Do politicians hate poor people? The question reads as simplistic, but it rates asking at times like these as legislation makes its way through Congress that would legalize a $5 cap on overdraft fees charged by financial institutions, and that was foisted on them by the Consumer Financial Protection Bureau (CFPB) during the Biden administration.

The simple, frequently stated response to such a cap is that it sounds nice in theory, but it would be bad in practice. Actually, it sounds awful in theory precisely because it would be much worse in practice.

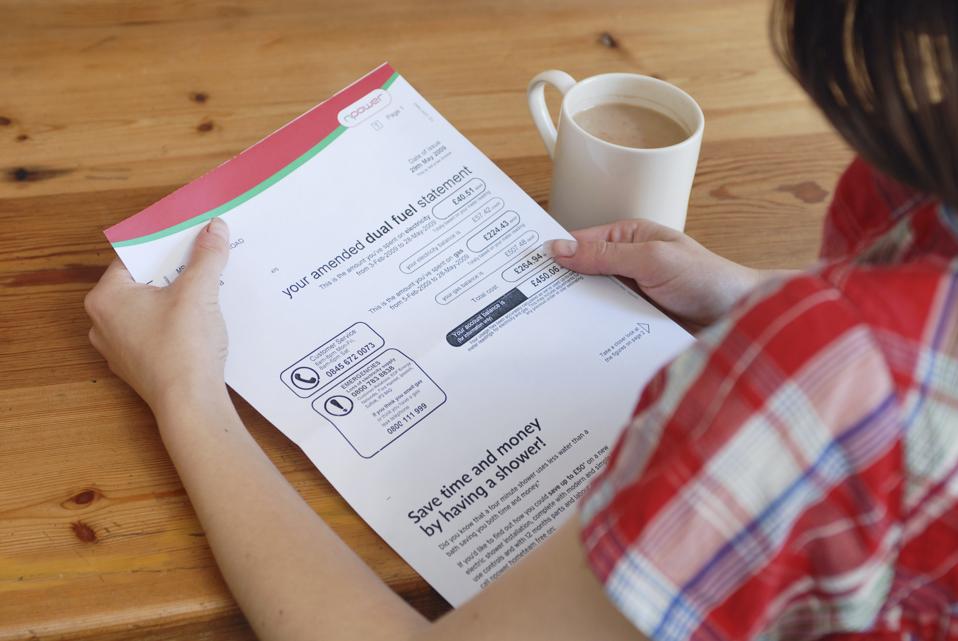

The reality is that there are Americans who don’t earn six-figure congressional salaries for whom making the monthly rent, electricity, car, and grocery bills isn’t always a sure thing. Since it’s not, thank goodness banks offer the cash-strapped overdraft protection that keeps them sheltered, comfortable amid weather extremes, on the road (including to work), and fed.

It’s just a reminder that there’s nothing theoretically compassionate about price controls, and there isn’t precisely because they’re not price controls. They’re just shortages cruelly foisted on those with the least by politicians who will never miss a meal, a rent payment, or any of the other necessities the payment of which keeps so many Americans up late at night (and awake early in the morning) thinking about.

When politicians use their power to replace market prices with fake ones, they deprive individuals of what they desperately need. Really, what’s more crucial for the typical individual than getting bills paid each month? Only for reality to occasionally intrude. Overdraft protection ensures that reality won’t be excessively painful for those of limited means.

Notable about reality of the cash-shortage kind is that it won’t disappear just because politicians aim to overlay fake pricing on real prices that render abundant a service that is also necessary. In other words, bills still need to be paid no matter the confusion of politicians eager to distort the pricing mechanism that organizes the market economy.

Which is a reminder that absent overdraft protection services offered by banks, those short on cash will still need to figure out a way to secure the funds necessary to remain afloat. Except that lenders in the proverbial shadows don’t have customer bases large enough to spread risky lending across. Which means fees to borrow must-have-now money outside the banking system are quite a bit higher. Paraphrasing the late P.J. O’Rourke, if you want overdraft fees to be really expensive, just let politicians decree them free, or nearly free.

Politicians want banks and other financial institutions to give away what’s not only precious, but also priceless. Overdraft protection is precious because it keeps borrowers afloat when money is tightest, it’s priceless for it sparing the near-term cash-strapped from the embarrassment of having their various transactions rejected, which means it’s also essential.

Naturally what’s essential must have a cost. Without the cost, how else to summon lenders willing to provide safety nets for those in dire need? It all begs for politicians to stop and think how mean overdraft-fee caps will be for those living paycheck to paycheck. That such awful legislation is even being considered yet again raises the question: do politicians hate poor people?