Key News

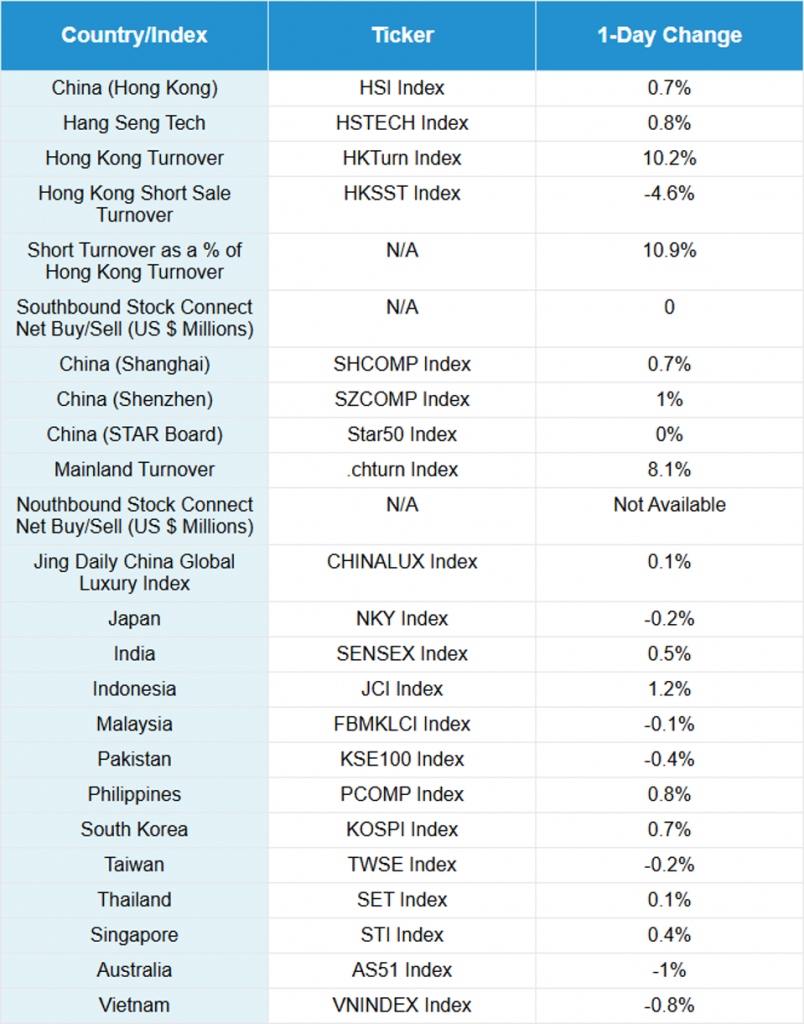

Asian equities started the week off on a positive note, except for Australia and Japan, which was closed for Marine Day, a public holiday celebrating and giving thanks for the ocean’s bounty, according to Perplexity.

The biggest news today was that Linzhi City hosted the ceremony for a new hydropower dam project on the Yarlung Zangbo River in Tibet. The dam, which Bloomberg says will be three times the size of the Three Gorges Dam, will consist of five electrical plants. Its construction will cost RMB 1.2 trillion. It will also generate 200,000 jobs and add RMB 2 billion in revenue for Tibet annually, once the decade-long construction is completed. The official start of the project ignited a rally in the Hong Kong and Mainland China-listed shares of construction-related subsectors, including construction machinery, oil, metals, mining, steel, building material, and heavy machinery companies.

Mainland and Hong Kong markets saw massive rallies in individual stocks. Hong Kong’s moves were amplified by short sellers getting steamrolled, as the Hong Kong-listed Dongfang Electric gained +65%, Huaxin Cement gained +85%, and China Energy Engineering gained +23%, while the Mainland-listed Anhui Conch Cement gained +10%. The project’s demand for steel and cement caused futures to rally, as both industries faced the anti-involution campaign’s effort to curtail overproduction and price wars.

The 1 and 5-Year Loan Prime Rates (LPRs) were left unchanged, as expected, at 3.0% and 3.5%, respectively.

Alibaba gained +1.81%, Meituan gained +2.75%, and JD.com gained +2.11%, following Friday’s after-the-close announcement that the State Administration of Market Regulation (SAMR) had met the three companies concerning their instant commerce price war. SAMR’s concerns are likely driven by restaurants and convenience stores not getting in store business due to significant subsidies for delivery. The intervention is very much aligned with the recent anti-involution campaign, which initially mentioned E-Commerce as an industry culprit.

Healthcare was lower both offshore and onshore, as investors took profits, though the sector remains a strong outperformer this year.

Hong Kong and Mainland brokerage stocks had good sessions, as Hong Chief Executive Li Jiachao stated that there have been 52 IPOs so far this year, 30% more than last year by this time, which raised a total of HKD 124 billion. Mainland investors made their presence felt, as Southbound Stock Connect saw a healthy net $898 million worth of buying from Mainland investors, accounting for 61% of Hong Kong turnover. The very high turnover percentage indicates a lack of foreign involvement, in my opinion.

The Hang Seng and Hang Seng Tech indexes both closed at big round numbers: 25,000 and 5,600, respectively. Shanghai and Shenzhen both grinded higher across the trading day.

After the close, Premier Li and the State Council announced new regulations concerning housing rentals. Chengdu announced that easing housing purchase restrictions would be done incrementally.

Reuters is reporting that President Xi will meet with European Commission President Ursula von der Leyen and European Council President Antonio Costa this Thursday in Beijing. The meeting comes against the backdrop of the EU’s sanctions against Russia.

There was also continued chatter that a Xi-Trump summit could be in the works, as Reuters reported that Putin would travel to Beijing to meet with Trump. The September summit floated by Reuters is aligned with our belief that a summit could occur around September’s 80th anniversary of World War Two ending.

Live Webinar

Join us on Tuesday, July 22, 10:00 am EDT for:

China Mid-Year Outlook: Trade Deal Loading, Consumption & Innovation Locked In

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.18 yesterday

- CNY per EUR 8.35 versus 8.36 yesterday

- Yield on 10-Year Government Bond 1.68% versus 1.67% yesterday

- Yield on 10-Year China Development Bank Bond 1.74% versus 1.72% yesterday

- Copper Price 1.17%

- Steel Price 1.62%