Key News

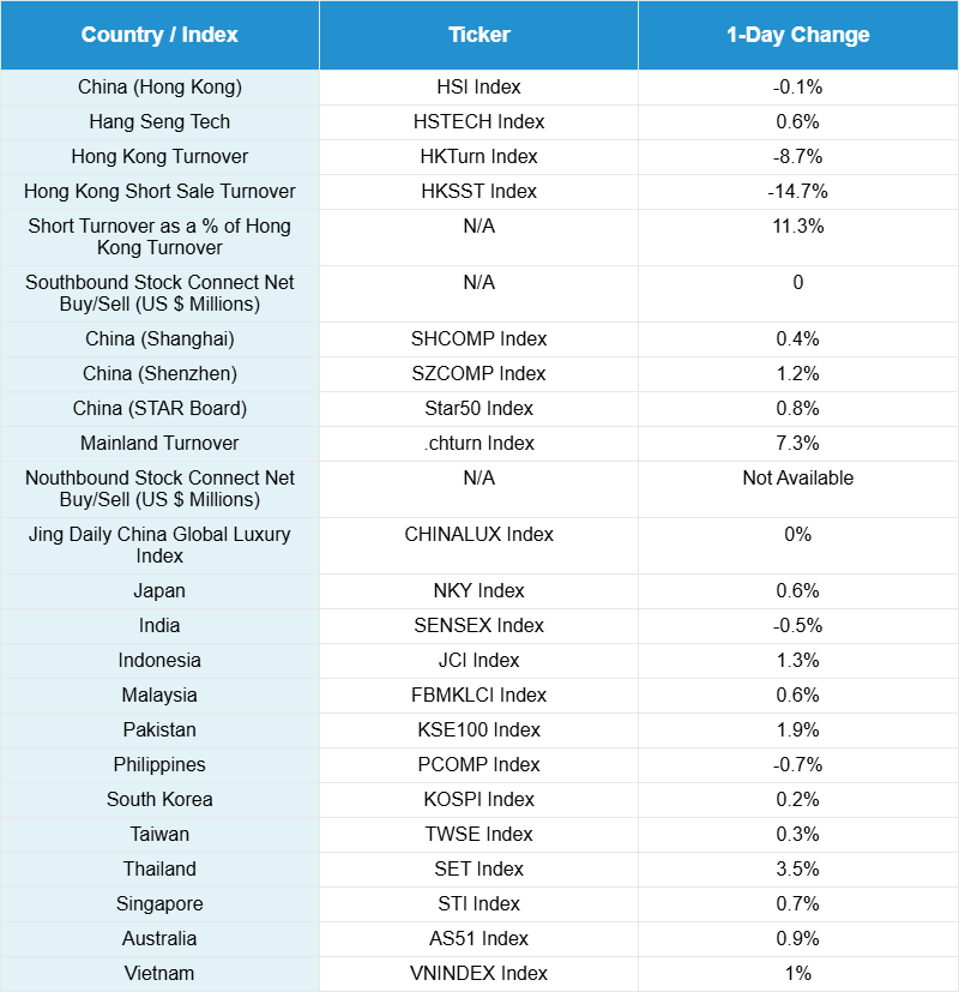

Asian equities had a good day as Thailand, Indonesia, and Pakistan outperformed, while India posted a small loss.

Hong Kong bounced around the room, while Shanghai and Shenzhen grinded higher, going from the lower left to the upper right.

It was a fairly quiet night, as Premier Li and the State Council’s meeting on “strengthening the domestic big cycle” and limiting EV price wars, i.e. ”anti-involution”, were front page news. The implications of the government curtailing “overcapacity” in the auto, steel, cement, E-Commerce, and solar industries are significant for corporate balance sheets, ending domestic deflation, and China not exporting deflation.

Li Auto gained +9.73% after announcing that a new model is open for pre-sales, as Geely Auto gained +4.16%, BYD gained +1.06%, XPeng gained +1.14%, though Xiaomi fell -2.01% and CATL fell -0.27%.

Biotech stocks in both Hong Kong and Mainland China continued to outperform overnight, as Akeso gained +10.71% after starting Phase 3 trials for a metastatic colorectal cancer treatment. The space continues to benefit from drug releases, distribution deals, and favorable policy support. BeOne, formerly known as Beigene, gained +10.6%, Jiangsu Hengrui gained +2.06%, Sino Biopharmaceutical gained +5.9%, CSPC Pharma gained +3.58%, and WuXi Apptec gained +2.42%.

Internet names were mixed, as Alibaba fell -1.14%, Meituan gained +1.13%, JD.com fell -0.16%, Trip.com fell -0.88%, Kuaishou fell -0.65%, and Tencent Music Entertainment gained +1.78%. South China Morning Post had an article about Meituan complaining about “irrational competition” from Alibaba and JD.com after the latter’s entrance into the restaurant delivery space sparked a price war. Another Chinese city announced local plans to curb the price war.

Mainland investors bought $236 million worth of Hong Kong-listed stocks and ETFs via Southbound Stock Connect, though Tencent, which gained +0.10% overnight, remains a funding source and was sold by Mainland investors. Hong Kong and Mainland China-listed electronic equipment makers, software, and semiconductor stocks had very strong days. Nvidia’s Jensen Huang’s China trip and comments on chip sale approvals and the quality of Chinese electric vehicles (EVs) and AI garnered significant attention.

According to the China Association of Automobile Manufacturers (CAAM), China’s auto exports increased +10.4% year-over-year (YoY) to 3.07 million in June.

After the close, the Ministry of Finance (MoF) adjusted the tax rate on ultra-luxury cars with price tags above RMB 900,000 and canceled taxes on used vehicles.

China and Australia singed a memorandum of understanding (MOU) to review the China-Australia Free Trade Agreement following Prime Minister Anthony Albanese’s six-day trip to China. There was also more media chatter of US-China trade deal percolating.

Live Webinar

Join us on Tuesday, July 22, 10:00 am EDT for:

China Mid-Year Outlook: Trade Deal Loading, Consumption & Innovation Locked In

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.18 versus 7.17 yesterday

- CNY per EUR 8.31 versus 8.34 yesterday

- Yield on 10-Year Government Bond 1.66% versus 1.66% yesterday

- Yield on 10-Year China Development Bank Bond 1.72% versus 1.72% yesterday

- Copper Price -0.08%

- Steel Price +0.51%