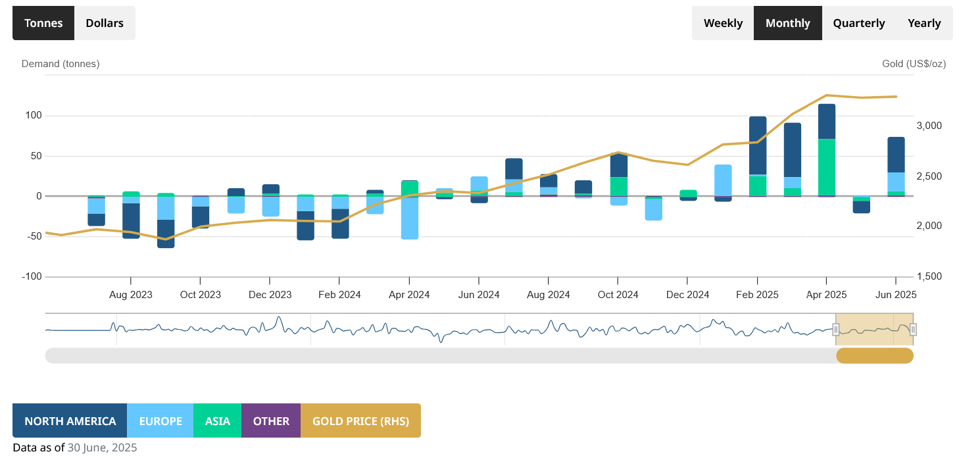

Bullion-backed exchange traded funds (ETFs) reported returning net inflows last month, meaning half-year flows reached levels not seen for five years, data from the World Gold Council (WGC) showed.

The organization noted that “all regions saw inflows last month, with North American and European investors leading the charge.”

Total holdings rose by 75 tonnes last month, the WGC said, to 3,616 tonnes. This was the highest for 34 months.

Inflows were valued at $7.6 billion, which in turn drove cumulative assets under management (AUMs) to $382.8 billion an all-time peak.

Fund AUMs were also helped by a slight uptick in gold prices over the month. These rose around 0.6% to roughly $3,316 per ounce.

Global gold ETFs endured their first net outflows for five months in May, as improving investor confidence dampened demand for safe havens like precious metals.

Strong First Half

Last month’s rebound meant total inflows between January and June represented the highest semi-annual level since the first half of 2020. This came in at $38bn.

The WGC said that “North America accounted for the bulk of inflows, recording the strongest first half in five years,” while European flows turned positive following non-stop semi-annual losses since the second half of 2022.

It added that “despite slowing momentum in May and June, Asian investors bought a record amount of gold ETFs during the first half, contributing an impressive 28% to net global flows with only 9% of the world’s total AUMs.”

Inflows Across The Board

For June, North American gold funds enjoyed positive flows of 44 tonnes worth some $4.8 billion, the strongest monthly inflow since March.

This pushed total holdings to 1,857 tonnes and cumulative AUMs to $196.3 billion.

The WGC said that “spiking geopolitical risks amid the Israel-Iran conflict boosted investor demand for safe-haven assets and supported inflows into North American gold ETFs.”

It added that increasing concerns of slowing growth and rising inflationary pressures also boosted demand.

In Europe, ETF holdings rose to 1,367 tonnes after a 23-tonne inflow. Flows were worth $2 billion, and pushed AUMs to $144.4 billion.

The Council said that “the UK led inflows in the month,” thanks to doveish comments from the Bank of England on future monetary policy.

It noted that “combined with weaker growth, easing inflation and the cooling labour market, investors raised their bets on future rate cuts.”

Furthermore, the eighth interest rate cut from the European Central Bank also boosted local demand for gold, the Council said.

Asian funds rose by five tonnes to take total holdings to 321 tonnes. Meanwhile, AUMs increased to $34.5 billion on inflows worth $610 million.

The WGC commented that “India led inflows in June, likely supported by rising geopolitical risks in the Middle East,” while rising inflationary worries meant Japanese funds recorded inflows for the ninth straight month.

It added that “China only saw mild inflows in the month… as trade tensions eased and the local gold price moderated.”

WGC data last week showed central bank gold demand continue to rise. Total purchases in May stood at 20 tonnes, up from 12 months in the previous month.