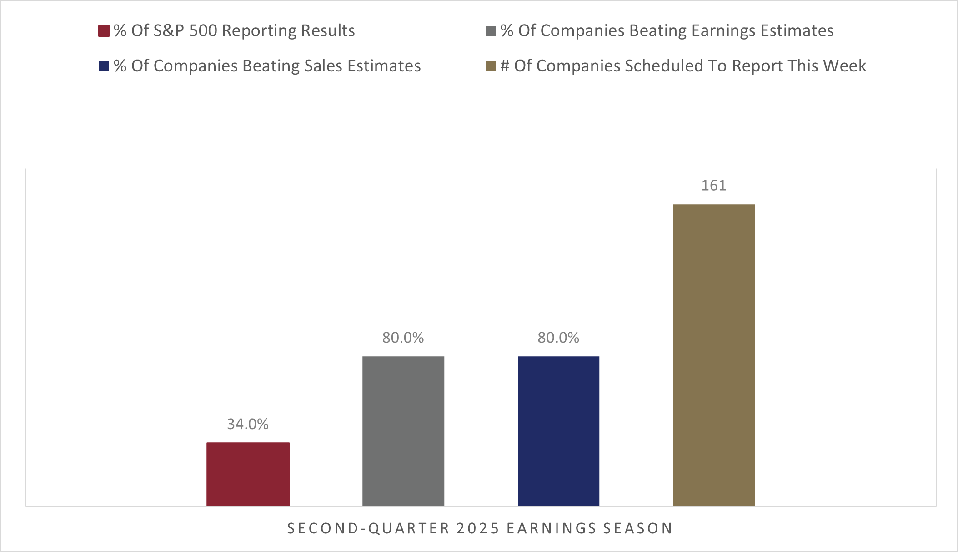

This week is the busiest of the second-quarter earnings season, with 161 S&P 500 companies scheduled to report. Notable companies scheduled to release earnings include: Merck (MRK), Starbucks (SBUX), Mastercard (MA), Chevron (CVX), and Berkshire Hathaway (BRK/A, BRK/B). Four of the Magnificent 7 are also on the docket this week.

Earnings Season At A Glance

According to FactSet, 80% of S&P 500 companies have reported earnings above consensus estimates, with 34% of companies having already reported results.

Earnings Estimates Summary

Companies reporting and combining actual results with consensus estimates for companies yet to report, the S&P 500’s blended earnings growth rate for the quarter is at 6.4% year-over-year, above the 4.9% expectations at the end of the quarter. Notably, the expected earnings growth rate for calendar year 2025 is 9.6%, and for 2026, the expectation is 13.9%.

Market Performance

The S&P 500 hit a new all-time high last week. The Magnificent 7, comprising Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA), underperformed primarily due to Tesla’s performance.

Magnificent 7

Because these companies are critical drivers of earnings growth and a significant percentage of the S&P 500’s market capitalization, the Magnificent 7 remains the group to watch this earnings season.

Tesla entered the earnings season with low expectations, but it failed to impress with its report last week. Tesla was the worst-performing member of the Magnificent 7, falling 4.1% last week. Alphabet, parent of Google, was expected to report robust earnings growth and managed to exceed expectations, sending the stock 4.4% higher for the week. Alphabet’s cloud revenue soared by 31.7% year-over-year, with improving operating margins. Data suggests that their artificial intelligence (AI) search is growing, without the feared decline in monetization. Google increased its planned 2025 capital expenditures to $85 billion from $75 billion, reflecting its confidence in the AI outlook, but investors are (rightly) always cautious about massive capital investments.

Four of the Magnificent 7 are scheduled to report results this week, with Microsoft (MSFT) and Meta Platforms (META) after the close on Wednesday, then Apple (AAPL) and Amazon.com (AMZN) after the close on Thursday.

Earnings Insights By Sector

Positive earnings surprises from the financial and communication services sector were the most significant contributors to the improved earnings picture last week. Better-than-expected earnings from Alphabet (GOOGL) and Capital One Financial (COF) were the most essential contributors, according to FactSet.

Revenue Results By Sector

Sales growth is closely tied to nominal GDP growth, which combines after-inflation economic growth (real GDP) with inflation. Following better-than-expected data last week, sales growth of 5.0% is ahead of the 4.2% year-over-year expectation at the end of the quarter. If the estimates of second-quarter nominal year-over-year GDP growth of 4.7% are correct, there could be limited upside to sales growth from here.

Better sales results in the communication services and healthcare sectors were the most significant drivers of the improvement in expected revenue growth last week, according to FactSet.

What To Watch Next Week

In addition to earnings, the economic calendar is packed with crucial releases this week after a lull last week. The first look at second-quarter US economic growth comes on Wednesday. GDP growth is expected to rebound to 2.4% after a decline in the first quarter. In contrast to the first quarter, the headline GDP number is likely to overstate the economy’s strength due to fluctuations in trade related to tariffs.

The Federal Reserve (Fed) rate meeting is scheduled for Wednesday, with essentially no chance of any change to rates. Instead, market participants will be looking for clues as to when the next Fed rate cut will occur. Markets are currently pricing in a 66% chance of a 25-basis-point cut at the September meeting.

News about the administration’s trade negotiations and new tariff announcements will remain a focus. Significant new tariffs are currently scheduled to take effect on August 1, unless an acceptable trade agreement is reached. Sectoral tariffs could also be announced. As a positive note, a trade deal framework with Japan was announced last week, providing reason for optimism about additional agreements with other nations.

Also on Friday, the monthly jobs report is expected to continue showing modest but slowing growth in nonfarm payrolls. The unemployment rate is expected to reverse last month’s decline and increase to a still low 4.2%.

Stocks continue to be boosted by the twin forces of better-than-expected earnings and a receding threat of recession. The betting odds of a 2025 recession fell to the lowest level of the year, while stocks reached an all-time high.