Key News

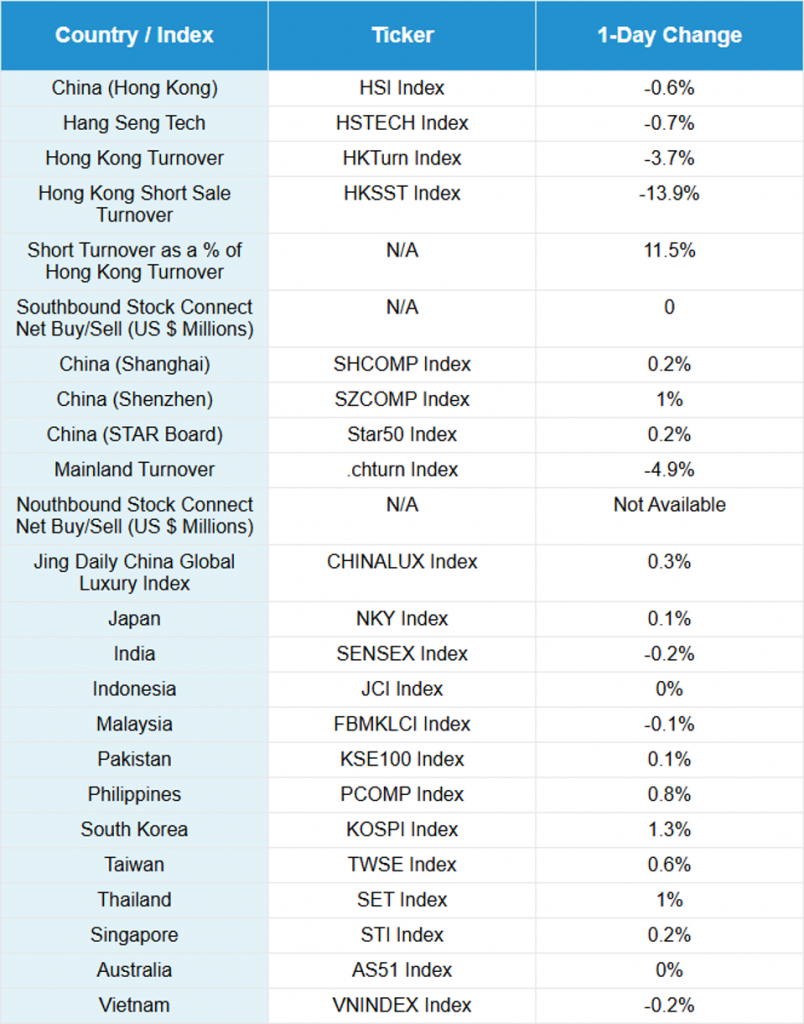

Asian equities were mixed, led higher by South Korea and Thailand.

Hong Kong was off, as growth stocks underperformed, though growth stocks were higher in Mainland China. The Caixin Services PMI was 50.6 versus expectations of 50.9 and May’s 51.1 as growth momentum slowed. Electric vehicle (EV) battery giant CATL gained +2.69% and most EV names were higher, less Li Auto, which fell -0.48%. June new energy vehicle (NEV) sales were 1.26 million, up +29% year-over-year (YoY) and +3% month-over-month (MoM), which brings the YTD total to 6.47 million units, which is up +38% YoY, according to the China Automobile Dealers Association.

Mainland-listed Foxconn Industrial gained +10.2%, as the Apple supplier ecosystem and technology hardware overall rose on news of Apple’s foldable iPhone coming next year.

Meanwhile, the US’ trade deal with Vietnam might also have been a factor, indicating China is well-positioned for the July 9th Trump Tariff Tweet bombs coming. Semiconductors outperformed after the US Commerce Department lifted semiconductor chip design software export restrictions. Baidu gained +0.77% after announcing “Baidu Revamps Search with New AI Features in Its Biggest Overhaul in a Decade, Launches Image-to-Video Model Muse Steamer”. The demo looks great!

Alibaba fell -2.93% and was today’s most heavily traded stock by value in Hong Kong, as Goldman Sachs’ China internet analyst lowered his price target to $150 from $158. Mainland investors were large net sellers via Southbound. Alibaba’s $7 billion subsidy announcement from yesterday raises fears of a race to the bottom in food delivery, restaurant delivery, and instant commerce between Alibaba, JD, and Meituan. This will inevitably weigh on profitability, though buybacks could limit the damage to earnings per share (EPS).

On Tuesday, the government sought to address this issue in E-Commerce, auto, solar, and lithium batteries. Several factors explain the recent weakness of the Hong Kong internet and Hang Seng Tech. Mainland investors were net sellers of Hong Kong today for the first time in weeks. Although Alibaba has been a net seller since May, Tencent and Xiaomi have been selling down all year. That money could be put back to work in mainland equities, which are lagging Hong Kong considerably year to date.

Hong Kong’s IPO frenzy requires funding as significant holdings are sold to fund IPO participation. On deck for a Hong Kong IPO is Apple AirPod maker Luxshare, which could raise $1 billion. We also have a few new “hot” names listed publicly that have been on a tear lately, including Labubu doll-maker Pop Mart, Guotai Junan, and Laopu Gold. Also, the healthcare sector’s strong performance is due to government policy support, deal-making, and biotech drug success. Nonetheless, the US stock rebound and the recent strong performance in South Korea might be pulling some funds away.

The Big Beautiful Bill would eliminate the de minimis trade exemption, though tariffs ended it, which has been well telegraphed, leaving PDD’s Temu E-Commerce platform exposed.

The reality is that China stocks remain out of sight and out of mind for many global investors, despite the YTD outperformance versus the US. Chinese equities have continued to grind higher since they bottomed in mid-January 2024, though no one seems to know! Hong Kong’s volume is nearly 50% from Southbound Connect, which indicates light foreign investor participation. I’m optimistic that the Chinese government stimulus should be filtering through to the economy and corporate balance sheets. While my patience is being tested, I am confident it will be rewarded!

Per yesterday’s move in Chinese solar stocks following a production cut, polycrystalline silicon, a primary ingredient in making solar cells, gained +2.14% following yesterday’s 6.99% closing at 35,050. Futures on the Guangzhou Futures Exchange reached a YTD high of 43,188 on July 1st after hitting a low of 30,400 on June 25. My weekend homework will be to see if there is any correlation between the futures and solar stocks. The chart of solar giant Tongwei (600438 CH) and the futures indicate there is.

Today, the Ministry of Commerce (MoC) spokesperson was asked if the US would send a trade delegation to China, but he didn’t know. Could the US and China be making progress on their own Big Beautiful Deal? There has been chatter about a Xi-Trump visit as China is hosting a big military parade in Beijing on September 9th to mark the 80th anniversary of World War 2. We know President Trump loves military parades, while President Xi has often cited the American pilots of the Flying Tigers and their role in World War II. As my kids frequently remind me, no one likes to be told what to do. Are the recent Chinese government policies pivots on addressing overcapacity and raising domestic consumption for internal and external purposes? Trump frequently cites those two issues. There are highly speculative rumors that August’s 4th Plenum could include government leadership and responsibilities broadening. There are signs, though nothing definitive yet.

For those celebrating the 4th of July, have a great holiday! ChinaLastNight.com is a team effort, with Joe, Henry, and Cole getting a well-deserved day off. We hope you come back with all ten fingers on Monday!

Live Webinar

Join us Thursday, July 10, at 11 am EDT for:

$5 Trillion Humanoid Robotics Opportunity – Capitalizing On The Boom

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.16 versus 7.16 yesterday

- CNY per EUR 8.43 versus 8.44 yesterday

- Yield on 10-Year Government Bond 1.64% versus 1.64% yesterday

- Yield on 10-Year China Development Bank Bond 1.68% versus 1.68% yesterday

- Copper Price 0.17%

- Steel Price 1.09%