because — negative investor sentiment notwithstanding — underlying supply and demand drivers for oil and gas are still overwhelmingly positive.

At the same time, dividend cuts in the energy sector have been relatively rare the past few years — other than for companies with payouts directly tied to energy prices and those attempting to dramatically cut debt.

That’s to be expected in the middle of an energy upcycle that has now passed its fifth birthday…with a long way still to climb. Nor are companies in our coverage universe by and large taking the kind of risks now that could come back to hurt them in tougher times.

North American shale discipline reigns supreme. Producers continue to tie output and CAPEX decisions to commodity price signals. Midstream companies are not building unless there are contracts in hand to lock in return on investment. The same is true of refiners and chemicals companies. And services companies are in restraint mode as well, joining forces to reduce costs.

Investors continue to reward cost discipline over production growth rates. And we expect expense reduction to be the major theme of energy company earnings calls in the coming weeks, especially for producers with commodity prices at current levels.

The Trump Administration’s oil and gas deregulation push should also be a positive for the sector as a whole. We expect our favorite producers to comment favorably on opportunities to push costs lower, as well as potential new investment.