A new wave of artificial intelligence startups is setting its sights on one of Wall Street’s most specialized roles: the quantitative analyst. From hedge funds to commodity trading floors, AI platforms are promising to democratize the complex mathematical models and data analysis that have long been the exclusive domain of highly-paid quants.

Until recently, large language models for trading have been the domain of billionaire fund managers like Igor Tulchinsky, whose WorldQuant hedge fund manages over $23 billion and employs more than 150 PhDs to build custom AI systems. As Tulchinsky recently told Forbes, his firm is using LLMs to “convert and discover alphas in different domains,” creating proprietary tools that can answer “very sophisticated questions” by combining standard models with internal data that “really nobody can replicate.”

But a new generation of startups is working to change that exclusivity, offering sophisticated AI-powered analytics to firms that previously couldn’t afford such capabilities. The trend represents a fundamental shift in how financial institutions approach data-driven decision making. Rather than hiring teams of PhD-level analysts to crunch numbers and identify market patterns, firms are increasingly turning to AI systems that can process vast amounts of information in seconds and deliver insights in plain English.

Three companies highlighted in recent case studies (FINTool, Metal AI, and Findly) are targeting different corners of the financial world with AI-powered research and analytics platforms. Each promises to transform hours of manual analysis into automated insights, potentially reshaping how investment decisions get made.

The AI Quant Replacement Wave

The key trend has to do with the ability of AI to take disparate data sources to analyze them according to the wishes of risk takers. The promise is that AI systems can search for, aggregate and synthesise data-sources without human intervention.

For instance, FINTool focuses on public equity research for hedge funds and banks, analyzing millions of documents from earnings reports to SEC filings. The platform claims to reduce analyst workloads from hours to seconds while maintaining “zero hallucinations” through a three-tier peer-evaluation system. On the other hand, Metal AI targets private equity firms, where deal teams struggle with fragmented data across multiple systems, be it market research platforms to confidential data rooms. The company’s intelligence platform claims to unify internal and external data sources, allowing investment professionals to ask complex questions in natural language rather than spending time manually aggregating information.

But perhaps the most developed attempt to replace traditional quant work comes from YC backed Findly, whose Darling Analytics platform is making waves in the notoriously complex world of commodity trading.

From Quant Trading Floor to AI Startup

Ignacio Hidalgo knows commodity trading from the inside. As a former lead book trader at some of the most prominent LPG trading desks, he experienced firsthand the daily struggle of synthesizing massive amounts of market data, weather patterns, shipping & flows information plus geopolitical developments into profitable trading decisions.

“The problem was the same, just different,” Hidalgo explains of his transition from trader to tech entrepreneur. “Most advanced tools for structured and advanced data analytics were still leaving traders without the context they needed. A very hard problem to solve”

Now, alongside co-founder Pedro Nascimento, Hidalgo is building what he calls “brand new in the world” technology through their Y Combinator-backed startup Findly. Their Darling Analytics platform aims to give average commodity trading desks the “super analytical powers” traditionally restricted to specialized quant desks.

Commodity trading operates in a world of extremes. Sophisticated mathematical models coexist with surprisingly basic tools. While some operations deploy complex algorithms and real-time analytics, others rely on WhatsApp group chats for deal-making. Traders often conduct business through messaging apps with minimal technological sophistication.

“Charts don’t give you the context,” Hidalgo notes. “It’s impossible for a human to ingest all the parameters: overnight price changes, ship loading information, weather data & forecasts, news. With AI, you can ask ‘What happened to the price of crude this week? Is it a good time to buy?’ and get a much clearer picture with market context.

AI Quants: Real-World Implementation

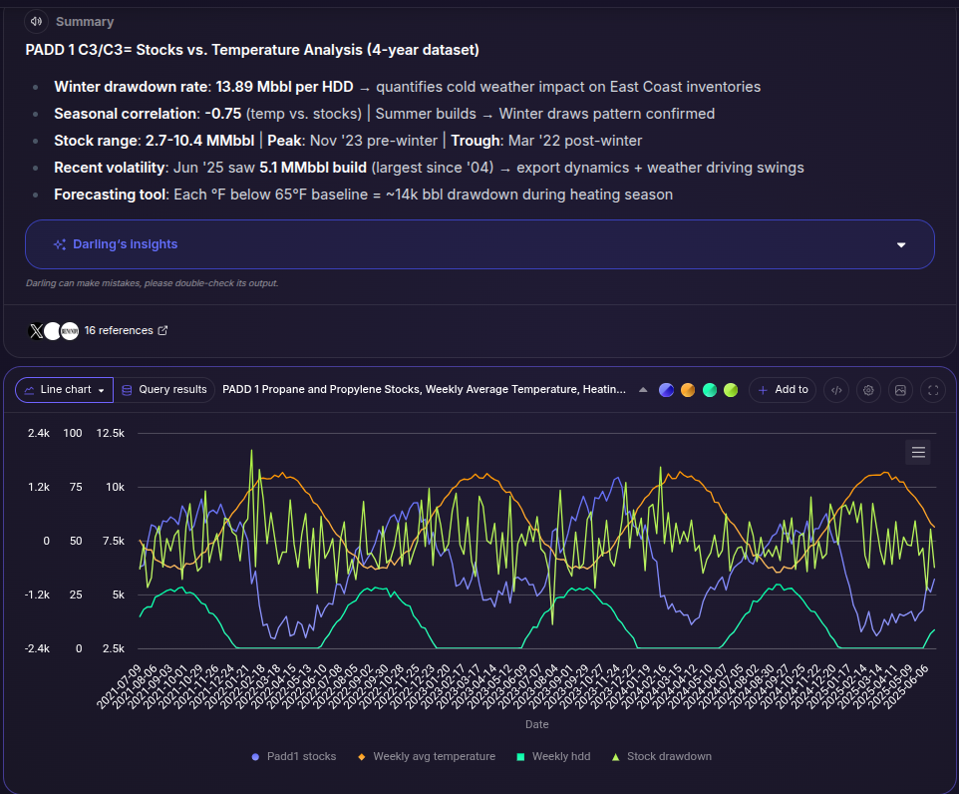

Darling Analytics is already being piloted at several large commodity firms. The system automates the kind of morning and event driven reports that junior traders typically compile manually, freeing up human analysts to focus on higher-value strategic work. It integrates (near) real-time structured data with unstructured information from market reports, X, Web, emails and news feeds to provide comprehensive market intelligence.

“The AI can give full context on data on your metrics. This is not the same as just plotting a graph, it tells you what the graph is in the current context of the market,” Hidalgo explains. The platform builds what he calls a “knowledge graph”, allowing users to ask trader-specific questions in natural language and receive analysis that would previously require hours of manual research.

For instance, a trader can ask the tool to plot the relationship between the weather and the propane stocks on the East Coast of the United States. While this previously would’ve taken a junior analyst hours to prepare, a trader can now delegate the task to the platform and see results in minutes.

What is next for AI quants?

The success of these AI platforms raises important questions about the future of quantitative analysis in finance. If artificial intelligence can truly replicate the pattern recognition and analytical capabilities that make quants valuable, it could significantly alter the structure of trading and investment teams.

For trading desks that rely on analysts or quants to provide studies for risk deployment, AI-powered analytics provide a competitive advantage by amplifying human capabilities rather than simply replacing them. The technology promises to democratize access to sophisticated analysis across entire organizations.

However, the transition isn’t without challenges. Commodity markets are notoriously unpredictable, influenced by everything from geopolitical tensions to weather patterns. The companies building these AI systems must ensure their platforms can handle the complexity and volatility that make human expertise so valuable in the first place.

As Hidalgo puts it, the goal is to “empower the average user in commodity trading companies” with analytical capabilities that were previously the exclusive domain of specialists.

Whether AI can truly replace the intuition and market feel that experienced traders bring to trading remains to be seen, but what it does do is provide an edge on data intelligence in minutes. But with major commodity traders already piloting these systems, the financial industry appears ready to find out.