Economists were wrong. They expected 100,000 new jobs in July. Instead, there were 73,000. Unemployment was up to 4.2% from 4.1%. Disappointing as those are, neither was the truly crushing news. This was, according to the Bureau of Labor Statistics release:

“Revisions for May and June were larger than normal. The change in total nonfarm payroll employment for May was revised down by 125,000, from +144,000 to +19,000, and the change for June was revised down by 133,000, from +147,000 to +14,000. With these revisions, employment in May and June combined is 258,000 lower than previously reported.”

Jobs Saw A Massive Downward Revision

BLS has explained jobs revisions for previous months as resulting from additional business and government agency reports as well as recalculation of seasonal factors. But it still comes to the same conclusion in this case: more than a quarter million fewer new jobs than had been reported.

Late last month I wrote about how getting a job was getting harder. ManpowerGroup President and Chief Strategy Officer Becky Frankiewicz wrote at the time about June jobs, “The top-line numbers look positive, but our real-time data reveals underlying shifts. June marked the weakest hiring month of the year, with new postings down 7% month-over-month and 2% year-over-year. Open postings fell 8% from May.”

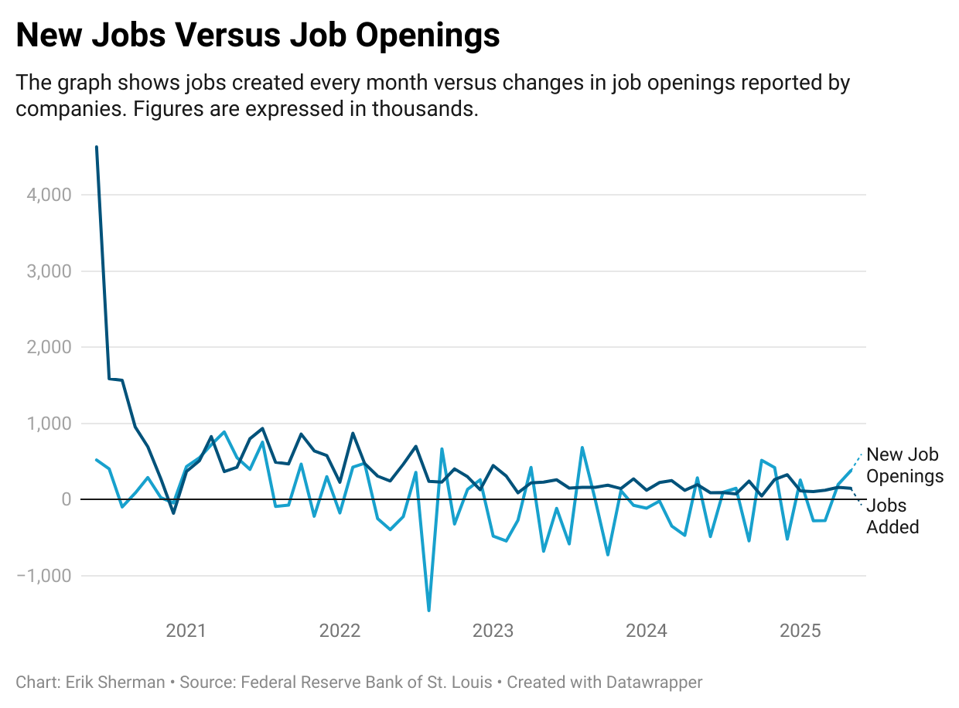

New monthly job openings in the aggregate have been lagging far behind jobs added, as the graph below, using data available from the Federal Reserve Bank of St. Louis, shows.

Companies can’t keep adding new real hires every month when they’ve reduced the number of job openings they have.

President Trump claimed on Truth Social that BLS Commissioner Erika McEntarfer had “RIGGED the numbers in order to make the Republicans, and ME, look bad” and then reportedly fired her according to The Hill.

It seems odd that this would only happen now and sounds like another attempt to sweep problems under the rug.

More Economic Bad News

More likely that the July number and downgrade of May and June had more to do with companies concerned about the administration’s tariff strategies. Uncertainty has had impact on the economy over the last few months. Many economists said the increase in the Consumer Price Index, another measure of inflation, was a result of tariffs finally affecting the economy, as The Hill reported.

Inflation from the Bureau of Economic Analysis shows personal expenditures (PCE, another inflation measure) up 0.3% month over month, versus the 0.2% expected by economists according to Dow Jones. Year over year, it was 2.6%. Look at core PCE without energy or food and it was up 2.8% since June 2024.

“Looking ahead, spending should come under pressure in H2 2025 as the labor market loses energy, interest rates stay high, and tariffs push inflation up,” wrote Nationwide Financial Markets Economist Oren Klachkin. “We foresee slower income growth as the main reason behind sub-1% GDP growth in H2 2025.”

The 3% annualized growth in GDP for the second quarter, announced in July, was more happenstance. When the Trump administration initially announced broad tariffs, many companies decided to sharply boost their imports in advance to avoid the additional charges, which are paid by the importers, not the exporters. Imports are subtracted from gross domestic product, just as things like foreign students in the U.S. paying tuition adds to GDP because what they pay is technically an export.

Why did none of this appear before? “Looking at the headline consumer price index isn’t where the tariffs are visible, it’s in goods prices and the increase in household appliances, apparel and toys highlight that tariffs are being passed onto the consumer, it just takes time,” Oxford Economics wrote two weeks ago.

Tariff concerns are again boiling over. One example came in Apple’s July 31, 2025, earnings call.

“Finally, the situation around tariffs is evolving, so let me provide some color there,” said CEO Tim Cook. “For the June quarter, we incurred approximately $800 million of tariff-related costs. For the September quarter, assuming the current global tariff rates, policies and applications do not change for the balance of the quarter, and no new tariffs are added, we estimate the impact to add about $1.1 billion to our costs.”

A well-known German tool company called Festool announced that all prices starting August 1 would go up because of tariffs.

This may be an unsatisfying look at the economy and state of the country, but that is where we are. In the short and long runs, no one knows what will happen.