Family offices are not static, as wealth passes from one generation to the next, family offices must navigate not only shifting dynamics but growing complexity. With each generational transition comes a new perspective, a new set of expectations, and often a new way of working. But while these transitions play an important role in shaping a family office, they are not the only factors. From generation to generation, we found that the most enduring family offices are those that professionalize with purpose and adapt to complexity.

We believe that the pillars of a successful family office are its people and governance. The ability to evolve is not guaranteed by time or succession, it is determined by the conscious decision to professionalize.

Generations May Shift, But Governance Endures

We have discussed in an article on our website before, that the leadership approach within a family office often varies by generation, due to factors such as experience, upbringing, and exposure to wealth management. First generations, the wealth creators, tend to lead instinctively, centralizing control and relying on trusted advisors. Second and third generation successors often bring more global exposure and a desire for structure into the organisation. By the fourth or fifth generation, many family offices resemble institutions, with professional boards, multi-jurisdictional operations, and a focus on ESG, philanthropy, and purpose-led investing.

While the above is very true, we have also seen the opposite.

We have worked with Gen 1 wealth creators who chose to professionalize early, bringing in experienced executives, formal governance frameworks, and robust investment oversight from the outset. Others, despite decades of succession, remain unchanged or even underdeveloped, operating with informal structures that put both capital and legacy at risk.

The takeaway? While generational transitions and governance maturity often overlap, they are not the same thing.

The Maturing of a Family Office

While generational change often marks turning points in a family office’s development, we believe the more significant transformation is in how the entity itself matures. With each generational handover comes an opportunity to reassess talent, governance, and structure.

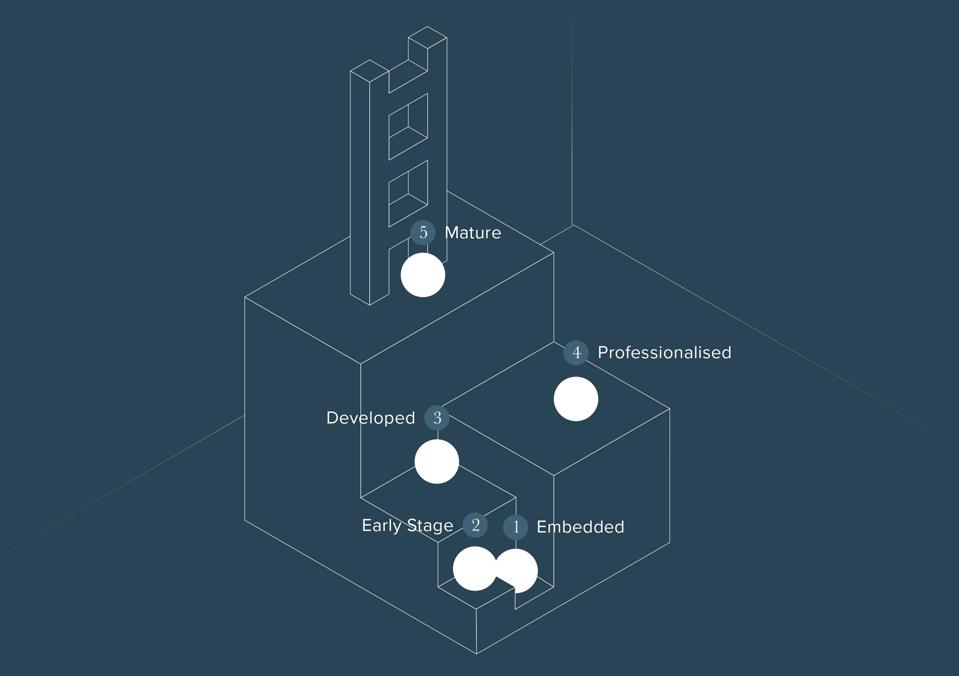

To support this, we developed a Family Office Maturity Model, identifying five distinct phases of family office maturity: Embedded, Early Stages, Developed, Professionalised, and Mature. While these phases may align with generational transitions, they ultimately reflect the progression towards formal governance, operational efficiency, and strategic clarity.

Phase 1: Embedded

At this early stage, the family office exists informally, often embedded within the family business. It is characterized by Founder-led, instinctive, and relationship-driven processes. The decision-making is fast and centralised. Trusted advisors and loyal employees, usually from the operating business, form the core team with minimal governance. While effective in the short term, this model can blur boundaries between personal and business matters, leading to inefficiencies and future succession challenges.

Phase 2: Early Stages

As the wealth grows, the need for a standalone family office becomes clear. The entity is separated from the operating business, while governance remains informal, echoing the founder’s leadership style. The family starts to experiment with external advisors and new structures, often driven by the need for succession planning, tax structuring, and clarity around roles.

Phase 3: Developed

With increasing complexity and a wider set of family interests, governance frameworks, such as family councils and investment committees (IC), emerge. In-house capability expands, and strategic planning becomes a priority. The focus shifts to risk management, stakeholder alignment, and building cohesion among family members.

Phase 4: Professionalised

The family office operates with corporate-level professionalism. Governance is formalized, succession planning is strategic, and decision-making is well-structured. Investment performance improves as qualified and experienced professionals lead operations. Values such as impact investing, philanthropy, and sustainability take centre stage, reflecting the interests of a globally engaged family.

Phase 5: Mature

At this stage, the family office becomes an enduring institution. It operates independently of day-to-day family involvement, it is governed at the board level and run by experienced executives. Cost structures are stabilized, performance is optimized and measured across financial and non-financial returns, and the entity is built to last. Purpose is clearly articulated, and strategy, talent, compensation and retention are aligned with long-term, multi-generational goals.

While each generational milestone often coincides with a leap in maturity. The wealth creator may prioritize capital preservation, while their successors push for structured governance or purpose-led investing. But the underlying theme across all generations is the need for a family office that can evolve with scale, complexity, and strategic clarity.

Ultimately, success is not just about passing the baton, but building a family office that is prepared to carry it.

Generations change. Values evolve. Markets shift. But the need for strong governance and skilled people is constant.