Key News

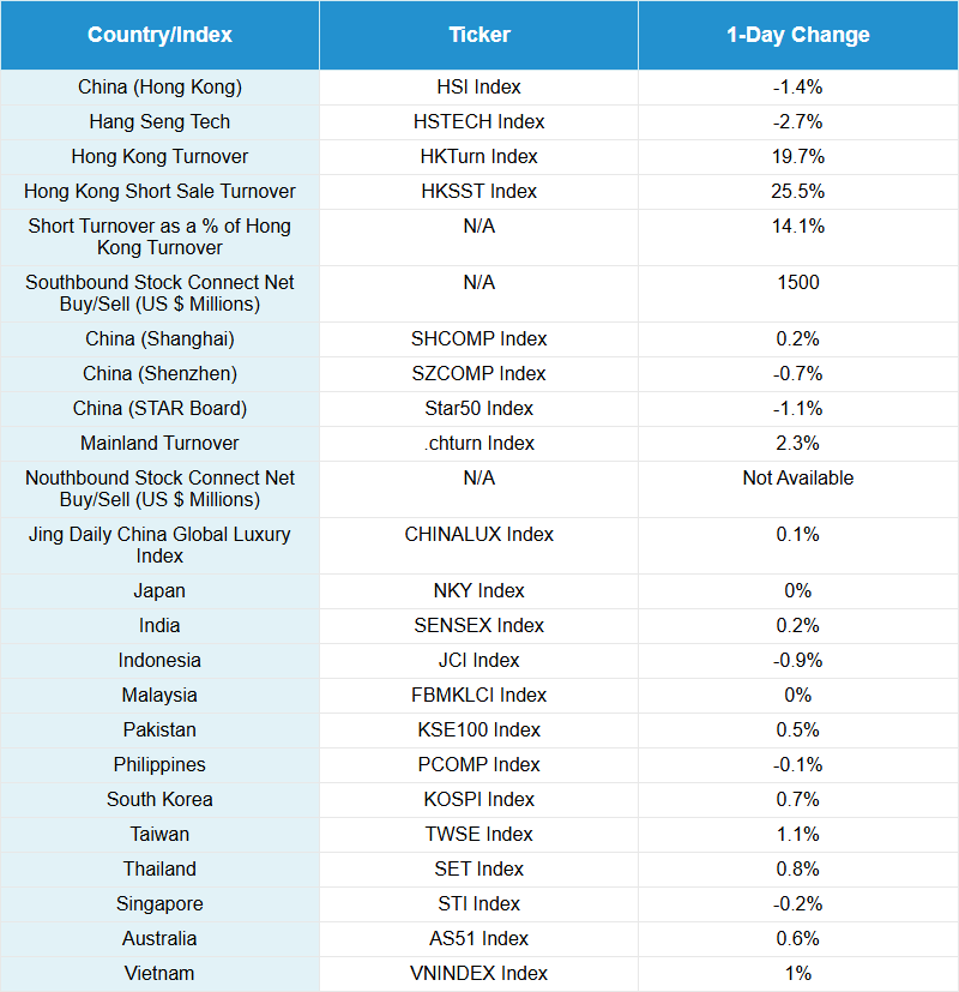

Asian equities were mixed overnight as investors awaited today’s decision from the US Federal Reserve, as Taiwan and Vietnam outperformed, while Hong Kong and Indonesia underperformed.

Battery giant Contemporary Amperex Technology (CATL) fell over -5% in Mainland trading despite strong earnings. The company reported a net income increase of 34% year-over-year in the first quarter of 2025. CATL is the world’s largest battery maker, supplying Tesla worldwide. The company’s results are a counter argument to the narrative of slowing electric vehicle (EV) adoption outside of China. They are also impressive amid all of discussion of overcapacity in China’s automobile sector.

CATL investors are concerned about Tesla’s partnership with another battery maker based in South Korea. Tesla likely just needs to balance its supply chain exposure. In our opinion, CATL still has the superior technology with the best range on its batteries, which is what counts for adoption, after all.

Mainland investors were net buyers of Alibaba and internet stocks broadly on weakness and they were net sellers of recent outperformers in health care as well a technology hardware stocks, such as Semiconductor Manufacturing (SMIC). Overall, Southbound flow was positive as Mainland investors bought a net $1.5 billion worth of Hong Kong -listed stocks and ETFs, following multiple billion dollar-plus days, which is positive.

There was little new news on the trade front as representatives wrapped up their Stockholm meeting. Investors would like more clarity on this, as there have been some conflicting signals. Trump’s pressure on Russia is a benefit to trade negotiations, in my opinion. The US can ask China to help bring Russia to the negotiation and/or cease fire table.

Mainland-listed A shares significantly outperformed Hong Kong stocks, a rare divergence and some welcome momentum in the Mainland market, which has been lackluster in terms of returns so far this year, compared to Hong Kong’s meteoric rise and outperformance versus most global stock markets.

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.19 versus 7.18 yesterday

- CNY per EUR 8.24 versus 8.29 yesterday

- Yield on 10-Year Government Bond 1.72% versus 1.75% yesterday

- Yield on 10-Year China Development Bank Bond 1.80% versus 1.82% yesterday

- Copper Price -0.52%

- Steel Price -1.94%