Key News

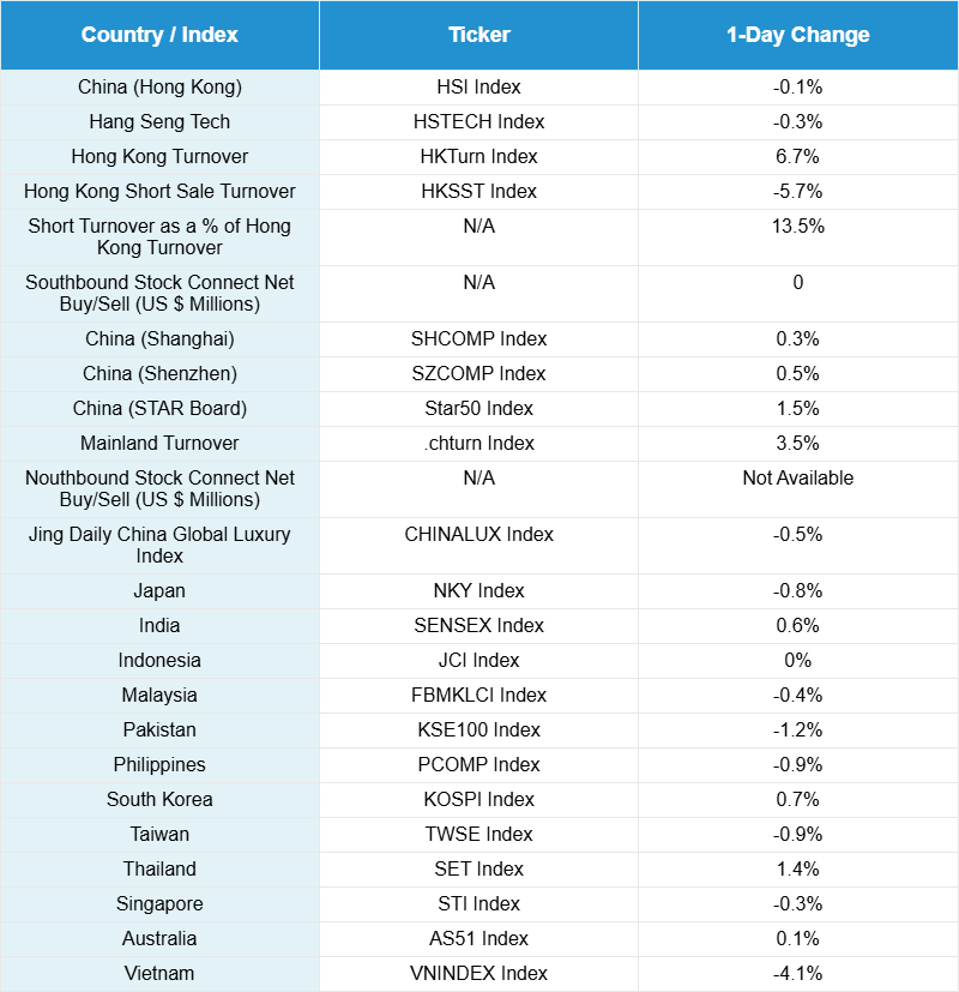

Asian equities were mixed overnight as Mainland China’s STAR Market and Thailand outperformed, while Vietnam and Pakistan underperformed.

Trade representatives from the US and China completed two days of talks that had the expressed purpose of extending the August 1st deadline for a trade deal. Most analysts are saying that a 90-day extension is likely. The global economy has weathered the tariffs better than expected so far, though it is important to remember the level of exemptions granted to key product areas, especially for China. We need a deal, but the negotiators are taking their time, which will hopefully result in the best possible outcome. Fingers crossed!

Recent outperformers were sold off today, except for health care. Viral Labubu doll-maker Pop Mart was net sold by Mainland investors via Southbound Stock Connect, who likely took profits in the name. Meanwhile, insurance companies were also sold off following a strong rally yesterday on lower interest rate guidance for insurance contracts. Internet stocks were mostly lower as we head into earnings season next month. However, some price targets for video platform Kuaishou were raised, though the stock was down overnight.

WuXi Apptec indicated that its net profit for the first half 2025 more than doubled. The stock was up +11.25% in Hong Kong overnight. WuXi Apptec has seen significant tailwinds this year, along with its co-named peer WuXi Biologics. These include the removal of an extreme geopolitical overhang on Wuxi Biologics and Apptec: the proposed BIOSECURE Act, which would have barred it from working with US entities receiving federal medicare and medicaid dollars. It is estimated that one-third of all the drugs on the US market today passed through China-based contract research labs, such as WuXi Apptec and Biologics. They are based in China but have facilities all over the world, including in the United States.

China committed new capital to increasing the birth rate. The government will now allocate RMB 3,600 annually for families with children under three. Related stocks cheered the news. Does this count as additional stimulus for consumption? Indirectly, yes. The lack of a social safety net and deflation are the primary reasons China’s consumers hesitate to increase spending significantly.

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.18 versus 7.18 yesterday

- CNY per EUR 8.28 versus 8.32 yesterday

- Yield on 10-Year Government Bond 1.75% versus 1.71% yesterday

- Yield on 10-Year China Development Bank Bond 1.82% versus 1.79%

- Copper Price 0.19%

- Steel Price 2.15%