Silver is moving out of a long shadow cast by gold, its precious metal sister with hints of a major new buyer, Russia’s central bank, starting to influence the silver price which has risen to a 14-year high.

Data is scarce but since Russia revealed a plan late last year to add silver for the first time to its State Reserve Fund the silver price has outperformed gold.

Part of the reason for silver’s 30.6% rise since early January compared with gold’s 27.5% increase is a simple case of silver trying to catch up with gold which has been a commodity sector star for the past three years.

There are also signs that the investors have hit the pause button on gold which has more than doubled since 2022 driven initially by central bank buying with private investors later entering the market.

Silver has been slower off the mark, lacking buyers with the firepower of central banks or well-funded exchange-traded funds and rich private buyers.

But if the Russian central bank is quietly building a silver stockpile, as seems to be the case, then it is possible to see other banks aligned to Russia following its lead.

Silver BRICs?

BRIC nations, a loose confederation led by Brazil, Russia, India, and China, are seeking to break the stranglehold held by the U.S. dollar on world trade.

Part of the BRICs plan is to accumulate gold as they look for a way to bypass the dollar, though with the gold price hovering close to an all-time high that action has been hugely expensive.

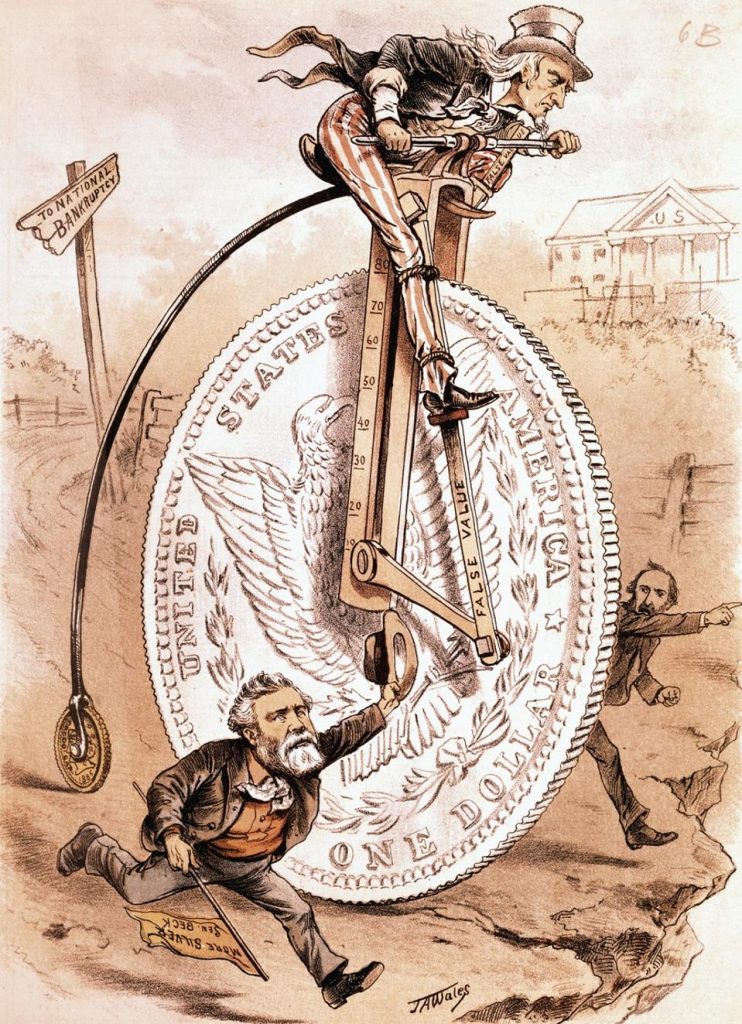

Silver, which has always been seen as an alternative to gold even to the point of acquiring an unkind nickname of the poor man’s gold, might enable members of the BRIC group to push on with their plan to break free of the dollar.

Strong industrial demand is also adding to silver’s appeal as an investment, as is the substitution factor in jewelry where gold has been priced out of some markets.

Topline jewelry makers have added silver to their offerings in the hope of appealing to younger buyers who cannot afford gold.

Demand for silver in technology is also rising, especially in the production of electricity producing solar panels where silver is used in paste form on the front and back of panels.

But the biggest factor at work in the silver market today appears to be investment demand with the metal increasingly seen as a gold substitute, along with platinum, another precious metal with a growing investment following and a rising price.

A measure of the improving appetite for silver is the basic test of the gold-to-silver ratio, an imprecise measure which compares silver with gold.

Historically, the gold/silver ratio has been around 65, which means an ounce of gold is valued at roughly 65-times an ounce of silver.

Gold/Silver Ratio Slips

The latest reading of the ratio is 88 which indicates that silver is cheap relative to gold.

Not everyone believes the gold/silver ratio is a useful measure of the price of either metal whereas the entry of a new class of buyer could be significant.

There has been no further news since Russia’s central bank last year announced that it would add silver to the country’s precious metal reserves dominated by gold and platinum.

But the relatively strong performance recently by silver compared with gold could be an indication of increasing central bank activity in the silver market.