Housing market activity has slowed significantly over the last few years thanks to higher interest rates, higher home prices, economic uncertainty and other factors. The relatively high level of new mortgage rates is one of the more obvious factors but not the only one. The price of existing homes, the low mortgage rate most homeowners are already paying, as well as potential new homebuyers’ confidence with regard to their future income and inflation, all have an impact on the housing market.

This vital portion of our economy is a major contributor to the country’s economic wellbeing. The National Association of Realtors (NAR) estimated that the real estate market contributed $4.9 trillion, or 18%, to U.S. GDP as of 2023.

While many people are asking whether the housing market is going to continue to flounder, the data is starting to show signs that the current malaise may be nearing a rebound.

Where Is The Housing Market Today?

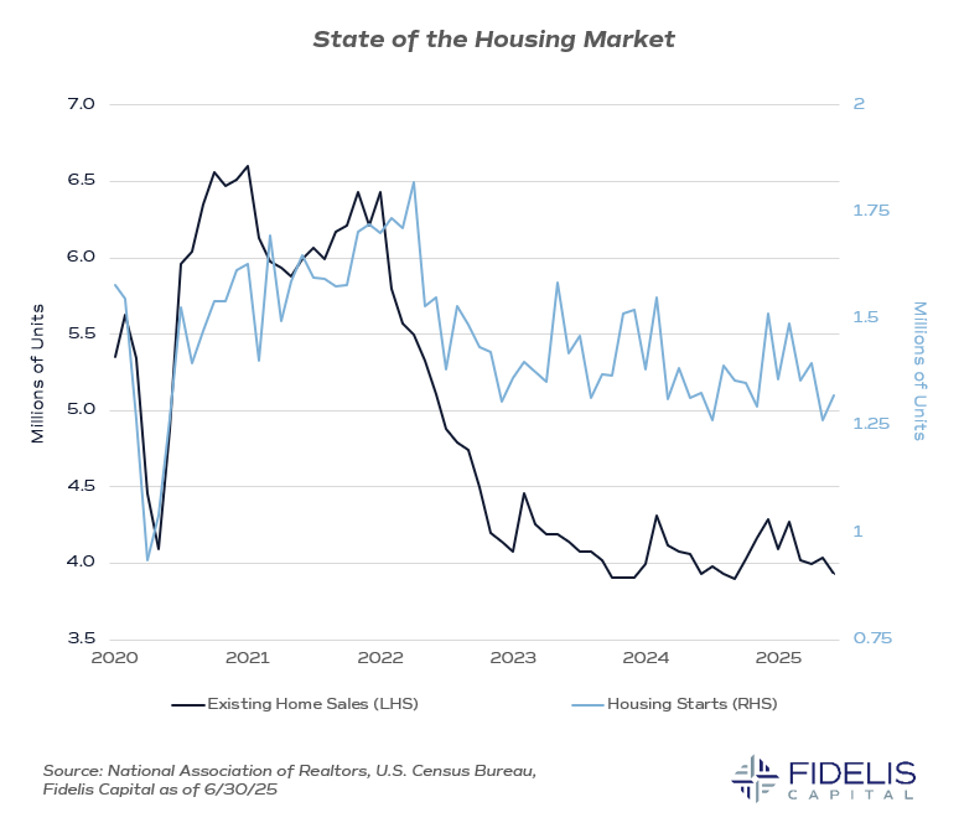

Let’s start by looking at the existing housing data to get a sense of how bad the current situation is relative to past slowdowns. Existing home sales and housing starts are two of the more important pieces of data when it comes to assessing the current health of the housing market.

As of June 2025, existing home sales slowed to a seasonally adjusted annual rate of 3.93 million units per month, near the low of 3.77 million units following the great financial crisis in 2008 and below the 4.09 million units during the peak of the Covid crisis of 2020. Additionally, June housing starts data, compiled by the U.S. Census Bureau, showed an anemic 1.3 million starts, well below its five-year average.

Factor #1: Mortgage Rates

The national average interest rate on a new 30-year mortgage is 6.8% according to Bankrate.com as of July 29. Although high, the current average rate is nowhere near the highest mortgage rates the U.S. has experienced in the past. In the late 1970s and 1980s, rates pushed well over 12%. The current rates, however, are the highest in 25 years.

The rapid rise in interest rates in 2022, engineered by the Federal Reserve in response to increasing inflation, pushed mortgage rates to their current highs. This elevated rate is keeping new homebuyers on the sideline and limiting the desire of existing homeowners to sell and purchase another home because they would have to forfeit their current low rate.

The difference between the rate current homeowners pay and the rate on new mortgage rates averages -2.75% according to figures from Bankrate.com and the Bureau of Economic Analysis. This difference, although large, is trending in the right direction as existing homeowners slowly become accustomed to higher rates. If the difference continues to narrow, then there should be less reluctance from existing homeowners to sell. Lower mortgage rates would certainly help the situation.

As I’ve written about previously, new mortgage rates are influenced by the overall level of interest rates, specifically the interest rates on Treasury notes and bonds, as well as the fed funds rate, which is set by the Fed. The Fed is expected to reduce front-end rates in the coming months and throughout 2026. Mortgage rates have a higher correlation to longer-term Treasury rates. However, if the fed funds rate is lowered and inflation remains tame, then it is reasonable to expect a decline in longer-term rates and subsequently in mortgage rates.

Factor #2: Housing Deficit

Another major factor affecting housing market activity is the cost of housing. This too has been steadily on the rise as the U.S. housing deficit continues to grow.

According to a recent report by the U.S. Chamber of Commerce, there is a shortage of 4.5 million houses (and growing) in the U.S. as the number of formed families outpaces the number of new homes.

However, data on single-family housing prices from the Federal Housing Finance Agency House Price Index® has recently plateaued and has been moving sideways over the last six months—another positive sign.

Factor #3: Consumer Expectations

Other factors affecting the home purchase decision are the consumer expectations around their income and inflation outlook. Potential homebuyers will be less likely to commit to a long-term mortgage should they have doubts about their future cash flow.

The July release of the University of Michigan’s Consumer Sentiment Index showed an increase from 60.7 to 61.8 after declining through most of the 2025, which is another positive sign.

The NAR releases the Housing Affordability Index, which I believe is one of the best indicators of U.S. housing market strength. It takes into account mortgage rates, income levels and housing prices to produce a consolidated measure.

The NAR says an affordability index value of 100 means that “a family with a median income has exactly enough income to qualify for a mortgage on a median-value home,” while an index level above 100 means the “family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

As of year-end 2024 and into Q1 2025, this index is above 100 after hanging in the 90s for a majority of 2023 and 2024, another positive sign for the housing market.

The Bottom Line: The Housing Market Is Poised For A Turnaround

Factors that drive the housing market are starting to show signs of a turnaround. The biggest contributor, mortgage rates, have stabilized and appear set to move lower, assuming the expected Fed rate cuts materialize. Other factors such as housing prices, consumer confidence and, most importantly, affordability are improving. Granted, it may take some time to regain its past glory, but the housing market appears to be headed in the right direction.