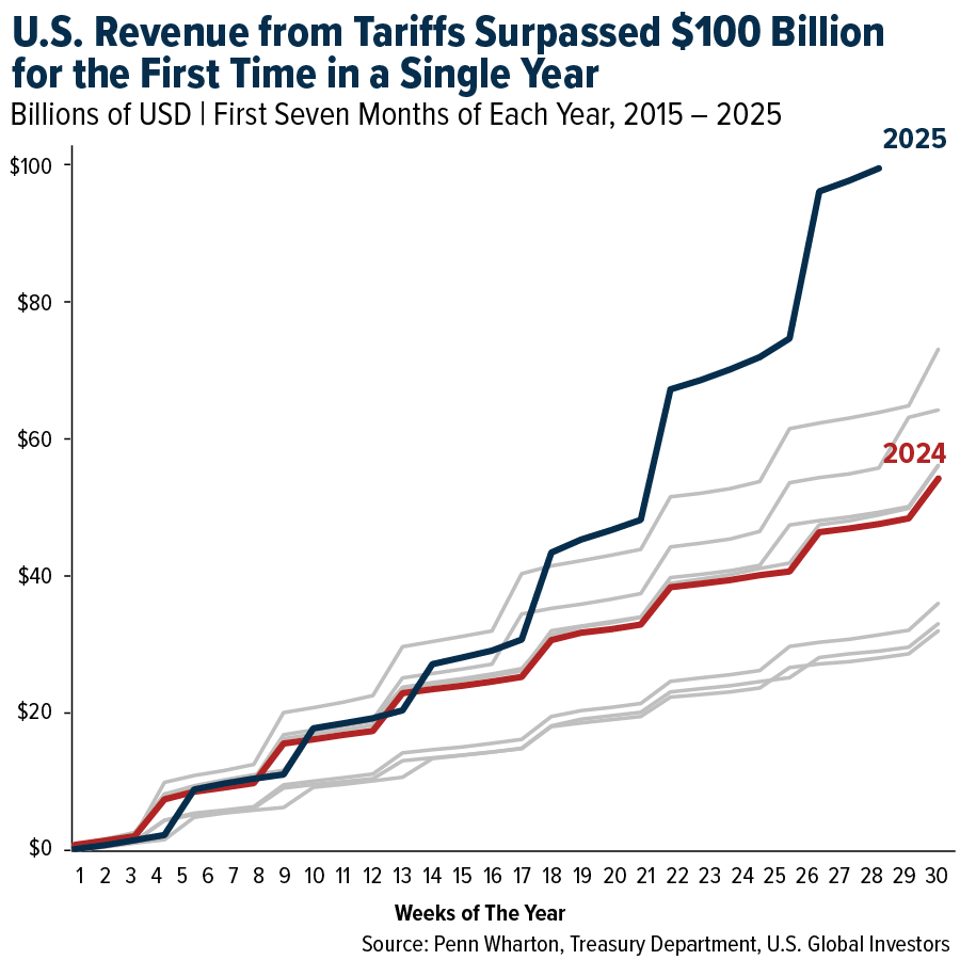

U.S. customs duties topped $100 billion for the first time ever in a single year this month. That number is even more remarkable when you consider that most of President Donald Trump’s new tariffs haven’t even taken full effect yet.

As you’ve heard me say countless times before, government policy is a precursor to change. We’ve already seen some big changes in trade, but come August 1, we’ll see even more. Investors are experiencing a mix of strong market performance on the one hand and growing economic friction on the other.

Historic Tariff Revenues

The U.S. pulled in over $27 billion in tariffs in June alone, according to the Treasury Department. That helped produce a surprise $27 billion budget surplus for the month, something we haven’t seen in a long time. Treasury Secretary Scott Bessent suggests that tariff revenue could exceed $300 billion by year-end if the administration’s plan stays on course.

Tariffs are clearly working as a revenue generator for the federal government. But keep in mind that tariffs are taxes, paid by American businesses and passed on to consumers in many cases.

Inflation may be creeping in already. June’s consumer price index (CPI) rose to 2.7% year-over-year, the highest rate in four months, and core inflation—excluding food and energy—is at 2.9%. The culprits? Imported consumer staples like clothes, shoes, furniture and electronics, which are facing some of the highest tariff rates since the 1930s.

For retirees and working families alike, that means higher prices at Walmart and Target, and fewer dollars left over to save or invest. Yale’s Budget Lab estimates that this year’s tariffs will cost the average U.S. household $2,500.

Big Pharma Braces for Impact

Auto prices, surprisingly, have dipped in recent months, likely due to an early surge in consumer demand ahead of new tariffs and incentives from dealers. I wouldn’t expect that trend to last. Analysts at Cox Automotive say the added cost from tariffs—up to $5,700 per imported vehicle—could eventually hit the most affordable models the hardest.

Meanwhile, the pharmaceutical sector is on high alert. Trump says his proposed drug import tariffs could begin at a low rate in August and ratchet up over the next year. According to the president, this is about bringing jobs home or making companies pay the price. Investors should watch this space closely, as health care stocks could be in for a wild ride.

S&P 500 Closes at a Record

Despite these headwinds, the S&P 500 closed at a record high on Thursday. And June’s PPI (producer price index) inflation came in flat, defying predictions from every one of Bloomberg’s surveyed economists.

Earnings calls from S&P 500 companies show fewer concerns about inflation than at any time since 2021, according to Schwab’s Liz Ann Sonders.

Some of the tariffs may be getting absorbed by companies willing to take on lower margins. Others are rerouting supply chains through lower-tariff countries like Vietnam and Mexico, in a process known as transshipment.

Manufacturing Execs Express Uncertainty

Not all business leaders are thrilled. A recent survey from the Atlanta Fed shows that 70% of executives overall report tariff-related uncertainty. That number jumps to nearly 90% in manufacturing. I see that as a red flag because when uncertainty is this high, companies tend to pull back on hiring and investment.

Historically, uncertainty has been an enemy of bull markets and long-term growth. The longer companies wait on new projects, the more it drags on GDP. Yale’s model suggests that U.S. economic growth this year will be approximately one percentage point lower due to tariffs, with a persistent 0.4% drag in the years to come.

Pharma Tariffs Loom as the Next Inflation Shock

Tariffs may bring in revenue and support reshoring efforts, but they also create friction. Certain sectors like industrials, autos and consumer discretionary will feel the pinch more acutely. Conversely, companies with domestic supply chains already in place and strong pricing power may fare better.

Gold also deserves a second look. Tariff-induced uncertainty and fiscal imbalances have tended to support demand for hard assets, especially if the Fed is constrained on rate cuts due to sticky inflation. As always, I recommend a 10% weighting in physical gold and gold mining stocks.

Again, keep your eye on August 1. That’s when the next wave of tariffs is set to roll out, potentially including those on pharmaceuticals. Whether markets stay calm or not may depend on how quickly businesses and consumers adapt.