Digital banks have sprung up across Asia in recent years. In many cases, they are having little impact on the overall banking market. Affluent societies like Singapore, Hong Kong, Japan and Taiwan are not lacking banking options. Even middle-income countries like Malaysia and Thailand have limited financial inclusion needs.

Yet in certain countries that are less affluent, and where the financial system is still underdeveloped, digital banks can play an important role in boosting financial inclusion. This is the case in several Southeast Asian and South Asian countries.

The Biggest Southeast Asian Market

In a population of more than 275 million, Indonesia is estimated to have well over 100 million people who are unbanked or underbanked. Further, the unique island geography of the country can make it impractical to serve customers in traditional bank branches. Indonesia has more than 17,000 islands, making it the largest island country in the world.

Given the government’s support for the fintech sector, it is no surprise that Indonesia’s digital bank sector is booming. Though for the most part, the country’s digital banks are controlled by its powerful conglomerates and large tech companies, reducing opportunities for startups, the advent of a greater variety of banking options ultimately benefits both consumers and small businesses.

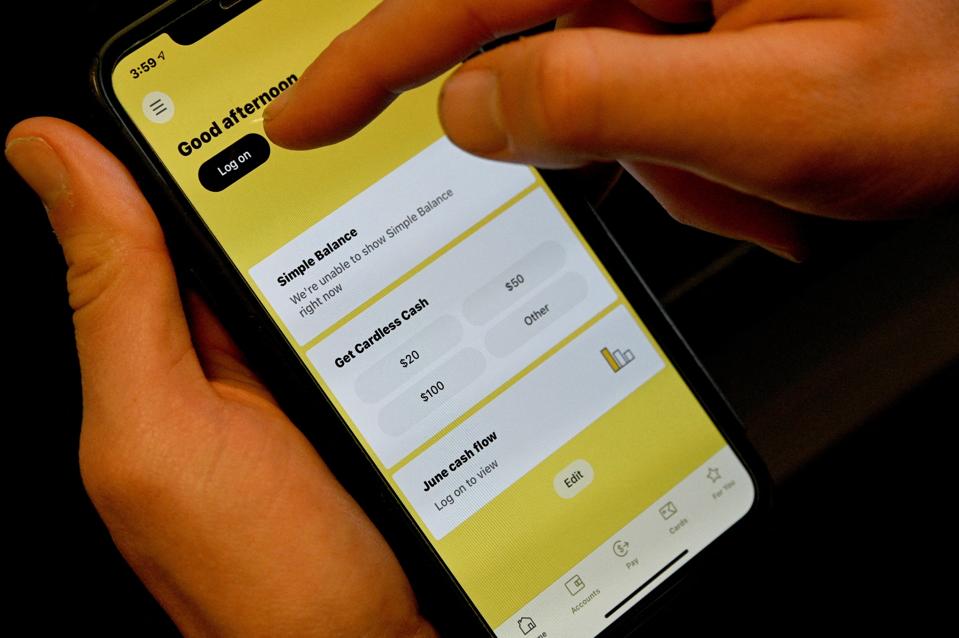

A recent trend borne of the arrival of pure-play digital banks is the willingness of incumbent lenders to launch their own digital units. For instance, the large state lender Bank Mandiri has a revamped app that now boasts nearly 90 features, allowing users to perform many functions in-app, from regular banking services and cross-border money transfers to investing in mutual funds and buying airline and concert tickets. The app has about 20 million monthly users, up fivefold from two years ago.

Large incumbent banks can undertake targeted digitization initiatives that leverage their existing customer bases while benefiting from being more trusted than tech companies – which are always looking for the next chance to monetize user data – when it comes to financial services.

Playing The Long Game

Like Indonesia, the Philippines has a challenging geography for traditional branch banking and has a significant unbanked and underbanked population. In contrast to some other Asian countries, the Philippines has also brought digital banks online relatively quickly in line with its ambitious financial inclusion targets. It currently has six online lenders.

Despite government support and strong market demand, thus far, the online lenders have not made significant inroads. A recent report by Fitch Ratings that cites data from Bangko Sentral ng Pilipinas as of June 2023 found that no digital bank in the Philippines has more than 0.14% of total bank deposits – that is Ant Group-backed Maya Bank. Union Digital has a 0.10% market share and Tonik Bank .04%. GoTyme, UNO and Overseas Filipino Bank (OFB) respectively have just 0.01% of overall deposits.

While digital lenders will inevitably try to briskly grow their deposit bases by offering high interest rates, the current macroeconomic environment makes doing so harder than in the days before high inflation. Trying to compete in this manner has never been a sustainable strategy, especially since increased digitalization has made it easier to switch accounts once promotional rates run their course.

In early March, BSP Director Melchor Plabasan said at a press conference that just two of the six digital banks in the country are profitable. The online lenders’ losses are likely to persist in the medium term as they figure out the optimal business model for their target market with a largely untested credit profile. “The expectation is that it would take about five to seven years before a digital bank becomes profitable,” Plabasan said.

Strength In Numbers

One of the most promising markets for digital banking in Asia also happens to be one the most overlooked: Bangladesh. In South Asia, India is a fintech juggernaut, while Pakistan has also been an increasing area of focus for forward-looking investors. Bangladesh, however, has one of the world’s largest unbanked populations – 60 million adults – and an overall population of 169 million not especially well served by incumbent lenders.

In December, Bangladesh’s central bank granted digital banking licenses in principle to eight online lenders: Naqd Digital Bank, Khaadi Digital Bank, bKash Digital Bank, Digi-Ten, DigiAll, Smart Digital Bank, Japan-Bangla Digital Bank, and North East Digital Bank. Under draft guidelines created by the central bank, the online lenders will be required to issue customers bank cards and QR codes as well as use “advanced technologies” like artificial intelligence, machine learning and blockchain to facilitate transactions.

As Bangladesh’s leading e-wallet, Bikash Digital Bank will likely be among the most competitive of the eight. The firm is 51% controlled by BRAC Bank, a leading incumbent lender, and 20% by Ant Group, while other shareholders include Money in Motion, the Bill and Melinda Gates Foundation, the International Finance Corporation and Softbank.

Future Prospects

We believe that digital banks in Indonesia, the Philippines and Bangladesh will be among the most successful of any in the Asia-Pacific region because of the real market opportunities that exist, strong government support and incumbents that are not as formidable as in more advanced economies. While competition will surely intensify, and the use of customer subsidies will undoubtedly complicate the path to profitability, the overall outlook is good.

Other countries in the region where we expect digital banks to find opportunities in the years to come include Cambodia and Laos – though these markets are significantly smaller than Indonesia, the Philippines and Bangladesh. Both Cambodia and Laos have embraced fintech to varying degrees and with their respective CBDC projects, will continue to do so.

Another Asian market with potential for digital banks in the long run is Myanmar. Indeed, prior to the recent downturn in Myanmar’s politics, its fintech sector was attracting significant investor interest. However, since early 2021, its political situation has deteriorated markedly. That must stabilize and Myanmar will need to be removed from FATF’s black list for money laundering and terrorism financing violations before investors will have confidence to return.