Kroger (NYSE: KR), which operates retail food and drug stores, multi-department stores, jewelry outlets, and convenience stores across the United States, is set to announce its fiscal first-quarter earnings on Friday, June 20, 2025. Analysts anticipate earnings of $1.46 per share on $45.3 billion in revenue. This would indicate a 12% year-over-year increase in earnings while showing flat sales growth compared to the previous year’s figures of $1.30 per share and $45.3 billion in revenue. Historically, KR stock has risen 55% of the time after earnings announcements, with a median increase of 5.4% in one day and a maximum observed jump of 12%.

In FY 2024, the company’s same-store sales increased by 1.5%, and the gross margin improved by 50 basis points to 22.3%. However, adjusted EPS fell by 6%. The company stabilized its performance by focusing on higher-margin private label products, enhancing its digital platform, and broadening its in-house advertising and health services. After the collapse of its planned merger with Albertsons in late 2024, Kroger declared a new buyback of $7.5 billion to facilitate EPS growth.

Nonetheless, recovery is still uncertain due to the Trump Administration’s unpredictable tariff policy and escalating trade tensions. Kroger intends to reduce these risks by diversifying its suppliers and optimizing its supply chain; however, the unexpected March departure of CEO Rodney McMullen—following a misconduct investigation—might complicate execution. The company currently holds a market capitalization of $44 billion. It generated $147 billion in revenue over the last twelve months and was operationally profitable with $3.8 billion in operating profits and net income of $2.7 billion.

For event-driven traders, historical trends could provide an advantage, whether by positioning in anticipation of earnings or responding to post-release movements. If you are looking for an upside with lower volatility compared to individual stocks, the Trefis High Quality portfolio represents an alternative that has outperformed the S&P 500 and yielded returns exceeding 91% since its inception.

See earnings reaction history of all stocks.

Kroger’s General Stores Historical Odds Of Positive Post-Earnings Return

Some insights on one-day (1D) post-earnings returns:

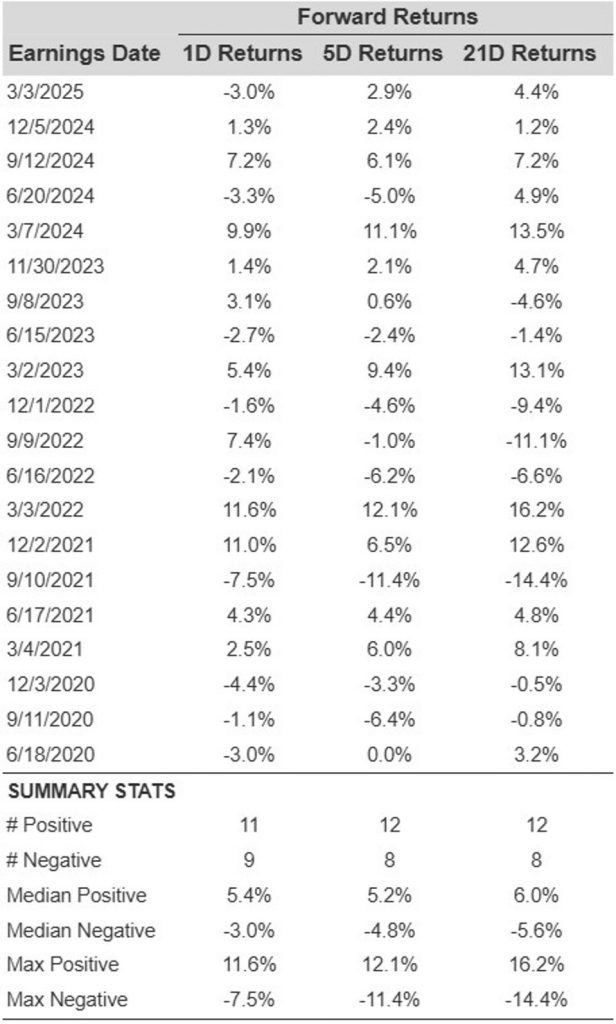

- There are 20 recorded earnings data points from the last five years, with 11 positive and 9 negative one-day (1D) returns observed. In total, positive 1D returns occurred approximately 55% of the time.

- Significantly, this percentage rises to 64% when we analyze data for the past 3 years instead of 5.

- Median of the 11 positive returns = 5.4%, and the median of the 9 negative returns = -3.0%

Additional data for observed 5-Day (5D) and 21-Day (21D) returns post earnings are summarized along with the statistics in the table below.

Correlation Between 1D, 5D, and 21D Historical Returns

A relatively less risky approach (although not effective if the correlation is weak) involves understanding the correlation between short-term and medium-term post-earnings returns, identifying the pair with the strongest correlation, and executing the relevant trade. For instance, if 1D and 5D show the highest correlation, a trader can go “long” for the next 5 days provided the 1D post-earnings return is positive. Here is some correlation data based on both 5-year and 3-year (more recent) history. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and subsequent 5D returns.

Is There Any Correlation With Peer Earnings?

At times, peer performance can impact stock reactions following earnings announcements. In fact, the pricing might begin before the earnings are disclosed. Below is historical data comparing the past post-earnings performance of Kroger’s stock with that of peers who reported earnings just before Kroger. For an equitable comparison, peer stock returns also reflect post-earnings one-day (1D) returns.

Discover more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (which includes the S&P 500, S&P mid-cap, and Russell 2000), yielding strong returns for investors.