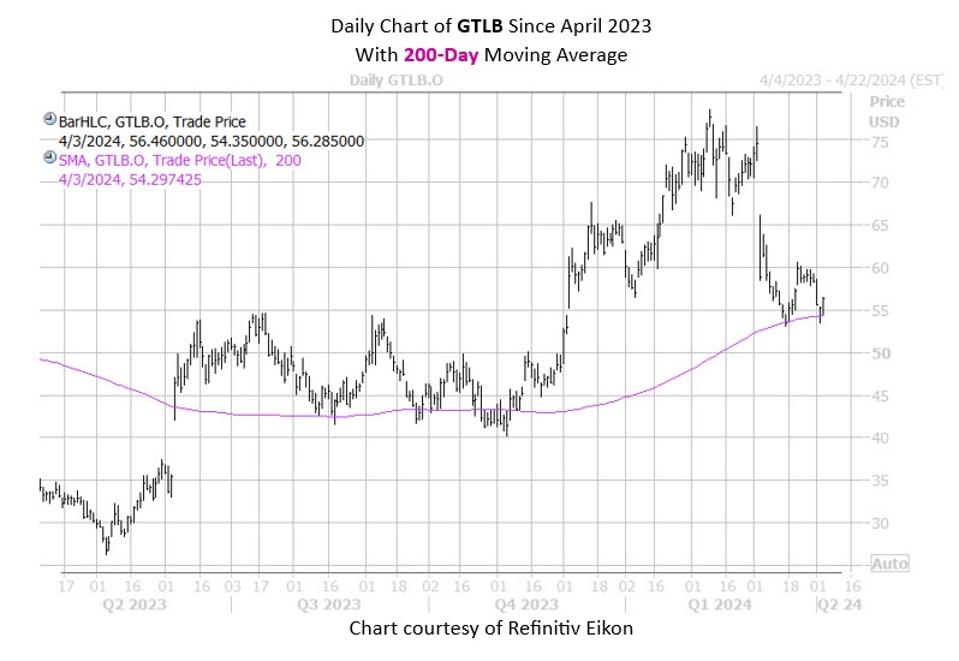

Nearly one month off a weaker-than-expected quarterly earnings and revenue outlook for 2025, software giant GitLab (GTLB) is struggling to maintain any fortuitous gains on the charts. The shares are now off more than 10% in 2024 and have pulled back to the $54 for support more than once in the past few weeks. Another trendline is also moving in, however — one with historically bullish implications that could be a saving grace for the underperforming tech name.

Per data from Schaeffer’s Senior Quantitative Analyst Rocky White, GTLB has come within one standard deviation of its 200-day moving average after a lengthy stretch trading above this trendline. Over the last three years, two similar pullbacks occurred, turning in a 13% return with a win rate of 100%. Should GitLab stock enjoy such a lift from its current perch of $56.26, the security will rise to $63.57 — levels not seen since early March.

Short sellers have been hinting that a run higher may be coming, with short interest falling nearly 26% during the past two reporting periods. Short interest now accounts for 2.6% of the stock’s total available float and would take less than two days to cover.