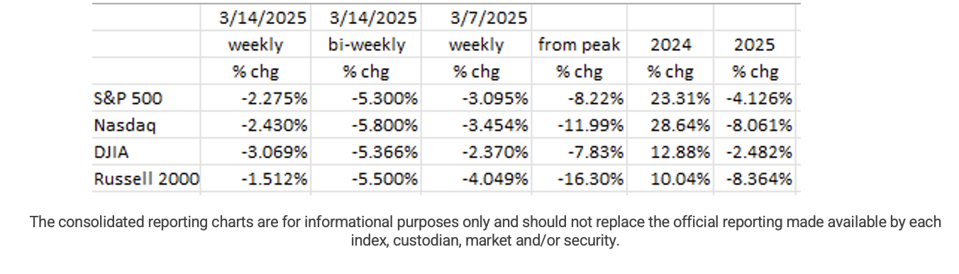

With uncertainty at record levels, and the probability of recession rising, equity markets fell into correction territory (-10% from the peak) on Thursday, March 13th. The markets bounced on Friday, likely a bounce from oversold conditions. Still, as shown in the table, markets are all down more than -5% over the two weeks ended March 14th. The percentage change from the peak in each index is shown in the 5th column of the table.

On Thursday, before Friday’s rally, the percentage changes from the peak were as follows:

- S&P 500: -10.13%

- Nasdaq: -14.23%

- DJIA: -9.33%

- Russell 2000: -18.36%

Hence, markets fell into correction territory. The cause? It appears that “uncertainty” is at record levels. High and rising uncertainty causes consumers to pull-back on spending, especially for leisure and luxury goods like vacations, a new car, home improvement, and dining out. Airlines, resorts, and restaurants are especially vulnerable.

High end retailers too. As noted above, the President’s tariff policies have played havoc with equity prices, not only because in a trade war, no one wins, but also because of the inconsistencies in those policies. Tariffs are announced, only to have certain products exempted or put on hold just a few hours later. This, of course, heightens the uncertainty.1

Six of the once red hot Magnificent 7 are down double digits year to date (Meta being the exception) even with Friday’s rally (last column in the table).

The fixed income (bond) market also appears to have recognized the slowdown, but not nearly to the degree that the equity market has. That is likely due to the fact that Fed Chair Powell continues to tell his audiences that the economy is in a “good place.” Hence, bond market participants don’t see an interest rate ease at the Fed’s March 18-19 conclave. Because the Fed believes the “neutral” Fed Funds Rate its 3%, its current 4.25%-4.50% target rate remains significantly restrictive.6

A Slowing Economy

As we have chronicled in this blog over the past few months, the economy is slowing if not already contracting (the Atlanta Fed’s GDP forecast for Q1 now sits at -2.4%).2 While one quarter of negative GDP isn’t considered a Recession, it is a start. While part of the reason for the negative reading from the Atlanta Fed was the huge negative trade balance (orders prior to tariff effective dates), there isn’t anything we see that will turn the economy in the near term. In this cycle, households have a record percentage of their wealth invested in equities. The drawdown in the equity indexes is certain to have a depressing effect on consumer spending via the “wealth effect” (i.e., when households feel wealthier, they spend more, and vice-versa). That “wealth effect” has not yet shown up in any of the national economic data, as the drawdown in equity prices is only a few weeks old. But we believe it will start in Q2.

Employment

February’s Nonfarm Payroll number (the Establishment Survey), the one the markets and the media watch, came in at +151k in February, up slightly from the downwardly revised +125k in January (revised down from +143k).3 The U3 unemployment rate ticked higher from 4.0% to 4.1%. Economist David Rosenberg, in his March 7th missive to clients, noted that the U3 rate would have risen to 4.4% except for the fact that the Labor Force Participation Rate (those with a job, or looking for one, as a percentage of the population) fell, as jobs appear harder to get and discouraged workers, not able to find one, stopped looking.

The real story, however, was in the U6 version of the Unemployment Rate which rose from 7.5% to 8.0%, its highest level since October 2021.

The financial markets pay attention to the Establishment Survey (+151k in February). However, the sister survey, the Household Survey (which is used to calculate the Unemployment Rate), showed up with a loss of -588k jobs!! That’s not a typo!

The weakening employment picture gains even more credibility from the Challenger Gray and Christmas layoff data. The +172k February number was the highest for a February month since 2009 and are at heights last seen at the start of the pandemic in 2020. Per Challenger, the layoffs were more than double from the same period a year ago.

In addition, per the Bureau of Labor Statistics’ (BLS) website, the +151k jobs created is the mid-point of a 90% confidence interval. In this case, the BLS has 90% confidence that the actual number is between +15k and +287k! We would come in at the lower end.

Also notable is the automatic add-on in the Establishment Survey called the Birth/Death model. This is a number that is simply added based upon an historic trend of new business formations versus business closures. For the nine months ending in December 2024, that average add from the Birth/Death model was +123k. Since it is a trend line, this fails to take economic conditions into account. (With these revelations, what’s your confidence level in the +151k job number?)

Other indicators of a weakening labor market include the increase in those working “Part-Time For Economic Reasons” (wanting full-time but unable to find such a job). When this statistic rises, it indicates that jobs are much harder to find. And this statistic rose by +460k in February (it was up +119k in January). The BLS weekly publication of Unemployment Insurance Claims (News Release 3/13/25) shows that insured unemployment was +116k higher the week of March 1st than it was a year earlier. The data clearly imply that jobs are harder to get than they were six or twelve months ago.

Consumer Confidence

The University of Michigan’s (U of M) recent Consumer Sentiment Survey hit its lowest level since November ’23.4 (The National Federation of Independent Businesses Sentiment Index also fell in February, and its uncertainty index climbed to the second highest level on record.) Back to U of M, inflation expectations for the next 12 months spiked to 3.5% in February4 from 3.2% in January and 3.0% in December, no doubt due to the public’s perception that the Trump tariffs would spike inflation. That 3.5% is the highest for this indicator since April 1995!! (Just for clarity, the tariffs will have an initial impact on prices, but economists believe that it is a one-time adjustment and does not feed the inflation process.) This is a problem the Fed is going to have to deal with and is likely why the financial markets don’t see any rate relief until later in the year. The Fed meets on Tuesday and Wednesday March 18-19 and they are expected to keep rates at current levels (4.25% – 4.50% for Fed Funds).6

The Wall Street Journal ran an article in Friday’s edition (3/14/25) on page B10 that said, in part, “American consumers’ spending on the luxury market… fell 9.3% in February from a year earlier worse than the 5.9% decline in January, according to Citi’s analysis of its credit-card transactions data.” Citi’s analysis shows spending is down across nearly all retail categories (apparel: -12% year/year; footwear: -22% year/year).

High end consumers told the NY Fed that they expect their financial situation to be worse a year from now. This implies a rising savings rate in the segment of consumers that account for half of the spending. As noted above, the high level of uncertainty leads to lower spending levels.

Inflation

On the good news side, both the Consumer and Producer Price Indexes came in relatively calm in February. The CPI rose +0.2% and is up 2.8% year/year, still higher than the Fed’s goal, but now back with the “2” handle. “Core” CPI (ex-food and energy) also rose +0.2% in February and is up +3.1% on a year/year basis. That’s down from +3.3% in January, and the lowest it has been since April 2021, nearly four years ago.5

The nemesis of good CPI numbers has been rents (including Owners’ Equivalent Rent (OER)) which has a 35% weight in the index. In February both rents and OER came in at +0.3%. As noted in past blogs, BLS uses rent data that is lagged by nearly a year. Rents have been falling, and, on a year/year basis, have turned negative as shown in the chart. Hence, going forward, for nearly the next year, those rents will not be raising the CPI, and, at some point, may actually be pushing it down.

The PPI showed up with no change in February, i.e., 0.0% vs. its large January print (+0.6%). On a year/year basis, it fell from +3.7% in January to +3.2% in February. Excluding food and energy, core PPI actually fell -0.1% in February, the first decline since last July, partially offsetting January’s +0.5% spike. (Note: The CPI and PPI are normally subject to high changes early in the year as many companies reset their prices at the beginning of each year.)

PPI normally leads the CPI. On the goods side, PPI spiked +0.4% in February (a 54% rise in egg prices played a key role). Services prices almost never fall, but they did in February, -0.2%; weakest since the pandemic month of April 2020. The fact that services prices fell is another positive for future inflation.

The Fed

The Fed meets this coming week (Tuesday-Wednesday, March 18-19). Despite evidence to the contrary, Chair Powell has stated several times recently that the economy is in a “good place.” The headline employment number from the Establishment Survey (+151k) is probably enough to convince him he is correct. This despite the -588k employment from the Household Survey, the highest February layoffs since 2009 via the Challenger Survey, and the large +0.5 percentage point rise in the U6 Unemployment Rate.6

Final Thoughts

Unemployment rose in February. The U3 was up to 4.1% from 4.0%, admittedly not by much. The big move was in the more comprehensive U6 rate which rose a half percentage point from 7.5% to 8.0%. This is a precursor for the next few U3 numbers. The record number of layoffs from the Challenger report reinforces the weakness that showed up in U6’s 8.0% number.

The University of Michigan’s Consumer Sentiment Survey hit its lowest level in 15 months, and the NFIB’s Uncertainty Index climbed to its second highest level on record, clearly due to the Trump tariff file. Consumer spending has already begun to fall.

The good news is that inflation continues to retrench as measured by both the CPI and PPI. While our analysis indicates that it’s time for another Fed rate cut, we don’t think that will occur at the Fed’s upcoming March meeting. It will more likely occur at the May meeting when the evidence of economic slowdown is incontrovertible and inflation has continued to recede.6

(Joshua Barone and Eugene Hoover contributed to this blog.)