Key News

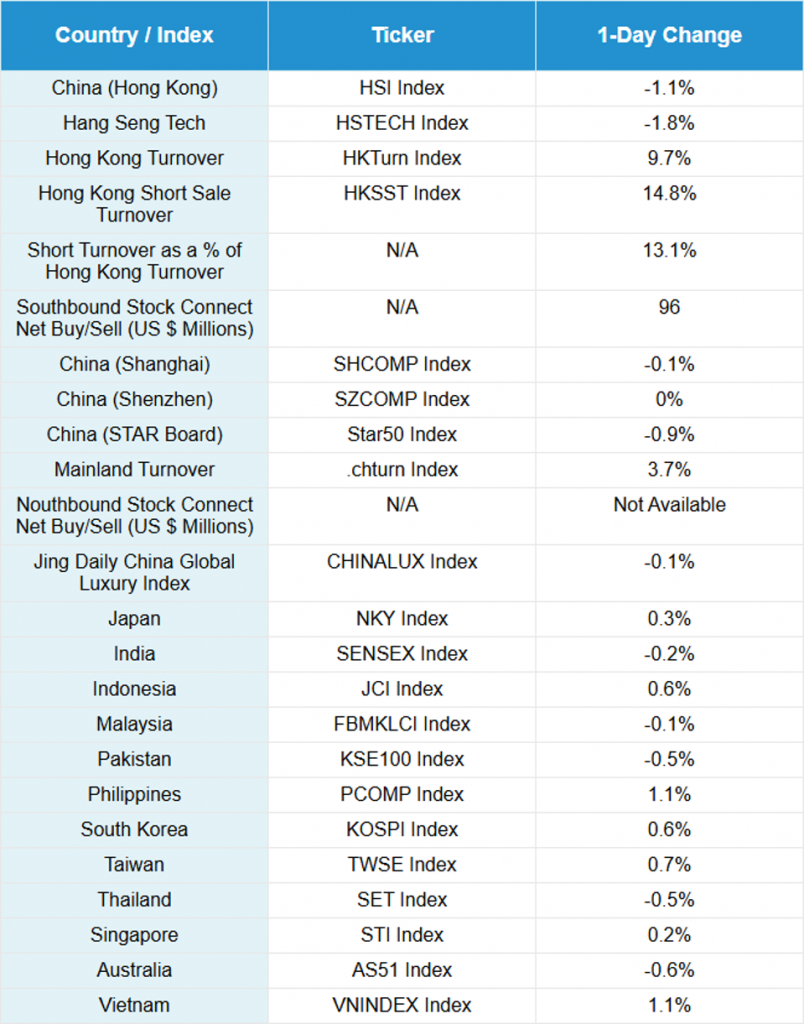

Asian equities delivered a mixed performance overnight, as the Philippines and Vietnam outperformed while Hong Kong underperformed. This occurred despite former President Donald Trump’s threats of new tariffs on copper and pharmaceuticals, as well as a stronger U.S. dollar.

June inflation data was also mixed. The Producer Price Index (PPI) declined by 3.6% year-over-year, which was steeper than expectations of -3.2% and May’s -3.3%. The Consumer Price Index (CPI) rose by 0.1%, ahead of expectations for a 0.1% decline and May’s -0.1%. The PPI’s decline was attributed to weaker domestic raw material manufacturing industries and the impact of increased green electricity, which is expected to drive down energy prices as coal use is reduced.

Both Hong Kong and Mainland China equity markets fell, with growth stocks in Hong Kong particularly weak. Internet stocks declined as concerns over a restaurant and food delivery price war weighed on sentiment. Alibaba Group Holding Limited fell 3.83%, Meituan dropped 2.45%, and JD.com declined 1.88%. The selloff spread to Tencent Holdings Limited, which fell 1.37%, and Xiaomi Corporation, which declined 2.13%.

After the close, the People’s Daily published an article on the “Takeaway War,” stating, “there is no winner in price war, only innovation can bring the future.” The article noted that while ultra-low prices may benefit consumers, the resulting “explosive orders” can lead to irrational consumption, dilute company profits, and exhaust delivery riders. I can relate to that exhaustion! Regulators are reportedly examining similar competitive dynamics in the auto sector. The original government release last week also referenced solar, steel, cement, and plastic industries, in addition to auto and e-commerce.

Despite above-average short selling in Alibaba and Meituan, both stocks saw significant buying from Mainland investors, who purchased the Hong Kong dip with a robust net inflow of $1.179 billion. It would be encouraging to see regulators address the ongoing takeaway war.

According to Bloomberg, JP Morgan’s Asia and China equity strategist Wendy Liu believes that regulatory scrutiny of “excess capacity” in auto, steel, and cement could ultimately benefit related stocks, as we discussed yesterday. Another factor weighing on Hong Kong was the funding required for five companies that went public today on the Hong Kong Exchanges and Clearing Limited, led by Apple supplier Lens Technology, which rose 9.13%. The capital needed for initial public offerings must come from somewhere. Eight companies have listed in Hong Kong month-to-date, raising a total of HK$16.8 billion, following 15 IPOs in July.

Henderson Land Development Company Limited fell 8.64% after raising US$1 billion in a convertible bond deal. The risk of real estate companies issuing convertible bonds and new stock to cover debt is why we continue to prefer their debt over their equity. Despite attractive yields on Asian high-yield bonds, investors remain enamored with U.S. high-yield bonds. #frustrating

Contemporary Amperex Technology Co. Limited gained 7.18% in Hong Kong and 2.84% in Mainland China after Bloomberg reported that Ford’s new plant will use CATL’s battery technology. Taiwanese pop star Jay Chou created an account on Douyin (TikTok), which led to his mother’s merchandise store, Star Plus Legend, surging 94.38%.

Healthcare stocks outperformed in both Hong Kong and Mainland China, despite the pharmaceutical tariff threat. Precious metals and mining stocks were weak across both markets.

Looking ahead, the State Council Information Office will hold a press conference and reporter Q&A next Tuesday at 10:00 a.m. to discuss the economy’s performance in the first half of 2025.

Live Webinar

Join us Thursday, July 10, at 11 am EDT for:

$5 Trillion Humanoid Robotics Opportunity – Capitalizing On The Boom

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.18 versus 7.17 yesterday

- CNY per EUR 8.40 versus 8.42 yesterday

- Yield on 10-Year Government Bond 1.64% versus 1.64% yesterday

- Yield on 10-Year China Development Bank Bond 1.70% versus 1.70% yesterday

- Copper Price -0.72%

- Steel Price +0.13%