Vertex Pharmaceuticals (NASDAQ:VRTX) is set to release its earnings on Monday, August 4, 2025. Over the last five years, Vertex’s stock has displayed a trend of positive one-day returns in 58% of cases following earnings announcements. The median positive return has been 3.0%, with a maximum one-day increase of 9.0%.

For those trading based on events, recognizing these historical trends can prove advantageous, although actual performance against expectations will be crucial. There are two primary strategies to think about:

- Pre-Earnings Positioning: Assess the historical probabilities and establish a position prior to the earnings announcement.

- Post-Earnings Positioning: Investigate the links between immediate and intermediate returns subsequent to the earnings release to inform your strategy.

Analysts anticipate Vertex will disclose earnings of $4.25 per share, generating a revenue of $2.91 billion. This marks a considerable improvement compared to the same quarter last year, which reported a loss of $12.83 per share on sales of $2.65 billion.

However, if you are looking for upside with reduced volatility compared to individual stocks, the Trefis High Quality portfolio offers an alternative – having outperformed the S&P 500 and achieved returns exceeding 91% since its launch.

View earnings reaction history of all stocks

Vertex Pharmaceuticals’ Historical Probability of Positive Post-Earnings Return

Some insights regarding one-day (1D) post-earnings returns:

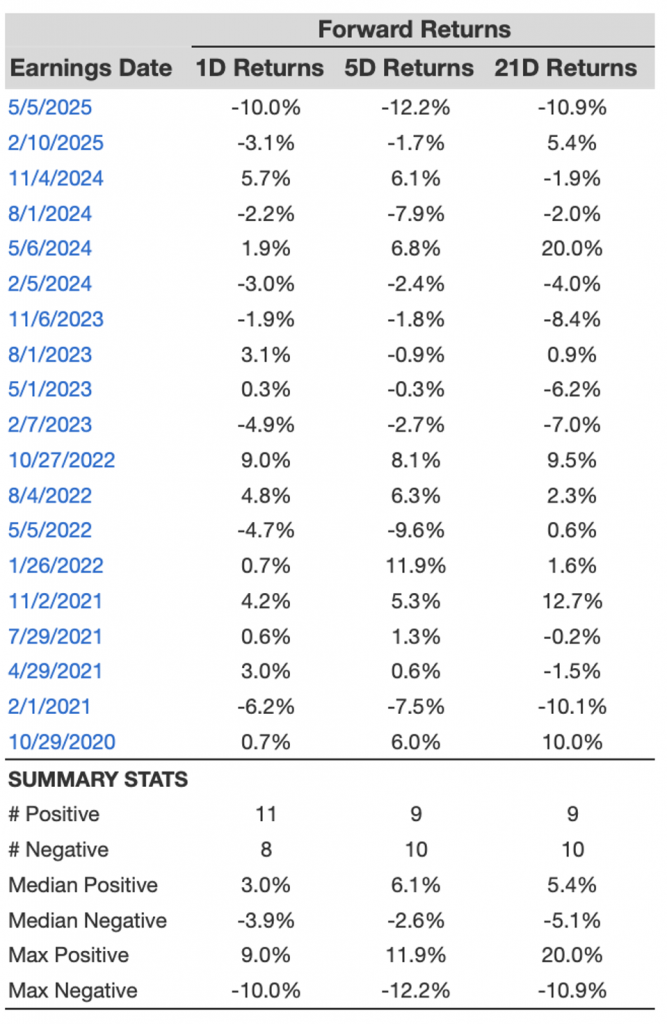

- There are 19 earnings data points recorded over the previous five years, with 11 positive and 8 negative one-day (1D) returns noted. In total, positive 1D returns were recorded approximately 58% of the time.

- However, this percentage drops to 50% when considering data from the last 3 years instead of 5.

- The median of the 11 positive returns is 3.0%, and the median of the 8 negative returns is -3.9%.

Further information on observed 5-Day (5D) and 21-Day (21D) returns following earnings is summarized in the table below along with the related statistics.

Correlation Between 1D, 5D and 21D Historical Returns

A comparatively lower-risk approach (though not effective if the correlation is weak) is to evaluate the correlation between short-term and medium-term returns after earnings, identify the pair that exhibits the strongest correlation, and perform the proper trade. For instance, if 1D and 5D display the highest correlation, a trader can place themselves “long” for the forthcoming 5 days if the 1D post-earnings return is favorable. Below is some correlation data based on both a 5-year and a 3-year (more recent) history. Please note that the correlation 1D_5D indicates the relationship between 1D post-earnings returns and subsequent 5D returns.

Discover more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (the combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000), providing strong returns for stakeholders. Additionally, if you’re seeking upside with a more stable journey than an individual stock like Vertex Pharmaceuticals, think about the High Quality portfolio, which has outperformed the S&P and achieved >91% returns since its inception.