The Magnificent Seven? They’re yesterday’s news! The stock market advance is now broadening out, with new sectors and new stocks starting to win the performance race. Here are some fresh insights and new stocks worth considering for Q2 and beyond, straight from top MoneyShow top expert contributors.

John Buckingham The Prudent Speculator

We can’t remember a day recently that skipped some mention of the “Magnificent 7,” a nickname for the seven stocks in the S&P 500 Index that have swelled. But hot investment themes (and acronyms) change. We own four of the Magnificent 7 in our portfolios, though not at the S&P’s weights, and we initially recommended them with inexpensive valuations.

By the end of February, nearly a third of the index by weight and half of the index’s 34% gain since October 2022 could be attributed to the septuplet of Apple Inc. (AAPL), Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), Meta Platforms Inc. (META), Microsoft Corp. (MSFT), Nvidia Corp. (NVDA) and Tesla Inc. (TSLA).

Hype on television and in print has projected a sense of missing out on investors who do not own the group of stocks. That should not be the case.

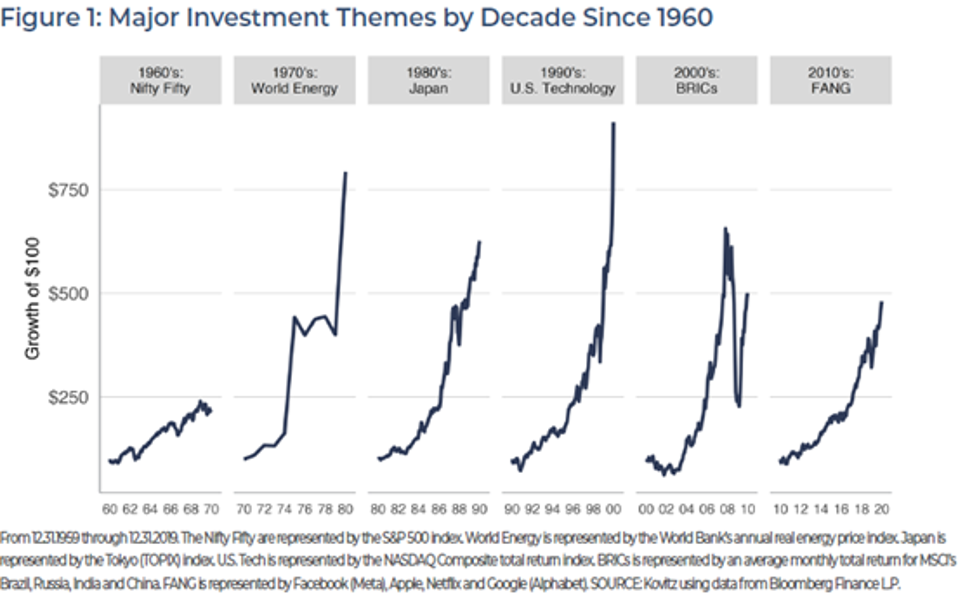

Here, we chart performance by “theme” for each decade or so. In recent history, it’s fairly easy to access all of the areas of focus in the chart. However, it’s worth noting that some of these trends were hard to exploit in the past. With the benefit of hindsight, one could believe they’d have capitalized on the on-the-run mania, but how many individual investors had oil drums filled with crude to sell in the 1970s?

Through the 1960s and into the early 1970s, investors were enamored with the “Nifty Fifty” stocks, a collection of 50 NYSE-listed growth stocks that were considered to be “one-decision” investments, meaning the only choice an investor had to make was to buy them.

Oil was the place to invest in the 1970s thanks to soaring prices. However, at the time, there were few vehicles other than the major oil companies that one could use as proxies to invest with the trend.

The 1980s saw the rise of Japanese stocks. In the first half of the decade, Japan’s TOPIX (Tokyo) index doubled thanks to very loose monetary policy by Japan’s central bank, which caught the attention of investors worldwide. They piled in.

In the 1990s, it was the Dot Com Bubble. Internet companies popped up overnight and investors shoved enormous amounts of capital their way. Profitability was no impediment, nor were there many other considerations for that matter. Simply being associated with technology, the Internet, or computing was enough to send a share price soaring. And soar they did.

There’s nothing wrong with certain stocks getting their day in the sun. The attention that has been drawn to the FAANG stocks, the Magnificent 7, or any other grouping is almost always well-deserved, and we are happy to own many of them for our clients. However, the point of walking through decades of market history is to show that trends can change quickly and thematic investing often is a backward-looking retelling, rather than a forward-looking endeavor.

Over the decades, the names in our portfolios have changed and we have evolved our approach to include the latest tools, best practices, and resources. But our philosophy has remained constant throughout. We believe the steady approach has served us well.

Elliott Gue Energy and Income Advisor

The S&P 500 Energy Index was recently more than 11% higher than where it began the year. The midstream-focused Alerian MLP Index is on a similar trajectory, up 12.3% year to date. Even the Philadelphia Oil Service Sector Index was up 7.4%, despite the fact producers are getting more done with fewer rigs and related services. I like CrossAmerica Partners LP (CAPL) here if you can buy on a dip.

Fourth-quarter and full-year financial filings are always far more complex than quarterly results the rest of the year. Smaller companies especially need more time to complete them. So, it’s no surprise the data we receive as investors is always stretched out, with CAPL and ONEOK Inc. (OKE) the last two Model Portfolio and High Yield Energy List members to report this time.

The good news is, both had the solid numbers and guidance needed to remain recommended companies. For investors in High Yield Energy list member CrossAmerica, the high dividend is the primary driver of returns.

With no increases since a May 2018 cut, assessing payout safety is always our primary concern. Fortunately, there were no real causes for concern, as distributable cash flow covered the payout by 1.8 times in Q4 and 1.46 times for the trailing 12 months. That compares with 1.67 and 1.77 times, respectively, for the year-ago period.

Leverage was higher at 4.2 times (3.7 times in 2022) but well within management’s target range. And there’s a strong likelihood of further moderation this year as growth CAPEX boosts cash flow.

Traffic typically drives revenue from CrossAmerica’s network of service stations and convenience stores. It, in turn, is heavily impacted by demand for fuel. Volumes were generally weaker this year. But the company was largely able to offset the impact with effective cost management, boosting margins and offsetting softer wholesale and retail volumes. The company also benefitted from acquisitions that added 41 new stores.

A Federal Reserve pivot to lower interest rates should help demand for gasoline as well as reduce the cost of CrossAmerica’s debt, which has been moderated with extensive use of interest rate swaps. But until there is a return to at least modest dividend growth, we expect the stock to continue trading in a relatively narrow trading range.

Recommended Action: Buy CAPL on a dip.

Freeport-McMoRan Inc. (FCX) carries CFRA’s highest investment recommendation of 5-STARS, or “Strong Buy.” It is one of the world’s largest copper producers and a major producer of gold and molybdenum.

FCX’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits, and significant mining operations in the Americas, including the large-scale Morenci minerals district in North America and the Cerro Verde operation in South America.

In North America, FCX operates seven copper mines: Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona, and Chino and Tyrone in New Mexico. FCX also operates two molybdenum mines in Colorado: Henderson and Climax. In South America, FCX operates two copper mines: Cerro Verde in Peru and El Abra in Chile. FCX produced 4.2 billion pounds of copper in 2023, in line with 2022.

In 2024, we anticipate copper production to remain flat again at around 4.2 billion pounds. But gold production is poised to increase by around 17% and molybdenum should rise by around 5%. As of the end of 2023, the Indonesian smelter project was more than 90% complete and capital expenditures related to the project are poised to fall to $1 billion in 2024 (down from $1.7 billion in 2023).

We think FCX offers the best leverage to a copper bull market, as every $0.10 per pound increase in the price of copper adds around $430 million to annual EBITDA and $340 million to annual cash flow. In 2023, adjusted EBITDA was $8.3 billion and cash flow from operations was $5.3 billion.

Our Strong Buy opinion is driven by our bullish view on the copper market, FCX’s history of solid execution on growth projects, its top-tier (and geographically diverse) copper reserves, and our outlook for stable copper production at 4.1 billion to 4.3 billion pounds annually through 2026.

We expect the copper market to remain strong, given copper’s role in technological innovations, as well as the limited ability of the industry to increase supply. More than 70% of copper is consumed for applications that deliver electricity. Copper is also a critical ingredient to decarbonization.

Hybrid and electric vehicles use 2x-4x more copper than vehicles with internal combustion engines. Renewable energy technologies (wind and solar) use 4x-6x more copper than fossil fuel power generation.

Our 12-month target price of $51 assumes FCX will trade at an EV/EBITDA multiple of 7.5x our 2024 EBITDA estimate, above its three-year average forward EV/EBITDA of 6.6x. We forecast a strong copper bull market to be a positive catalyst.

Recommended Action: Buy FCX.

In this MoneyShow MoneyMasters Podcast episode, which you can watch here, David shares his technical take on the stock market as of the end of Q1 2024. The bad news? Some of the old, Magnificent Seven leaders are falling by the wayside. The good news? Some of the old, Magnificent Seven leaders are falling by the wayside.

In other words, the advance is broadening out to include new leaders in sectors like financials, industrials, basic materials, and home builders – something that is ultimately HEALTHY. As David puts it in our chat, “For stock pickers, it’s a pretty ripe environment.” Roughly 80% of S&P 500 names are trading above their 200-day moving averages, while around 70%-80% are trading above their 50-day MAs. Though there is one potential warning sign to watch, primary uptrends remain intact for the major averages.

David then explains that his scans of stocks making new three-month highs and new three-month lows continue to show better results in value-oriented, non-tech groups. He cites a handful of names he likes, including one particularly strong play in the gasoline retail business. On the flip side, he explains why one incredibly popular “Big Tech” stock looks to be carving out a major top. He also addresses the strength in gold and Bitcoin, noting that the weekly chart for the former looks great and the latter is clearly benefiting from the “halving.”

Finally, he shares a sneak peek at the trading methodologies, process-oriented tips, and chart-reading lessons he’ll cover at the Investment Masters Symposium Silicon Valley, set for May 7-9, 2024 at the Hyatt Regency San Francisco Airport.