Week in Review

- Asian equities were mixed for the week, as Vietnam and Korea outperformed, while India and Malaysia underperformed.

- The Central Committee for Financial and Economic Affairs, led by President Xi, vowed to step up efforts to limit subsidies for instant commerce from the large E-Commerce platforms and reduce overcapacity in an expanded list of industries.

- It was a strong week of net buying of Hong Kong-listed stocks by Mainland investors, on several positive catalysts, including higher-than-expected consumer price inflation in June and a confirmation of central government support for resuming construction of stalled, pre-paid real estate projects.

- Rumors of US officials and business people, including Nvidia’s Jensen Huang, led to speculation that more trade deal details could be coming soon, which was also positive for markets this week.

Key News

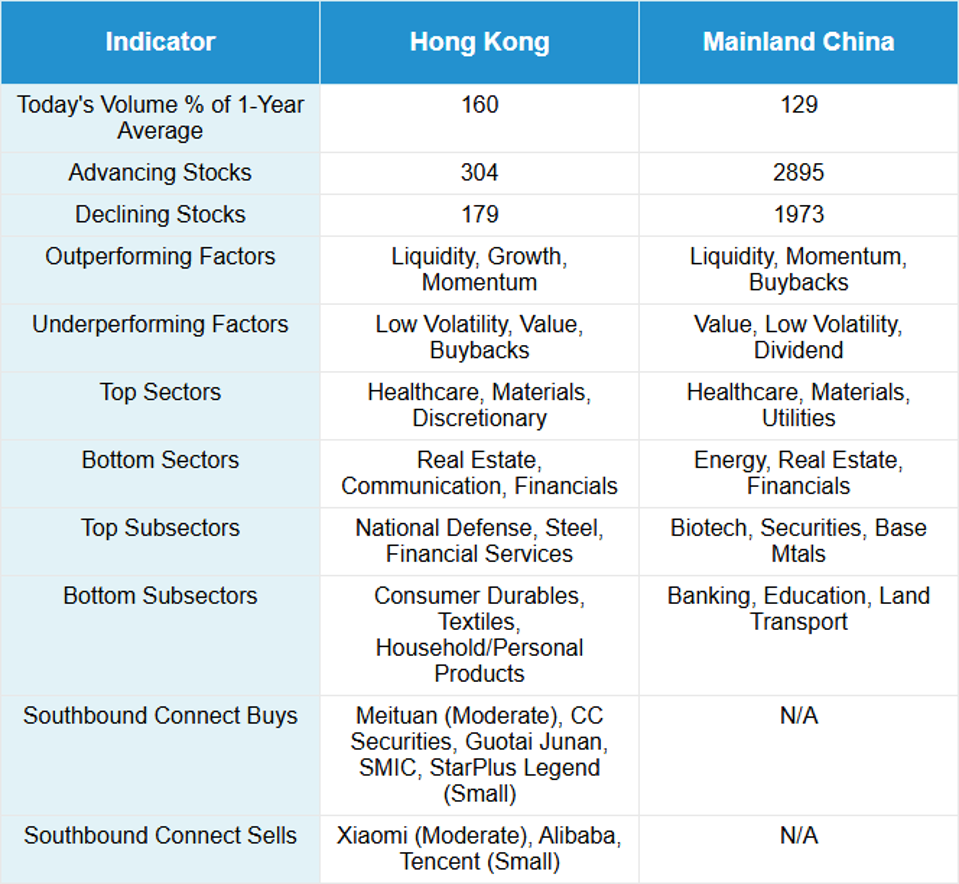

Asian equities were largely higher despite President Trump’s rising tariff rhetoric, except for India, which underperformed today and this week. The resilience is a great sign, in my opinion. Hong Kong and Mainland China ended a good week on a positive note despite a late afternoon slump that brought the market off its intraday highs.

US Secretary of State Marco Rubio met with Foreign Minister Wang Yi at the ASEAN conference in Malaysia, stating that the meeting was “very constructive and positive” and that a Trump-Xi summit was likely. I suspect that the trips in the works for Rubio, Nvidia’s Jensen Huang, and potentially Treasury Secretary Scott Bessent are all to ensure that a big, beautiful deal happens. As my childhood hero Hannibal Smith of the 1980s TV show The A-Team, would say, “I love it when a plan comes together!” (My favorite character was Mr. T’s B.A. Baracus, due to my initials). I’m still betting on an early September visit to commemorate the 80th anniversary of World War II, though we shall see. Let’s not pop the champagne yet, though, but maybe let’s go buy some ice.

Chinese Vice Minister of Finance Liao Min met with former US Treasury Hank Paulson in Beijing.

Hong Kong-listed growth stocks had a good day, as internet names gained. Hong Kong’s most heavily traded stock by value Alibaba gained +1.84%, despite the ongoing price war with Meituan, which gained +1.18%, and JD.com, which fell -0.24%. Even with growth factors outperforming hard, it was hard not to notice the strong performance of brokers following preliminary net income releases from Huaxin Securities, which gained +118%, and Guolian Minsheng, which gained +1,183% (not a typo).

Healthcare had a strong day as Wuxi AppTec gained +10.46% after pre-announcing that its first half net profit is expected to rise by 101% year-over-year (YoY). The Ministry of Finance (MoF) released a notice that state-owned enterprise (SOE) insurance companies should “improve their asset liability management level and strengthen the matching management of assets and liabilities in terms of term structure, cost income, and cash flow.” That sounds shareholder-friendly!

Gaming and social media company Bilibili gained +0.41%, after the company’s Bilibili World 2025 started in Shanghai with 300,000 attendees, as VIP tickets sold out in 17 seconds. Shanghai is too hot in the summer for me, but maybe my colleague Xiabing can swing by and check it out. Semiconductors had a good day in both Hong Kong and Mainland China. Growth stocks also had a strong day in China as Shenzhen outpaced Shanghai, as banks weighed on the latter. Growth sub-sectors, such as semiconductors, software, and household appliances, along with brokers, had a strong day. The Mainland-listed robotics stocks, including Shenzhen Zhaowei Machinery, Jiangsu Leili Motor, and Ningbo Zhongda Leader Intelligent Transmission, all gained after Shanghai Pudong’s government stated a policy focus on “key technologies and promote a number of key component enterprises such as reducers, dexterous hands, and controllers to gather rapidly in Pudong.” Next week will see the release of June economic data, including Q2 GDP.

I asked Perplexity, “If one removes the US-China geopolitical overhang, what’s the amount that would go back into Chinese equities from US institutions?”. The large language model (LMM) ascertained that US institutions hold $250 billion of US-listed China stocks, $522 billion worth of Hong Kong-listed stocks, and less than 0.5% of onshore equities, totaling over $800 billion. It’s not a perfect answer, but let’s run with it. Noting that “US and global investors are currently “deeply underweight” Chinese equities, and a normalization of relations would likely result in a substantial increase in allocations—potentially restoring or even exceeding previous peak exposures—the LMM said $800 billion could go back in, as that represents the most at risk—very imprecise, in my opinion. I like Perplexity, as it shows its sources. So, I asked what the peak value of US equity holdings was, and it found a Rhodium Group report stating that it was $1.1 trillion at the end of 2020. Neither number “feels” right to me, but a few hundred billion dollars worth of inflow would be significant.

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.18 yesterday

- CNY per EUR 8.38 versus 8.39 yesterday

- Yield on 10-Year Government Bond 1.67% versus 1.66% yesterday

- Yield on 10-Year China Development Bank Bond 1.73% versus 1.72% yesterday

- Copper Price 0.18%

- Steel Price 1.10%