Roth IRA vs Traditional IRA retirement savings decisions are some of the most important financial choices you’ll make when planning for retirement. Choosing between these two types of accounts can significantly impact their future income, tax burden, and financial flexibility. That said, there are two retirement phases to consider regarding this decision: saving up for retirement and how much you will spend in retirement on a.k.a. withdrawals, a.k.a. distributions a.k.a. decumulation. In this first part of a two-part series, I will start with the end in mind, spending.

In this article, we’ll explore the implications of withdrawals in each type of account, why the tax differences matter, and how aligning your strategy with your values, such as passing on savings to heirs or making charitable contributions can help you retire with both peace of mind and purpose.

Roth IRA vs Traditional IRA: Understanding Traditional IRA Taxes

The first step in retirement planning if you have a long-time horizon is deciding how much income you want to spend. As horizons shorten, the question becomes how much income will my resources and current savings allow me to spend? Distributions from Traditional IRAs are taxed as income, while Roth IRA withdrawals are tax-free.

While there are many potential retirement income strategies, to simplify the tax analysis, we will assume a flat annual income.

Let’s consider a simple scenario:

- Single Household

- Want $75,000 per year in post-tax retirement income

- Expect to receive $25,000 from Social Security at Age 65.

- Annual withdrawals to fill the gap is $50,000 annually

- Inflation of 3% per year

1. Social Security Provisional Income Calculation

Provisional Income determines how much of your Social Security is taxable:

Provisional income =

Half of your Social Security + Other taxable income

= 50% × $25,000 + $X (Traditional IRA/401(k)/403(b)/457/TSP withdrawals)

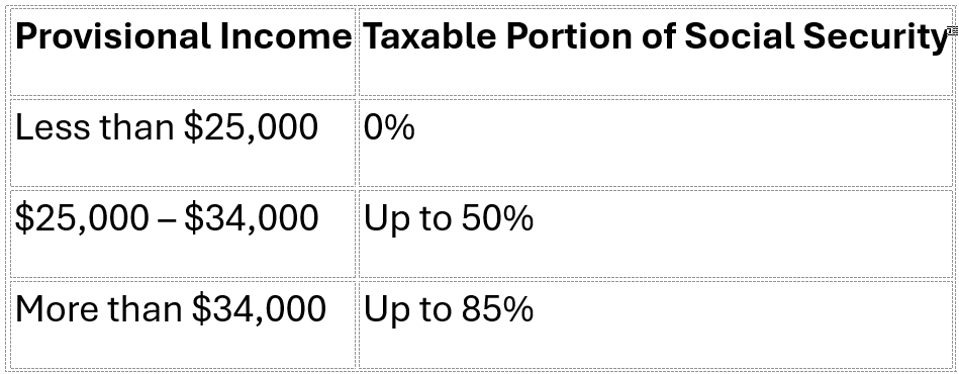

2. Social Security Taxation Thresholds (for single filers)

Because you’ll be withdrawing at least $50,000, currently 85% of your Social Security will be taxed. 85% × $25,000 = $21,250 taxable Social Security

3. Estimated Federal Tax Liability

Withdrawals from these accounts tax both the original savings any matching contributions and all of the growth. Assume $63,000 gross withdrawal from IRA/401(k)/403(b)/457/TSP:

- $63,000 (fully taxable)

- $21,250 (85% of SS benefit)

- Total taxable income = $84,250

- 2025 Standard Deduction (Assume age 65+): $15,700

- Taxable income after deduction = $84,250 – $15,700 = $68,550

2025 tax brackets for single filer (estimated):

Total federal tax = $1,160 + $4,266 + $4,708 = $10,134

Income Realized After Tax on Social Security and Withdrawals

- Gross IRA/401(k)/403(b)/457/TSP withdrawal = $63,000

- Federal tax ≈ $10,134

- Net after-tax = $63,000 – $10,134 = $52,866

Ultimately, to net the $50,000 you had to pull more than what you wanted.

Traditional IRA/401(k)/403(b)/457/TSP Tax Scenario

This calculation does not include state taxes. Depending on where you reside in retirement you may have to increase withdrawals.

Roth IRA vs Traditional IRA: Understanding Roth IRA Taxes

If all your retirement savings are in Roth accounts (Roth IRA or Roth 401(k)), the outcome is very different from the Traditional IRA/401(k)/403(b)/457/TSP scenario. Here’s a detailed breakdown of how much you’d need to withdraw to get $75,000 in post-tax income, assuming $25,000 from Social Security and needing $50,000 from your Roth accounts.

- Roth withdrawals of earnings are tax-free (assuming you meet the age 59½ rule and the 5-year rule). You paid the tax on the savings so you will not pay on the earnings.

- Social Security is only partially taxable, and the taxation depends on other taxable income

- With Roth income being non-taxable, your provisional income stays very low

Social Security Provisional Income Calculation

Provisional income =

Half of Social Security + taxable income

= 0.5 × $25,000 + $0 = $12,500

- $0 of your Social Security is taxable

- 100% of your $25,000 Social Security benefit tax-free!

- 100% of your Roth withdrawals tax-free!

Roth IRA Tax Scenario

That means you need less in Roth savings to achieve the same spending power as you would in IRA/401(k)/403(b)/457/TSP. As you know, retirement is not a point in time but over time. Unfortunately, a time period that is unknown as my 96-year-old mother approaches her 97th birthday. Inflation has changed her spending needs since she retired at 62.

Wish you had more money in Roth accounts? In “Use Roth IRA Conversions to Cut Your Taxes and Boost Retirement Income” I explore how conversions can help manage taxable income and reduce Medicare IRMAA (Income-Related Monthly Adjustment Amount) costs.

Roth IRA vs Traditional IRA: Required Minimum Distributions

Traditional IRAs have RMDs whereas Roth accounts do not. With RMDs, the government says that you have had a tax holiday for quite a while and we need to start collecting revenue. This can speed up the depletion of your accounts for your own use, much less for heirs that you may have hoped would reap the rewards of your unused funds. For more on IRA withdrawal rules, visit the IRS Required Minimum Distributions (RMDs) page.

Roth IRA vs Traditional IRA: Income Related Monthly Adjustment Amount (IRMAA)

In addition to this consideration, you should also consider Medicare’s IRMAA. This adjusts the monthly premium on your Medicare premiums. While IRMAA has a tiered system similar to the tax brackets, it is not as kind.

First, once you hit the tier, you are in that tier, there is no averaging of the brackets. Furthermore, if you are 1$ over, you are in the next bracket. In this case, your required minimum distribution, not your needed income, could push you into this new IRMAA bracket. I know a few people where their RMD pushed them into a higher IRMAA bracket.

Roth IRA vs Traditional IRA: Taxes Over a 30-year period

Consider the following assumptions of a 30-year period Roth vs. Traditional IRA comparison assuming:

- Taxes on Traditional withdrawals are approximated at 15.3% effective rate

- Inflation is assumed at 3% annually in the inflation-adjusted version

30-Year Account Depletion Comparison (Inflation-Adjusted)

If you were to fully deplete each account over 30 years to meet your retirement income goal (adjusted 3% annually for inflation):

You can easily see that you would need $1.39 million more in Traditional IRA/401(k)/403(b)/457/TSP than in Roth to generate the same after-tax income over 30 years. Roth accounts provide a major advantage in tax efficiency and simplicity, especially in retirement years with predictable income needs.

Closing Thoughts Roth IRA vs Traditional IRA Savings

All of the Roth IRA vs Traditional IRA scenarios were simplified in order to highlight the difference in savings from a future tax perspective. While many financial professionals have suggested diversifying the savings approaches. Under the scenario that I have laid out, clearly there is one winner. Many mistakenly believe that there IRA savings gives them a much larger current deduction than it already does. If you target the zero tax of Roth, you are taking tax increase risk off of the table.

Also, your cognitive powers are likely going to decline somewhere during a long retirement period. This may nullify the great tax diversification you had developed during your younger days.

All of this said, I don’t believe in one size fits all. Your circumstances may be unique. I hope that this article on Roth IRA vs Traditional IRA encourages you to build your own scenarios and to stress test and build your own and stress test them.