The second-quarter earnings season begins this week. 39 S&P 500 companies scheduled to report, with a heavy emphasis on the large banks. Notable companies scheduled to release earnings include: Blackrock (BLK), JPMorgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), Bank of America (BAC), Johnson & Johnson (JNJ), Goldman Sachs (GS), PepsiCo (PEP), Netflix (NFLX), 3M (MMM), and American Express (AXP).

Earnings At A Glance

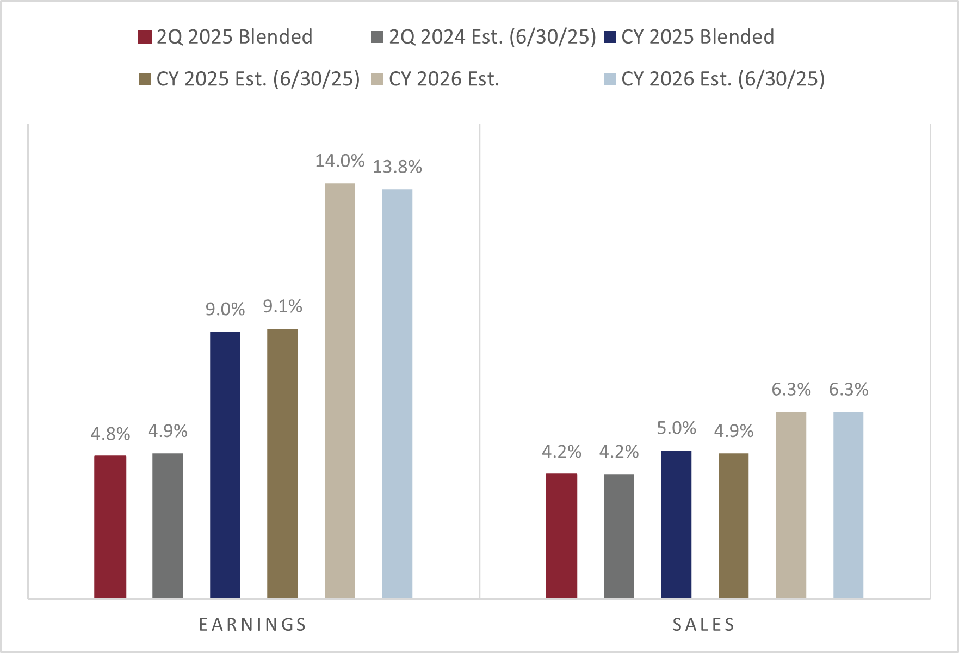

With only a few companies reporting and combining actual results with consensus estimates for companies yet to report, the S&P 500’s blended earnings growth rate for the quarter is at 4.8% year-over-year, slightly below the expectations at the end of the quarter. Notably, the calendar year 2025 expected earnings growth rate is 9.0% and 2026’s expectations are at 14.0%.

Market Performance

Tariff worries led to a slight decline in the S&P 500 last week. The Magnificent 7, consisting of Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA), outperformed last week.

Magnificent 7

Because these companies are critical drivers of earnings growth, a significant percentage of the S&P 500’s market capitalization, and are currently in a bear market, the Magnificent 7 remains the group to watch this earnings season. The first of the Magnificent 7 is scheduled to report results next week.

Earnings Insights By Sector

According to FactSet data, the earnings expectations for the financial sector are deceptively low due to JPMorgan Chase (JPM). JPM reported a significant gain from sales of Visa (V) stock in the same quarter last year, so the company has challenging year-over-year comparisons. If JPM is excluded from the financial sector, year-over-year earnings growth improves to 9.3% from 2.4%.

On the other side of the ledger, earnings growth rate expectations within the communication services sector are being flattered by Warner Bros. Discovery (WBD). According to FactSet, WBD reported a significant loss last year due to a goodwill impairment charge, so it is benefiting from extremely easy comparisons. If WBD is excluded, the expected growth of the communication services sector falls from 29.4% year-over-year to 8.2%.

The energy sector is predicted to show the most significant decline in year-over-year earnings due to lower oil prices.

Revenue Results By Sector

Sales growth is closely tied to nominal GDP growth, which combines after-inflation economic growth (real GDP) with inflation. If the estimates of second quarter nominal year-over-year GDP growth of 4.7% are correct, there could be some upside to sales growth. At this early point in the earnings season, sales growth at 4.2% is meeting expectations.

Consistent with the earnings picture, revenues in the energy sector should see the most significant year-over-year decline.

Dollar Weakens

The US dollar weakened relative to the same quarter last year. On the margin, this should benefit companies’ international earnings. According to FactSet, 41% of S&P 500 sales are from international sources.

What To Watch Next Week

The economic calendar also heats up this week with consumer inflation (CPI) and retail sales. Tuesday’s June CPI is expected to be hotter, increasing to 2.6% year-over-year from 2.4%. The Federal Reserve already expects some inflation impact from tariffs and is likely on the sidelines until at least September.

The retail sales report on Thursday is expected to show a modest rebound for the US consumer. Since consumers are a crucial driver of the US economy, this rebound will be essential for economic growth expectations.

Newsflow about the administration’s trade negotiations and new tariff announcements will remain a focus. Significant new tariffs are currently scheduled to be implemented on August 1, barring an acceptable trade agreement.

With financials dominating the first week of earnings season, the headline earnings should begin on a positive note. With the tariff overhang and consensus expecting an acceleration in earnings growth for the third quarter, forward earnings guidance from management will be watched closely.