Conagra Brands (NYSE: CAG) is scheduled to announce its fiscal fourth-quarter earnings on Thursday, July 10, 2025. Analysts predict earnings of $0.61 per share on revenue of $2.88 billion, approximately unchanged year-over-year. Investors are keenly observing inflation, tariffs, and consumer sentiment. Q3 results met expectations, and Conagra is expecting strong consumption in Q4. As service levels improve, shipment volumes and gross margins are expected to increase, while SG&A trends are anticipated to remain favorable despite inflationary pressures. Snack volumes rose by 4% in Q3, driven by meat snacks and popcorn. With the industry moving towards healthier options, Conagra’s portfolio seems well-prepared. The recent acquisition of FATTY Smoked Meat Sticks is also performing admirably.

The company has a current market capitalization of $10 billion. Revenue over the previous twelve months amounted to $12 billion, and it was operationally profitable, boasting $481 million in operating profits and net income of $329 million. Much will depend on how the results compare with consensus and expectations, but understanding historical patterns may enhance the odds in your favor if you are an event-driven trader.

There are two approaches to achieve this: comprehend the historical probabilities and position yourself before the earnings release, or analyze the correlation between immediate and medium-term returns after earnings and position yourself accordingly following the release. That said, if you are seeking upside with lower volatility than single stocks, the Trefis High-Quality portfolio offers an alternative, having outperformed the S&P 500 and achieved returns exceeding 91% since its inception. See the earnings reaction history of all stocks.

Historical Probability of Positive Returns for Conagra Post-Earnings

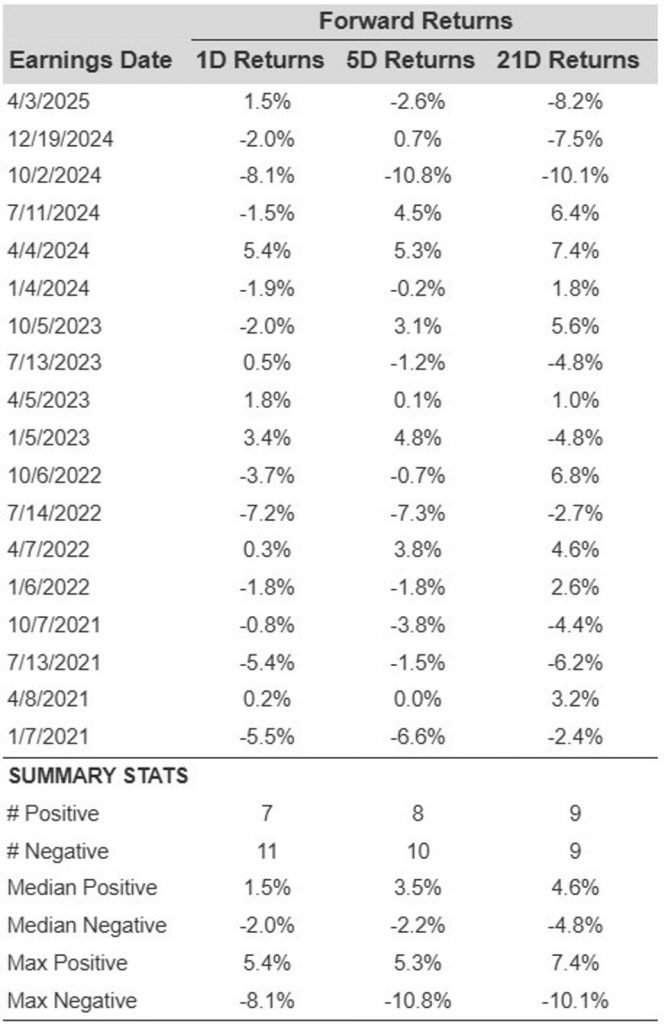

Here are some insights into one-day (1D) post-earnings returns:

- Over the last five years, there have been 18 recorded earnings data points, with 7 positive and 11 negative one-day (1D) returns noted. In conclusion, positive 1D returns were observed approximately 39% of the time.

- Remarkably, this percentage rises to 42% if we focus on the data from the last 3 years instead of 5.

- The median of the 7 positive returns is 1.5%, while the median of the 11 negative returns is -2.0%

Additional data regarding observed 5-Day (5D) and 21-Day (21D) returns post earnings are summarized along with the statistics in the table below.

Connection Between 1D, 5D, and 21D Historical Returns

A relatively less risky approach (although not helpful if the correlation is low) is to comprehend the correlation between short-term and medium-term returns following earnings, identify a pair that exhibits the highest correlation, and execute the appropriate trade. For instance, if 1D and 5D display the highest correlation, a trader may choose to position themselves “long” for the next 5 days if the 1D post-earnings return is positive. Below is some correlation information based on 5-year and 3-year (more recent) history. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and the subsequent 5D returns.

Discover more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (a combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000), generating robust returns for investors. Additionally, if you are seeking upside with a smoother journey than an individual stock like Conagra Brands, consider the High Quality portfolio, which has outperformed the S&P and achieved >91% returns since inception.