Deal Overview

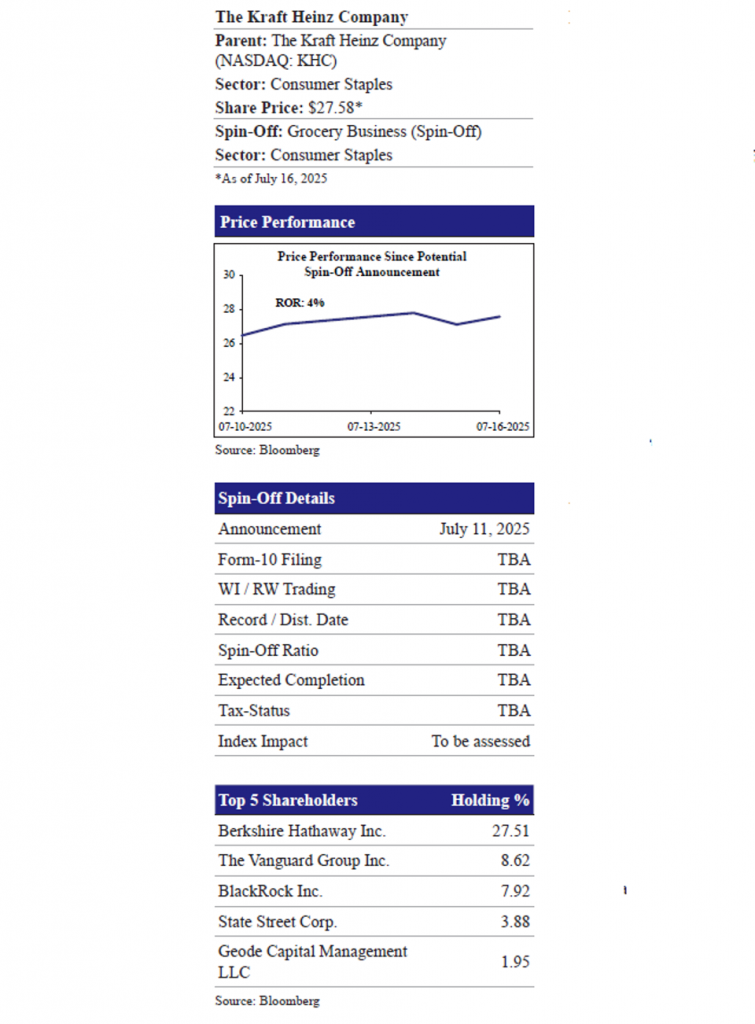

According to media publications on July 11, 2025, The Kraft Heinz Company (NASDAQ: KHC, $27.58, Market Capitalization: $32.64 billion), a leading global packaged food company, is contemplating spinning-off its grocery business while retaining its high growth condiments and sauces segment. As per market estimates, the spin-off entity would command a valuation $20 billion, on favorable turnaround of business prospects.

Post-separation, RemainCo will retain Kraft Heinz’s faster-growing and more consumer-aligned brands, focusing on flavor-forward and health conscious products. This includes iconic names like Heinz ketchup, Grey Poupon mustard, and a portfolio of hot sauces, dressings, and condiments. RemainCo will prioritise innovation, reformulation (such as removing artificial dyes), and expansion into global markets where demand for sauces and spreads is rising.

SpinCo (Grocery segment) will focus on Kraft Heinz’s traditional packaged food brands, which have long been staples in American households but have experienced slower growth in recent years. This includes products like Kraft cheese, Oscar Mayer meats, Maxwell House coffee, Jell-O, Planters nuts, Lunchables, and Capri Sun. These offerings are typically shelf-stable, processed, and widely distributed through grocery channels. SpinCo will aim to stabilize and optimize these legacy brands, potentially through operational efficiencies and targeted marketing, while navigating shifting consumer preferences toward fresher and healthier options.

Kraft Heinz was formed in July 2015 through a merger between Kraft Foods Group and H.J. Heinz Company. Berkshire Hathaway and 3G Capital led the deal to create a global packaged food giant. It combined Kraft’s grocery staples with Heinz’s condiments. Despite high hopes, the merger struggled due to shifting consumer preferences. The company has been actively reshaping its portfolio to align with evolving consumer preferences for healthier, less processed foods. Recent initiatives include removing artificial dyes from US products and divesting underperforming brands. In May 2025, Kraft Heinz announced a strategic review aimed at unlocking shareholder value, and Berkshire Hathaway relinquished its board seats, signaling potential structural changes. There is no official announcement about the separation as the company is undertaking a strategic review to explore various options. A formal announcement is expected to be made in the coming weeks.

Deal Rationale

Kraft Heinz’s decision to spin-off its grocery business is a significant step toward improving focus and performance. The move reflects a broader effort to recalibrate the business around its most promising assets and future growth drivers. The new grocery entity will include many of Kraft Heinz’s traditional staples, such as processed cheeses, lunch meats, boxed meals, and snack brands. Meanwhile, the RemainCo will focus on its premium condiments and sauces segment, which has demonstrated stronger growth, higher consumer engagement, and a broader global appeal. The separation allows each business to operate with strategies tailored to their distinct market dynamics, enabling the grocery unit to focus on cost efficiency and potential consolidation in the value segment, while the high-growth condiment division can prioritize global expansion and targeted capital investment.

The spin-off also addresses operational inefficiencies that have plagued the company since its 2015 merger, which was driven by aggressive cost-cutting under 3G Capital’s zero-based budgeting model. That approach ultimately failed to deliver sustainable results, resulting in a decline in the operating margin to 6.5% in FY24 from 14.4% in FY16. Reflecting this, the stock value fell 60% since the merger, erasing nearly $57 billion in market capitalization. The separation will enable RemainCo company to move forward in areas such as clean-label formulations, bold global flavors, and cross-border expansion, areas where consumer trends are clearly shifting.

Financially, the move can potentially unlock significant value only if the business sees a meaningful turnaround, which could, as per market estimates, value the company at $20 billion. Combined, the two entities could surpass Kraft Heinz’s current market capitalization of approximately $32 billion, offering investors clearer visibility of the performance and potential of each segment.

Kraft Heinz’s restructuring mirrors a broader industry shift, similar to Kellogg’s 2023 split into Kellanova and WK Kellogg, which helped both companies grow independently. Since then, Kellanova’s stock rose 43.7%, WK Kellogg gained 36.4%, while Kraft Heinz’s shares dropped by 19.0% during the same period. Kraft Heinz has already demonstrated a willingness to pare down its portfolio through the divestment of non-core units, such as its Italian infant nutrition division, signalling that the potential spin-off is part of a larger recalibration of its brand ecosystem. With both Berkshire Hathaway stepping back from board involvement and 3G Capital having exited its stake by the end of 2023, it becomes easier for Kraft Heinz to take a bold step, such as a spin-off.

Company Description

The Kraft Heinz Company (Parent)

The Kraft Heinz is a packaged food company, incorporated on July 2, 2015, following the merger of Kraft Foods Group, Inc. and the H.J. Heinz Company. With net sales of approximately $26.0 billion in FY24, Kraft Heinz operates across eight consumer driven product platforms: Taste Elevation, Easy Ready Meals, Substantial Snacking, Desserts, Hydration, Cheese, Coffee, and Meats. Kraft Heinz maintains a global footprint with operations segmented into North America, International Developed Markets, and Emerging Markets, supported by 70 manufacturing and processing facilities worldwide. The company features iconic product names such as Heinz ketchup, Grey Poupon mustard, and a portfolio of hot sauces, dressings, and condiments.

Grocery Business (Spin-Off)

The grocery business will house a significant portion of Kraft Heinz’s traditional grocery business. This includes products like Kraft cheese, Oscar Mayer meats, Maxwell House coffee, Jell-O, Planters nuts, Lunchables, Capri Sun, and other staples. These offerings are typically shelf-stable, processed, and widely distributed through grocery channels.