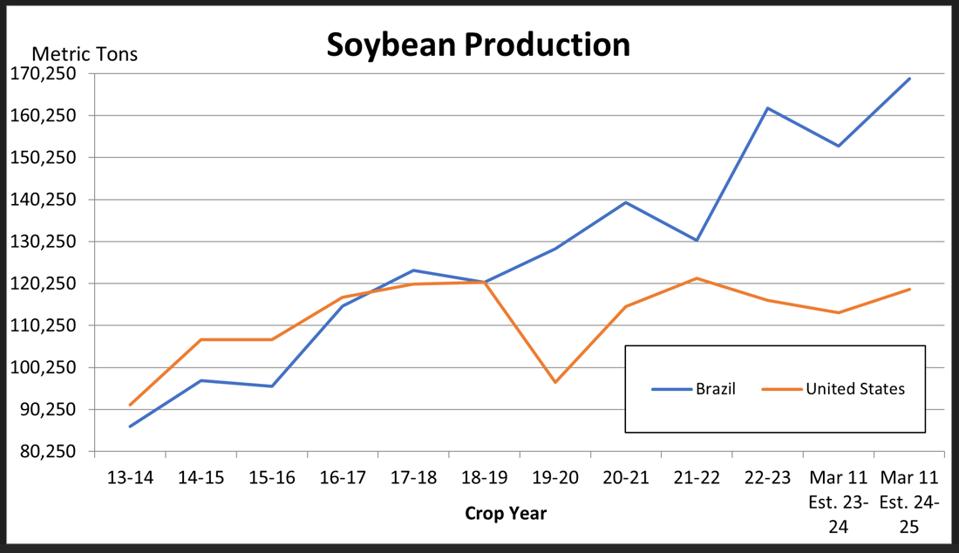

Projected record production from the world’s largest producer and exporter of soybeans is keeping global supplies plentiful and prices in check.

Brazil became the world’s largest soybean producer about five years ago after having already overtaken the United States as the world’s largest soybean exporter more than a decade ago. The impetus for Brazil’s staggering agricultural production growth versus the U.S. has been the development of new farmland, something which the U.S. is unable to do. In fact, in the United States, arable farmland has actually been in downtrend for several years.

Brazil has immense amounts of arable and potentially arable land, much of which, in today’s environmentally conscious world, will thankfully come from the conversion of sub-par pastureland rather than the destruction of rainforest. Like the United States, Brazil is an agricultural powerhouse, producing a plethora of agricultural products. But Brazil has several advantages over the U.S., not the least of which is its ability to vastly expand its area of arable farmland.

Brazil also has an equatorial climate, enabling both the large scale production of crops like coffee and sugar as well as something called “double cropping” i.e., the ability to plant more than one crop of something on the same land during the same growing season. Wintertime is short or non-existent in much of Brazil, which allows farmers to plant both soybeans and corn on in the same fields back-to-back in a single season.

Those two aforementioned factors are what has enabled Brazil to overtake the U.S. in global soybean production and export markets.

This year, Brazil is expected to have a record soybean harvest, with both the USDA and official Brazilian estimates aligning to predict the largest soybean crop in history. Right now is an interesting time of year, because Brazil’s soybean harvest is well underway but the U.S. has not even begun this season’s soybean planting yet. This means that the currently robust projections for a record large crop in Brazil are in the process of being confirmed and realized, while USDA estimates for U.S. production have to be taken at face value, at least for now. Early USDA crop estimates always assume good weather and “trendline” production estimates, both of which naturally provide an optimistic view of the future. These two factors are combining to create very healthy estimates for global soybean supplies, which is putting a lid on global soybean prices.

The global soybean balance sheet is loosening, that is to say production and supplies are increasing faster than demand. This is creating ever larger projections for global soybean ending stocks. Ending stocks are a measure the amount of soybeans that remain at the end of a growing season after harvest and after all demand is satisfied.

At this point, the outlook for global soybean prices is one of stability at best. Soybean prices in the United States are subject not only to healthy early season production estimates but also to possible additional pressure from Chinese reciprocal tariffs, which could hold U.S. soybean prices in check for even longer than global prices. The good news for farmers is that markets are forward looking; prices have already declined substantially and likely have some, but perhaps fairly limited downside from current levels. Over the next several months markets will digest South American harvest results and see how the U.S. planting season progresses, after which the outlook for soybean markets, and future price movements, will become more clear.