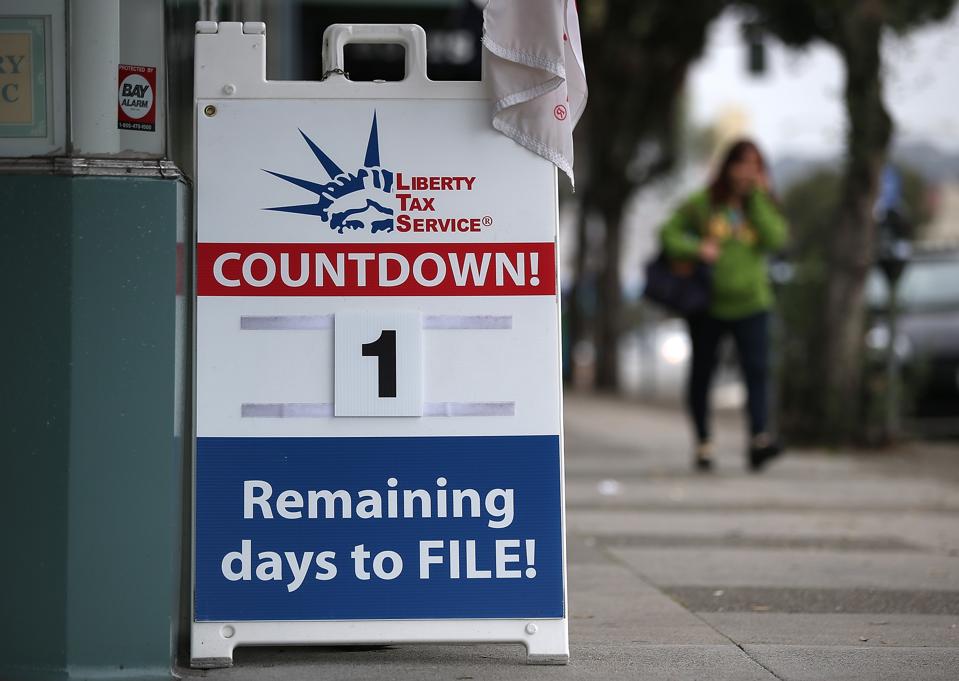

Tax season is here, and the deadline to file your 2024 federal income tax return (Form 1040) is April 15, 2025.

How Many People File Income Taxes?

In 2023, 163 million federal tax returns were filed. Just over half were completed by tax professionals. 135 million of those returns were filed by the deadline April 15, 2024. The rest—28 million—were filed after the deadline. 17% of taxpayers filed after the regular deadline.

So far this year, the IRS has received 1.7% fewer tax returns compared to last year.

What Is an Income Tax Extension?

Filing Form 4868 gives you six extra months to file your tax return. Most people file this form electronically. The form is simple: it asks for your name, address, Social Security number, your estimated total tax, what you’ve already paid, what you still owe, and how much you’re paying now.

But here’s the key point: an extension to file is not an extension to pay. If you owe taxes and don’t pay by April 15, you’ll owe interest—and maybe penalties as well.

To avoid this, it’s smart to pay at least the amount you owe when you file your extension. Paying a little extra is even better.

Common Myths About Income Tax Extensions

Some people believe filing an extension increases your chances of getting audited. That’s simply not true. Many tax professionals, including myself and my partners, file extensions every year due to our busy schedules—and we’ve never been audited.

If I worked at the IRS, I’d be more likely to look closely at returns filed right before the deadline or on the deadline, when tax professionals are most rushed by management and clients. Those returns are more likely to contain mistakes.

Why Do People File Extensions?

There are many valid reasons:

- They don’t have all their documents, especially if they own a business or receive a K-1 form from a trust, partnership, or S corporation.

- Life events like illness, travel, or divorce can delay tax preparation.

- Their tax professional does not have the capacity to get them finished by the deadline.

- Wealthy taxpayers often have more complex finances and more documents to gather.

There is nothing wrong with filing an extension—as long as your taxes are paid in full by April 15.

IRS Staff Cuts May Cause Delays

The Department of Government Efficiency (DOGE) is expected to cut up to 20% of the IRS workforce by May 15, 2025. Some tax professionals are urging clients to file their returns before then to avoid possible delays.

Final Thoughts

Filing taxes is stressful for many people. That’s understandable—the U.S. has the most complicated tax system in the world. Even tax experts can’t fully master it all.

If you can’t file by April 15, don’t panic. File an extension, make sure you pay what you owe by the deadline, and take the extra time you need. You’ll be just fine.