Week in Review

- Asian equities had a stellar week of performance as Mainland China’s STAR Board and Japan’s Nikkei 225 outperformed while Australia, India, and Taiwan were the only markets lower for the week.

- Ground was broken on a new hydroelectric dam in Tibet, which will be three-times larger than the Three Gorges Dam, and powered industrials and construction-related stocks higher this week.

- There were several indications of progress on trade talks between the US and China this week, as Trump indicated that he may visit China’s Xi “in the not-so-distant-future” and US Treasury Scott Bessent met with his Chinese counterparts in Stockholm.

- The National Development and Reform Commission (NDRC) and the State Administration of Market Regulation (SAMR) released a “Price Law” setting the parameters for instant commerce deals being offered by internet platforms.

Key News

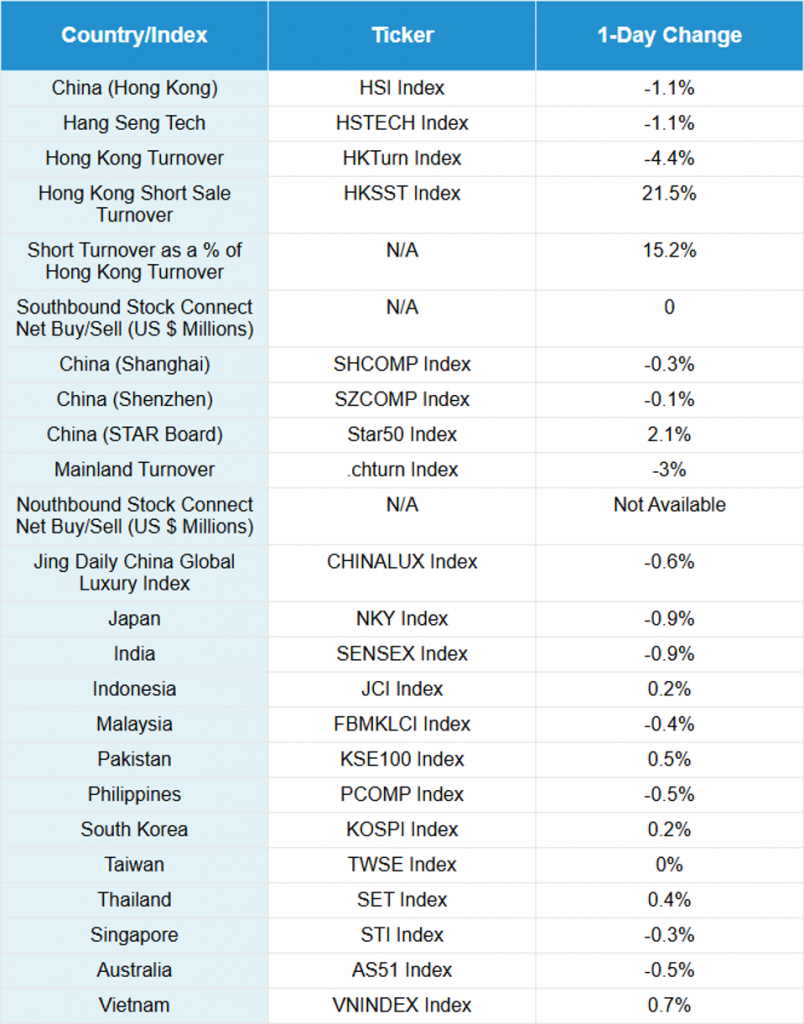

Asian equities were lower overnight after a significant rally for the week. Hong Kong and Mainland China both closed lower, though the latter outperformed. Analysts cited profit taking after a strong week, though the looming August 1st tariff deadline also likely weighed on sentiment.

China’s Premier Li met with European leaders at the EU-China Business Symposium. European leaders cited industrial overcapacity as a primary concern. It is good, then, that addressing overcapacity, especially in autos and solar panels, has become a top priority for China’s government. At the Summit, Premier is quoted by the South China Morning Post as having said, “Amid rising protectionism and unilateralism, if China and Europe join hands in upholding free trade and multilateralism while deepening economic and trade collaboration, they can serve as a stabilizing anchor for economic globalization and the stability of global industrial and supply chains”.

The deal with Japan is interesting as it involves a half-billion US dollar investment in the United States. We have advocated for some time that investment commitments are a superior alternative to tariffs as they do not punish US consumers and weigh on growth. Could this happen with China? We will see. Though, some security guardrails around the investments would have to be put in place. The America First Investment Plan memo provides for these guardrails, in theory, including a note that the US should consider employing what is basically a variable interest entity (VIE) structure for foreign investments. However, they did not call it that, of course.

Semiconductor Manufacturing International (SMIC) gained +4.98% overnight as UBS issued callable bull/bear contracts (CBBCs) on the semiconductor stock in Hong Kong. UBS also issued new CBBCs for Meituan, Ping An, BYD, Hong Kong Exchanges & Clearing, and Tencent.

Health care and industrials were the top-performing sectors in Hong Kong. Industrials continue to benefit from the perceived renewed infrastructure push in China, signified by the Tibet dam. However, not all were higher overnight as China Power Construction fell -3.10%, Inner Mongolia Baotou Steel fell -2.00%, and China Energy Engineering fell -9.60%. China will report industrial profits over the weekend.

Internet stocks were mostly lower overnight. Alibaba fell -1.91% and Meituan fell -3.20%. Markets have mostly taken the instant commerce promotion rules in stride, as these stocks had a positive performance week. Profit taking was likely the culprit behind last night’s price action.

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.15 yesterday

- CNY per EUR 8.40 versus 8.40 yesterday

- Yield on 10-Year Government Bond 1.73% versus 1.74% yesterday

- Yield on 10-Year China Development Bank Bond 1.82% versus 1.83% yesterday

- Copper Price -0.26%

- Steel Price -0.24%