Key News

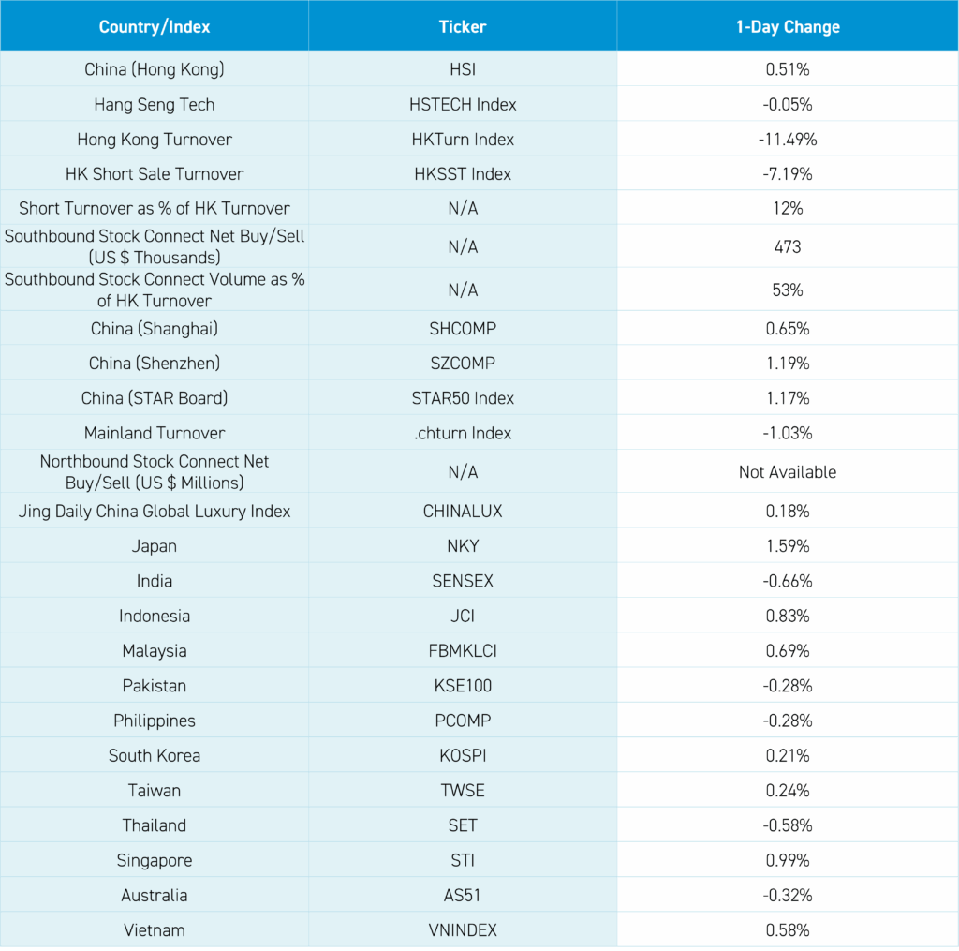

Asian equities were mixed overnight, as Japan and Mainland China outperformed.

It was a relatively quiet night with Hong Kong and Mainland China semis higher on President Trump’s AI Action Plan as Mainland China had a very broad rally led by Shenzhen growth stocks while mega cap banks, oil, and telecom lagged. Remember our thesis that foreign investors will always favor growth stocks when investing in China! Hong Kong and Mainland China were led by healthcare and materials.

The biggest news item today was the National Development and Reform Commission (NDRC) and State Administration for Market Regulation (SAMR) announced a price law amendment draft that included “criteria for identifying unfair price behavior” including “identifying low-priced dumping”, “improve the identification standards of unfair price behaviors such as price collusion” and stated industry leaders “shall not use their influence or dominant position in the industry to force or bundle sales of goods”. There will be a consequence for such behavior as “improve the legal responsibility for price violations” such as “punishment for unfair price behaviors” and for those “who violate the clearly marked price”. This draft is extensive, though one line that jumps out is “dumping at a price lower than the cost”.

Reuters had a good article on rising commodity prices in China and the government’s overcapacity crackdown (I’ll put it on X/Twitter @ahern_brendan). Another thesis is that China’s deflationary days are over, in addition to China exporting deflation. Hopefully, the restaurant delivery war between Meituan, Alibaba, and JD.com will also end. Meituan +0.9% seems to see the writing on the wall as the company held a symposium in Shanghai with participants in its ecosystem, which included restaurant owners voicing concern that the current delivery price war is weighing on restaurant dining. Remember, we had Shanghai’s local SAMR meet with Meituan, JD.com, and Alibaba yesterday.

Hong Kong growth stocks were mixed, with Tencent +0.91%, while NetEase -3.25%, CATL -1.24%, and Alibaba -0.5%. Biotech was led higher by WuxiBiologics +3.83% which announced that the 1st half of 2025 revenue will increase ~16% YoY and net income ~56% YoY. Mainland Chinese investors bought $473mm of Hong Kong stocks via Southbound Stock Connect. The State-owned Assets Supervision and Administration Commission (SASAC) met with local SOEs in Beijing to discuss implementing reforms and becoming more efficient. President Xi met with European Commission President Ursula von der Leyen and European Council President Antonio Costa on EU-China relations. Premier Li met with EU Commission Chairman von der Leyen on trade. He will also give a speech at the opening of the 2025 World Artificial Intelligence Conference in Shanghai on July 26th.

The China equity rally is a sleeper of a trade (not just YTD but since January 2024), though the renminbi’s rally versus the US dollar is even more so. On April 9th, USD/CNY hit 7.34 versus today’s close of 7.15. Yes, the US dollar index is off nearly twice as much in percentage terms versus CNY’s gains. Maybe countries should accuse the US of being a currency manipulator! Just kidding!

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.15 versus 7.16 yesterday

- CNY per EUR 8.40 versus 8.39 yesterday

- Yield on 10-Year Government Bond 1.74% versus 1.70% yesterday

- Yield on 10-Year China Development Bank Bond 1.83% versus 1.78% yesterday

- Copper Price +0.04%

- Steel Price -0.09%