First steps have been taken in a complex process which could create two globally dominant mining companies valued at $315 billion, with Rio Tinto and Glencore edging towards a merger, while BHP considers a fresh takeover offer Anglo American.

Speculation that the deals are being planned has seen a remarkable divergence of stock market performance with investors following textbook advice of buying the targets and selling the bidders.

Despite all four having broadly similar exposure to industrial metals, Glencore’s share price is up 16% while Anglo American has risen by 24% over the past month.

The potential bidders have gone the other way. Rio Tinto is down 5% and BHP has eased back by 1%.

A combination of BHP which has a stock market value of $125 billion, and Anglo American ($45 billion) would create a company worth around $170 billion, while Rio Tinto ($100 billion) and Glencore ($45 billion) would create a business valued around $145 billion.

No official comment has been made by any of the companies, but a series of events point to preparations for a pair of deals.

At London-based Glencore, which also has strong Swiss connections, a “deck clearing” exercise is underway aimed at creating a separate company holding politically unpopular coal assets while another company focuses on copper and commodity marketing.

The process of creating a copper-rich business which would appeal to Rio Tinto started earlier this year when a reported $20 billion in international assets were shifted by Glencore onto the books of an Australian subsidiary, Glencore Investments.

DirtyCo & RemainCo

Dubbed “DirtyCo” by investment banks, Glencore Investments will hold all of Glencore’s thermal and coking coal assets, as well as ferroalloys such as chrome, vanadium, and manganese.

As well as copper and an extensive marketing business “RemainCo” is being prepared as the home for zinc, nickel, and alumina assets.

Barrenjoey, an Australian investment bank, said the restructure would make it easier to work with Rio Tinto on a merger after initial talks failed eight months ago.

Another hint of a move by Rio Tinto to acquire Glencore is the unexpected resignation of Rio Tinto chief executive Jakob Stausholm, reportedly after a disagreement with his chairman, Dominic Barton, over the Glencore situation.

Ben Cleary, a portfolio manager with the Australian fund manager Tribeca Investment Partners told the Australian Financial Review newspaper that no potential Glencore suitors want coal or assets in South Africa.

A similar situation developed at Anglo American which successfully thwarted a takeover proposal last year from BHP by refusing to first sell its South African platinum assets and Australian coal mines.

Deals by Anglo American to quit coal are nearing completion and the platinum interests have been shifted into a new company called Valterra which listed in Johannesburg last week and London yesterday.

Another Anglo American asset not wanted by BHP is a controlling stake in the De Beers diamond business which has been prepared for sale, perhaps by Christmas.

Once both Glencore and Anglo Amercian complete their house cleaning, the door will be open for a deal and the creation of mega miners more likely to attract the attention of major investment funds.

Copper Driver

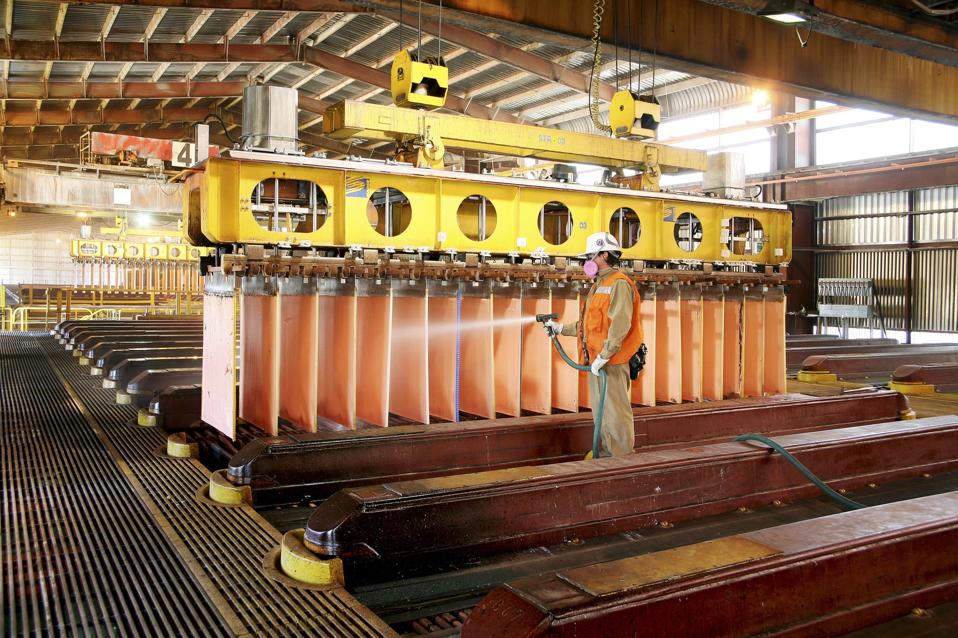

A growing global appetite for copper, the metal in heaviest demand from producers and consumers of electricity, is the primary force behind the mergers brewing in mining.

Both BHP and Rio Tinto have relied heavily on their iron ore business units for the past 20 years but with Chinese demand for steel starting to decline the next growth area for both is copper.

Multiple approvals from a number of governments will be required before either deal can proceed but the incentive is to become a critical supplier of copper which BHP describes as a key “future facing” metal.