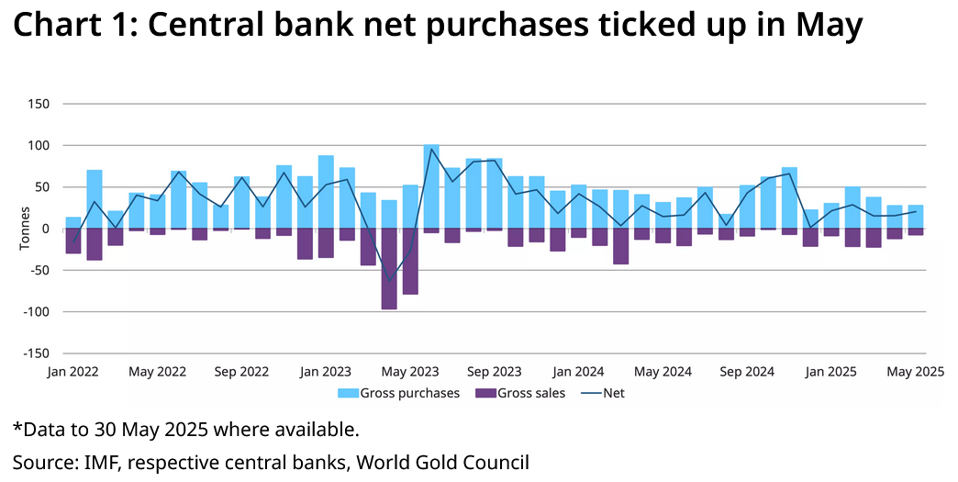

Global central banks bought another 20 tonnes of gold in May as conflict erupted in the Middle East, the World Gold Council (WGC) announced on Wednesday.

Total purchases were up from 12 tonnes in April, but lower than the 12-month average of 27 tonnes, data from the organization showed.

The WGC commented that “fresh tensions in the Middle East may have reinforced the strategic appeal of gold for central banks looking to safeguard reserves against geopolitical shocks.”

Gold demand has risen sharply in recent years, driven by military actions in Europe and the Middle East, and concerns over the impact of fresh trade tariffs on global growth and inflation.

Central bank buying has also risen as reserve managers have sought to diversify their holdings away from the US dollar and towards other paper currencies and gold bullion.

Gold prices surged to all-time peaks just above $3,500 per ounce in late April before falling as profit taking set in and market confidence improved.

It was last changing hands at $3,334.40, still up 43% year on year.

Biggest Buyers

The National Bank of Kazakhstan was the busiest bullion buyer in May, the WGC said. It added seven tonnes over the month to take its holdings to 299 tonnes.

This raised total purchases in the year to date to 15 tonnes.

The Central Bank of Turkey and National Bank of Poland (NBP) were tied in second place on the buyers’ list, both institutions purchasing six tonnes.

As a consequence, “the NBP remains the largest net purchaser of gold in 2025, adding 67 tonnes,” the WGC said.

Both the People’s Bank of China and Czech National Bank added two tonnes of gold in May.

The National Bank of the Kyrgyz Republic, National Bank of Cambodia, the Central Bank of the Philippines, and the Bank of Ghana each purchased one tonne of gold.

Gold Sellers

On the selling side, the Monetary Authority of Singapore offloaded the most gold – it emptied its vaults of five tonnes of the precious metal.

Next up came the Central Bank of the Republic of Uzbekistan and the Deutsche Bundesbank, which each sold one tonne of material in May.

May’s activity cements Uzbekistan as the largest seller so far in 2025, racking up 27 tonnes of gold sales. Singapore is in second place, with sales coming in at 10 tonnes.

Rising Demand

According to the WGC, central banks have bought 1,000 tonnes of gold annually during the last three years. That compares with between 400 and 500 tonnes during the preceding decade.

A recent Council poll showed that officials plan to continue building their metal reserves, too.

A whopping 95% of 72 respondents said they expect global central bank reserves to rise over the next 12 months. Furthermore, 43% of those tipped their own holdings to increase over the period.

These numbers were up from 81% and 29% respectively in 2024, and represented all-time highs.

The WGC also noted that “76% of respondents believe that gold will hold a (moderately or significantly) higher share of total reserves five years from now, up from 69% last year.”