It seems like we’re in a different spot with venture capital, compared to where it was five years ago, or 25 years ago, for that matter. There’s been a notable boom in individual investors and companies backing AI players, as the technology advances quickly.

We can see the results of this in the media, and in quarterly statements, and around the water cooler.

But it’s likely to have very specific ramifications for investors startups and funds, and that may be getting overlooked.

Venture Capital 3.0: A Whole New World

One of my colleagues, James Currier, wrote a very interesting essay on this new era in VC that he dubbed “VC 3.0.”

I call it a manifesto.

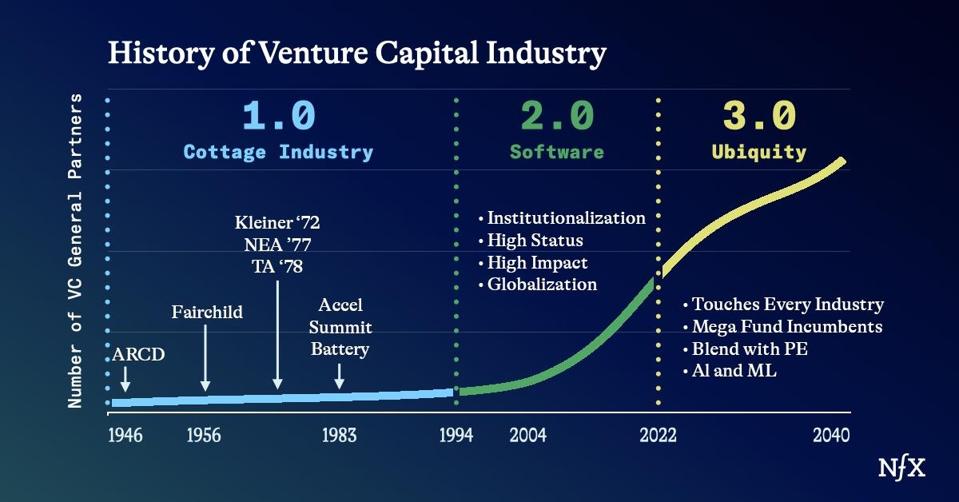

In this analysis of the current VC market, he labeled three stages – “cottage industry,” “software,” and then, in 2022, the advent of a new phase: “ubiquity.”

That last stage is where the technology is everywhere, and funds and investors are clamoring to get on board.

By the Numbers

Currier points out that there are over 32,000 investor profiles on his NFX VC platform, compared with the reality that when he started getting involved in 1994, there were around 150 investment parties.

This enormous growth, he said, will change the VC world in core ways.

Changes to Come

One notable prediction in the manifesto is that Currier posits the growth of “special community VCs.”

“Every city, every university, every state and every nation will want VC entities to help them flourish economically,” he writes. “VC investing and startups is increasingly recognized as an engine of prosperity. If administrators of those communities don’t create VCs in their region, they seem irresponsible. This will also be true of large corporations, who will want Corporate VC arms, to make sure they aren’t being left behind. Universities set up business plan competitions and then, naturally, small VC funds, or their alumni will. Each of these entities will need human VCs taking a salary to attract, coach, and deploy capital into private companies.”

He also speaks to the human side, with a note on how market changes affect the “cultures and personalities” of players:

“There will be a clash (of cultures and personalities.)” he writes. “You, the founder, will be caught in the crossfire. Sometimes it will be good for you … and sometimes it won’t.”

Here’s his take on the VC mindset:

“The VCs typically have a creative and flexible personality and culture. They are generally supporters of the founders. … They are trained to create value from nothing. They are there to make the pie bigger. They were attracted to this job because they are creative, and the VC business model is fueled by the 100X dream-like outcomes.”

As for the PE partners:

“The PE partners typically have a different personality. They are hard-nosed efficiency experts. They are not romantic, sentimental, or dreamers. They are realists. They are fixers. … They are trained to squeeze out value from existing, well understood machines. They are fighting over pieces of a fixed-sized pie.”

That’s probably enough of that. For now. But this entrée into the human side of VC, I thought, was compelling.

Currier also notes, elsewhere, that VC will be a “core economic weapon” for Western societies, and throughout the manifesto, you can see how he’s predicting that interest will continually increase.

The Background

Currier calls himself a “historian” in VC. He started four companies before founding the VC firm NFX, and now he sees a lot of this investor activity firsthand.

It took him 13 months, he said, to write the essay. I was sitting with him and Dave Blundin at an Imagination in Action event in April, talking about his manifesto and what it means for the market.

The condition of the VC world, Currier said, is a function of the technology window

“As I go to speak at Harvard and Stanford, I get all these young people talking to me,” he explained, invoking the metaphor of a fish in water. “I’m like, God, they don’t realize that they’re inside this thing that just wasn’t here 30 years ago, (a) startup industrial complex, and so their whole lives, and how they’re thinking about their careers, (are) a function of where they are, the curves there. And I just want to let them understand that.”

A Dearth of IPOs

We also discussed the use of SPACs (Special Purpose Acquisition Companies) over IPOs and how initial public offerings just dropped off a cliff, while CoreWeave remains an example of a company committing to an IPO process. Dave called it a “bellwether.” James spoke to the challenge, but suggested that we’ll see a rebound, of sorts.

“The confidence will come back,” he said.

The Human in the Loop

We so often talk about AI being assistive rather than replacing human work.

Currier, for his part, is dismissive of that: one other assertion that he made on stage was that his company is trying to replace him with an artificial intelligence engine.

12 people, he said, are working on it.

“(The AI replacement) will be smarter than me,” he said. “It’ll absolutely be smarter than me – of course, it’s going to be smarter than me. It remembers everything; it can analyze for 24 hours, and I have to sleep. So, of course it’s going to be smarter than me, but right now, what we’re working on is the sourcing part.”

He pointed to four overall stages in which AI intervenes: sourcing, analyzing, deciding and supporting. AI, he said, will change #1, #2 and #4 a lot, and it’s working on #3.

As for the question of how not to miss good startups as an investor, Currier suggested AI will be ok at that, too.

“We miss a lot of companies already due to human error,” he said. “I don’t know that we will miss … more with AI, or less … I think it will improve.”

Investors want you to think they have a strategy, Currier said, but he pointed to a randomness in the market, in a sort of echo, to me, of Burton Malkiel’s famously fatalistic “random walk on Wall Street” acknowledged by big names such as Warren Buffet. Maybe AI VC isn’t that different, in some ways.

Expansion and Change

We talked more about surprises to come with VC 3.0.

“I think people will be surprised at how many people continue to want to be venture capitalists when the returns keep going down,” he said. “If you want to understand why the world is the way it is, think about status. How do people get their status? … look at what people get their status from. They’re going to want to be venture capitalists (even though) the returns will continue to go down. So think of Los Angeles. You go there, and there are people who are waiting tables for 30 years, waiting for their big break … They’re willing to do that on the hope of (a kind of) lottery ticket.”

At the end of the discussion, there was a notable mention of something I’m involved in personally – Liquid AI.

Dave brought it up, not me, but I need to include the disclaimer that I have consulted with Liquid AI founders and key personnel in finding a way forward with the foundation models that the company promotes – a new way of powering neural networks.

So using that as an example, we talked about the ability of companies to get noticed…

Currier had an interesting piece of advice – if you can’t get interest in your product or plan, join up with another team that has more existing funding, or more ability to get in front of VCs.

Conclusions for the Future

All of this struck me as very relevant to how we assess this burgeoning market. Before I’m done, I’ll include a few more pithy quotes from the manifesto, that relate to the things that we discussed:

“This has already been happening in Silicon Valley in the later stages but will expand to every corner of startup land over time as the “asset class” of VC becomes “more efficient,” meaning everyone gets the same information.”

“AI will change how VCs make decisions to invest in you. They won’t want to say it publicly or to their LPs until societal norms evolve to accept it, but AI will increasingly be part of the VC decision phase. First, AI will help a little, and in several years it will be a lot. Google Ventures very famously was using AI to help them decide on investments and to set valuations. About six years ago, they publicly announced they were stopping that practice.”

“AI will help VCs support you, and monitor your progress.”

“AI will lower the cost of doing a startup, so some good percentage of founders will not need VC money, or will need far less of it, selling less of their companies to VCs.”

“With all the money in private capital VCs and PE, your company will have the chance to stay private longer. That can reduce the hassle for you of being public, but it can also stunt your personal growth and the growth of the culture of your company. It might also give you a large and political board that becomes a threat to the success of your company.”

“It’s going to be a great 15 years.”

And with that, at the end of the essay, I’ll leave it in the reader’s hands. If you’re interested in some of the biggest trends going on right now, don’t overlook this analysis of the venture capital field. Because it really is a main indicator of what people are doing as the technology takes off.