On March 26, BlackRock CEO Larry Fink released his annual Chairman’s Letter to Investors. While much of the focus has been on his call to rethink retirement, his approach to the energy sector and the lack of mention of environmental, social and governance shows a pivot in strategy.

ESG is a type of investing where non-financial factors are considered when making investment choices. ESG has grown significantly over the past few years following a push from the United Nations. In a very short time, ESG became an unregulated staple of corporate financial reporting. Sustainability and ESG reporting standards are now being adopted at the international level, including the U.S. Securities and Exchange Commission’s recently adopted Climate-Related Disclosure Rule, but most will not go into effect for a few years.

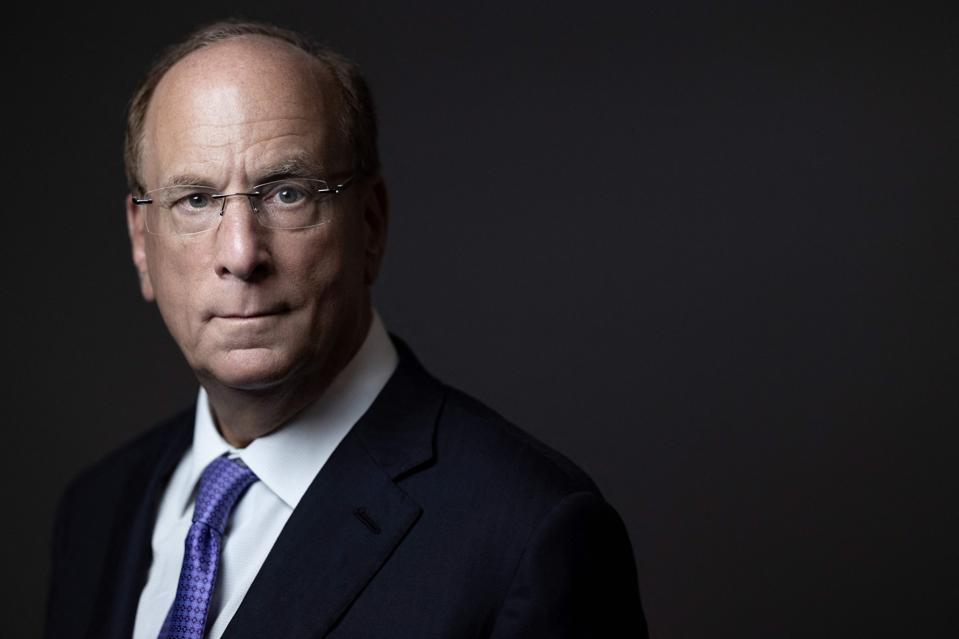

BlackRock Inc. was an early acceptor and advocate for ESG, with Fink leading the charge. Managing over $10 trillion in assets, BlackRock Inc. is the world’s largest asset manager. This provides Fink, who founded the company and has served as CEO since 1988, significant influence over the development of ESG. As conservatives began pushing back on ESG, criticism of BlackRock and Fink quickly escalated.

In December 2022, Florida pulled $2 billion in investments from BlackRock following a push from Governor Ron DeSantis. Fink later admitted that the divestment by Florida harmed BlackRock. However, that harm was short lived.

At the 2023 United Nations Climate Change Summit, commonly called COP28, the host country, United Arab Emirates, invested $30 billion into a new climate fund. The investment fund, called Alterra, will be managed by Lunate. The fund will be invested in various existing environmental, social, and governance funds — including $2 billion to BlackRock. Despite political backlash over ESG, in 2023, BlackRock experienced a 16% increase in managed assets from $8.6 trillion to $10 trillion.

In March 2024, the Texas State Board of Education pulled $8.5 billion in investments from BlackRock. While that is being praised in conservative circles as a major blow to BlackRock and ESG, it is notable that Alterra has a long-term goal of attracting $250 billion in investments by 2030. Expect BlackRock to receive a significant portion of those investments.

In the 2024 Chairman’s Letter to Investors, Fink avoided the phrase ESG. This is not a surprise. Following the conservative backlash of 2023, Fink stated he will no longer be using the term ESG, as it had become too political. He is opting instead for terms like stakeholder capitalism, sustainable investing, or climate investing.

Even with his stated change in terminology, the word stakeholder only appeared once in the letter, sustainable/ sustainability appears twice, and climate four times. The absence is notable and a drastic pivot from BlackRock’s 2020 Letter to Clients, Sustainability as BlackRock’s New Standard for Investing.

Further, Fink introduces a new term – energy pragmatism. Fink explains that there is a balance between “energy transition” to renewable energy as part of the global push to address climate change, and the need for “energy security” spurred by Russia’s invasion of Ukraine.

“I’m hearing more leaders talk about decarbonization and energy security together under the joint banner of what you might call ‘energy pragmatism.’ Last year … I spent a lot of time talking to the people who are responsible for powering homes and businesses, everybody from prime ministers to energy grid operators. The message I heard was completely opposite to what you often hear from activists on the far left and right, who say that countries have to choose between renewables and oil and gas. These leaders believe that the world still needs both. They were far more pragmatic about energy than dogmatic. Even the most climate conscious among them saw that their long-term path to decarbonization will include hydrocarbons, albeit it less of them, for some time to come.”

Further, in what appears to be a clear response to the Texas divestment, Fink states:

“Or look at Texas. They face a similar energy challenge – not because of Russia but because of the economy. The state is one of the fastest growing in the U.S., and the additional demand for power is stretching ERCOT, Texas’ energy grid, to the limit.

Today, Texas runs on 28% renewable energy – 6% more than the U.S. as a whole. But without an additional 10 gigawatts of dispatchable power, which might need to come partially from natural gas, the state could continue to suffer devastating brownouts. In February, BlackRock helped convene a summit of investors and policymakers in Houston to help find a solution.”

Finally, most likely to address concerns raised by the right that Fink’s opinions may be breaching his fiduciary duty, he states:

“The energy market isn’t divided the way some people think, with a hard split between oil & gas producers on one side and new clean power and climate tech firms on the other. Many companies, like Occidental, do both, which is a major reason BlackRock has never supported divesting from traditional energy firms. They’re pioneers of decarbonization, too… We invest in these energy companies for one simple reason: It’s our clients’ money. If they want to invest in hydrocarbons, we give them every opportunity to do it – the same way we invest roughly $138 billion in energy transition strategies for our clients. That’s part of being an asset manager. We follow our clients’ mandates.”

Interestingly, Fink’s approach could appeal to conservative critics by tying energy independence, a Republican election year hot topic, with the global push for renewable energy sources. This triangulation of the issue is a logical strategy and Fink’s approach may be an indicator of how this argument will develop in the Presidential election.