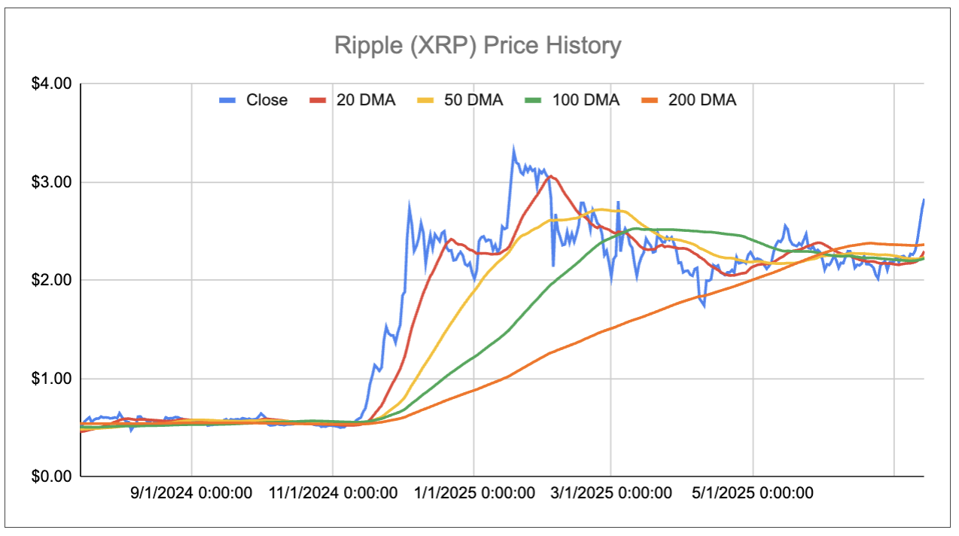

Ripple’s XRP has surged approximately 30% over the past week, decisively breaking above its 20, 50, 100, and 200-day moving averages. This impressive rally aligns with Bitcoin reaching new all-time highs around $121,000, generating strong momentum across the entire cryptocurrency market. Adding to the bullish sentiment, President Trump recently posted on social media: “Tech stocks, industrial stocks, & Nasdaq, hit all-time, record highs! Crypto, ‘through the roof’.” He also urged the Federal Reserve to “rapidly” cut interest rates, citing “no inflation.” This endorsement of cryptocurrencies and call for aggressive monetary easing has significantly supported digital assets, with Bitcoin, Ethereum, and XRP all posting solid gains. Trump’s remarks suggest a shift toward crypto-friendly policies and looser monetary conditions—two key factors that have historically bolstered digital asset performance. Also, check out the High Quality portfolio, which has outperformed the S&P and delivered >91% returns since inception.

The Impact of Federal Reserve Rate Cuts on XRP

If the Federal Reserve proceeds with rapid interest rate cuts, the cryptocurrency market—especially XRP—could see notable upside. This shift in policy fundamentally reshapes the investment landscape in ways that favor digital assets.

Lower interest rates reduce the opportunity cost of holding assets that don’t generate income. With diminished yields on traditional investments like bonds or savings accounts, investors often pivot toward higher-growth options, making cryptocurrencies more appealing. Additionally, weaker interest rates often result in a softer U.S. dollar, enhancing the appeal of alternative stores of value. Given XRP’s established role in cross-border payments, it becomes a viable dollar substitute in international transactions.

XRP is especially well-positioned to gain from a low-rate environment due to its practical use within the financial sector. Unlike assets driven purely by speculation, XRP facilitates real-time global payments, adding institutional value.

As financial institutions face tighter margins amid low rates, XRP’s efficient payment infrastructure offers a cost-saving solution. Banks and payment providers looking to preserve profitability may increasingly adopt XRP to reduce costs and improve settlement speeds. Moreover, XRP’s recent breakout above all key moving averages signals strong technical momentum, which could intensify if favorable monetary conditions materialize.

Broader Market Implications

Swift rate reductions would likely drive capital out of traditional “risk-free” assets into higher-risk segments. Cryptocurrencies—with their high-return potential—would likely benefit significantly. Historically, such conditions favor established digital currencies like XRP, which offer both speculative upside and real-world utility.

Falling rates also reduce borrowing costs, encouraging leveraged crypto investments and potentially accelerating institutional involvement. With traditional yield avenues narrowing, corporate and institutional investors may increasingly turn to digital assets as portfolio diversifiers.

Technical Momentum Supports Continued Gains

XRP’s clear breakout above key moving averages reflects solid technical momentum that may persist if macroeconomic conditions continue to improve. Its ability to stay above these critical levels highlights continued institutional and retail interest.

As Bitcoin continues pushing new highs and lifting the broader cryptocurrency sector, XRP appears primed for further gains—especially if the Fed adopts the kind of aggressive rate-cutting stance Trump has encouraged.

XRP’s 30% rally over the past week reflects growing optimism around Trump’s pro-crypto messaging and mounting expectations of monetary easing. Should the Federal Reserve follow through with swift rate reductions, XRP could benefit from sustained investor interest as a viable alternative to low-yield traditional assets. However, investing in individual stocks—or cryptocurrencies, which are significantly more volatile—carries substantial risk. For broader exposure, consider the 30-stock Trefis High Quality (HQ) Portfolio, which has a strong record of comfortably outperforming the S&P 500 over the past four years. What’s the reason? HQ Portfolio stocks have generally offered higher returns with lower volatility than the benchmark—resulting in a smoother ride, as shown in the HQ Portfolio performance metrics.