Jamie Dimon isn’t one to cry wolf.

So when the JPMorgan CEO says “you are going to see a crack in the bond market,” it’s worth listening. And he’s not alone. Ray Dalio, Peter Orszag, and Paul Tudor Jones are all sounding the alarm on America’s fiscal trajectory.

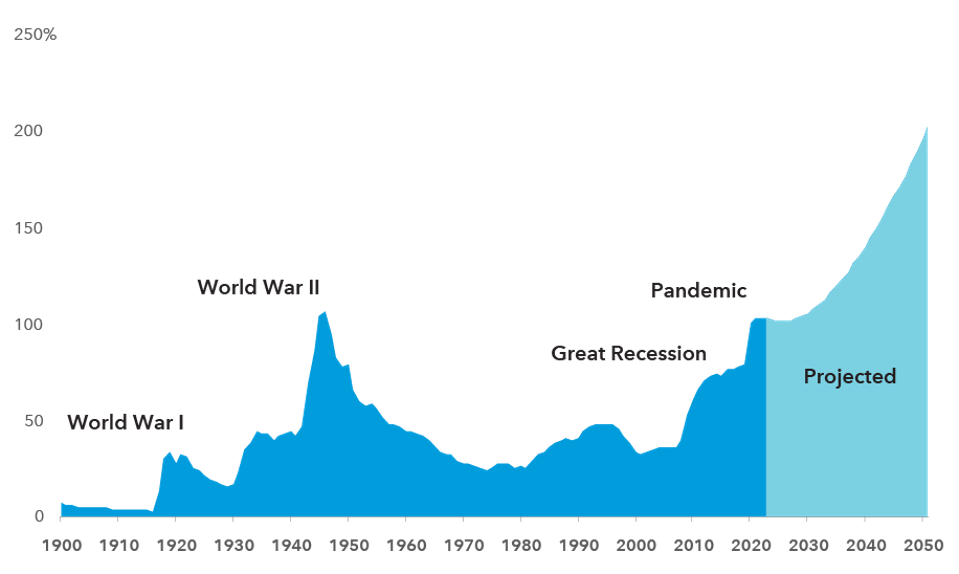

The math is getting hard to ignore. Interest on the debt just crossed $1 trillion annually — more than the U.S. spends on defense, Medicaid, disability insurance, and food stamps combined. The One Big Beautiful Bill Act (OBBBA), if passed without offsets, could add $5 trillion to the debt over the next decade.

According to the Committee for a Responsible Federal Budget, that pushes total public debt to nearly $57 trillion by 2034 — a number so large it’s bordering on abstract.

If 10-year bond yields simply hold at today’s ~4.4%, the CRFB estimates we add another $1.8 trillion in interest cost. And if rates rise further, a debt spiral isn’t a tail risk — it’s the baseline.

But here’s the problem: everyone agrees on the diagnosis. No one agrees on the cure.

Raising taxes? Politically impossible.

Cutting entitlements? Untouchable.

Both parties have proven incapable of fiscal restraint — even in peacetime.

So what’s left?

A Contrarian Path: Growth, Powered by AI

If the U.S. is going to escape its debt doom loop, we’ll need to grow through it — not tighten into it. And the most credible engine for that growth isn’t austerity. It’s artificial intelligence.

We are standing at the front end of a once-in-a-century platform shift. AI isn’t just another tech cycle — it’s a horizontal capability that will transform every sector of the economy, from finance and logistics to energy, healthcare, and defense.

AI isn’t just another tech cycle. It’s a general-purpose capability that could rewire the productivity backbone of every sector — from private credit and logistics to defense, software, and healthcare.

Already, we’re seeing AI reduce due diligence cycles from weeks to hours, compress legal reviews by 80%, and deliver spreadsheet analysis with near-perfect accuracy. AI-powered copilots aren’t replacing humans — they’re multiplying the throughput of every knowledge worker.

If this productivity surge lifts U.S. real GDP from ~2% to 3–4%, and inflation stays modest, we could see nominal GDP growth exceed 5% annually — fast enough to outgrow the debt even if rates remain elevated.

That’s not wishful thinking — it’s historical precedent. After WWII, the U.S. carried debt loads above 100% of GDP. We didn’t cut our way out. We grew — averaging nearly 4% real GDP growth for two decades through innovation, infrastructure, and industrial scaling.

This isn’t an argument to ignore the wolf. It’s a call to outrun it.

Addressing the Obvious Critiques

Yes, 3–4% real growth is aggressive. But it’s not impossible. It happened before — and it could again if AI unlocks true economy-wide productivity gains. The U.S. has unique advantages: it leads the world in foundational models, semiconductors, cloud infrastructure, and startup formation (yes, we still need more energy to power this expansion). If AI is going to remake the modern economy, it will start here.

Done right, AI can unleash the kind of broad-based productivity boom that defined the post-WWII economic miracle. Between 1947 and 1973, U.S. real GDP grew nearly 4% annually, driven by industrial innovation, global leadership, and a rising middle class. We’ve been chasing that growth rate ever since.

AI is the first real shot we have at reclaiming it.

And the numbers back it up. Vanguard projects that AI adoption could boost labor productivity by 20% by 2035, lifting U.S. GDP growth to 3%+ annually — the fastest pace since the 1990s. JPMorgan Private Bank sees productivity gains materializing as early as the late 2020s, lifting growth above 2.5%. And according to the AI Coalition, AI could raise long-run productivity growth by 0.8 to 1.5 percentage points per year — a massive unlock in a mature $27 trillion economy.

Yes, even 3–4% might not be enough if interest rates spiral. But today’s 4.4% Treasury yield isn’t permanent — it’s a reflection of uncertainty, not inevitability. If AI stabilizes growth expectations, that could anchor yields and restore fiscal confidence. The spread between nominal growth and average borrowing costs is the most important line on the chart — and AI could flip it back in our favor.

Yes, productivity gains may be uneven or delayed. That’s true of any general-purpose technology. Electricity and the internet took years to show up in the data. But early results are already promising — especially in high-leverage sectors like finance, law, and logistics.

And no, growth alone won’t fix Medicare or solve Social Security. But it will buy time — and make eventual reforms more politically and economically feasible. AI is not a substitute for tough decisions. It’s the only viable bridge to a sustainable future.

This Is Our Marshall Plan Moment

Post-WWII America didn’t just survive high debt. It flourished — building a dominant economy powered by innovation, infrastructure, and productivity. We now face a similar inflection point.

This time, AI is the catalyst.

We have a choice: treat AI like a regulatory threat, or embrace it as a national growth strategy. Because the truth is, America doesn’t have a debt problem — it has a growth problem. And the longer we delay confronting that reality, the more constrained our options become.

If AI can unlock a new era of economic abundance, it won’t just be good for business. It may be the only way to save the Republic’s balance sheet.